$23 A MORE BALANCED APPROACH

Increasing odds of a range-bound / slowly upwards-sloping grind with substantial rotation within equities

Executive Summary

Highly uncertain environment leads to a more balanced approach toward risk—increasing odds of a range-bound / slowly upward-sloping grind with substantial rotation within equities

Increasing comfort with current long-term equity longs, less inclination to open short positions than before and willingness to add opportunistically

Small caps seem particularly cheap relative to historical valuations—saw outperformance vs. large-caps over the inflationary mid-70s and early-80s

This post discusses—implicitly or explicitly—investments in bonds, FX, commodities (gold and uranium (ticker: SRUUF, U-UN.TO) and equities (small-cap equities [ticker: IWM] and ChinaTech).

*Sponsored Content*

Insightful business news that respects your time and intelligence.

The Daily Upside is a business newsletter that covers the most important stories in business in a style that's engaging, insightful, and fun. Started by a former investment banker, The Daily Upside delivers quality insights and surfaces unique stories you won't read elsewhere.

Sign up here / Powered by Swapstack

The ‘Everything Trade’

Expectations for a (relatively) calm, upward-grinding market did not disappoint.

A bit over a month ago in a note called $20 ANOTHER BEAR MARKET RALLY?, I underscored how technical (i.e., investor positioning, options positioning, corporate buyback flows, seasonality and midterms) and fundamental (i.e., earnings season and monetary policy / Fed) factors were conspiring for a “tactically constructive [view] on risk” leading me to “favor this outcome (bounce) in the short term”. S&P is up almost 5% since, VIX down ~20%.

That same note provided color on what would happen once markets sniffed out “peak inflation”:

The infamous ‘Fed pivot’ narrative (i.e., deceleration / pause in hiking, lower terminal rate or rate cuts / end of QT soon after terminal) could take off again, should peak inflation be re-established. […] If terminal rate peaks, […] it will drive what I call ‘The Everything Trade’ (i.e., long bonds, short USD, long equities, long gold).

It was followed up with an explainer of the ‘Everything Trade’ that would follow terminal rates peaking, including when to historically expect this / what to look for:

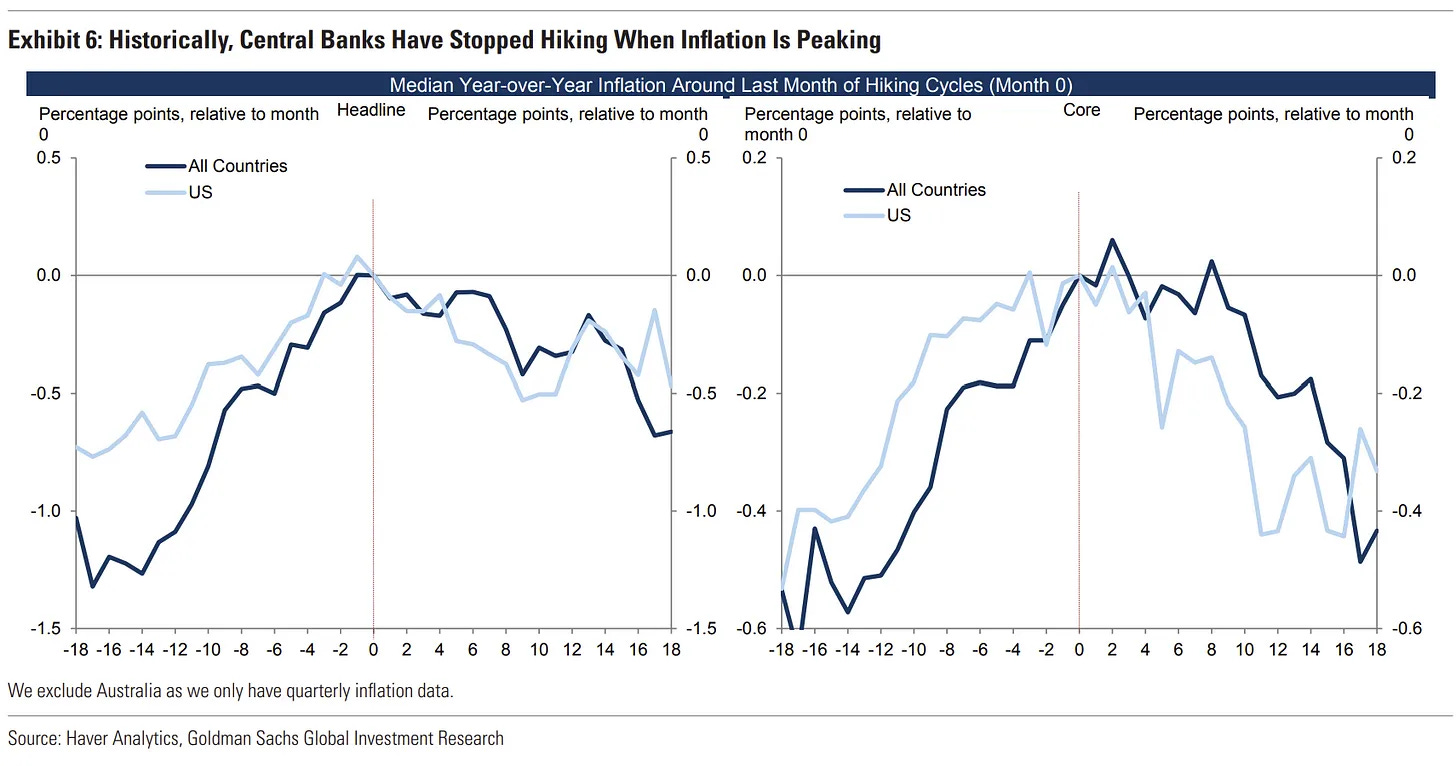

CBs often stop hiking around the same time—at / close to the peak in headline and core inflation (YoY)—and anticipate substantial declines in inflation by several months.

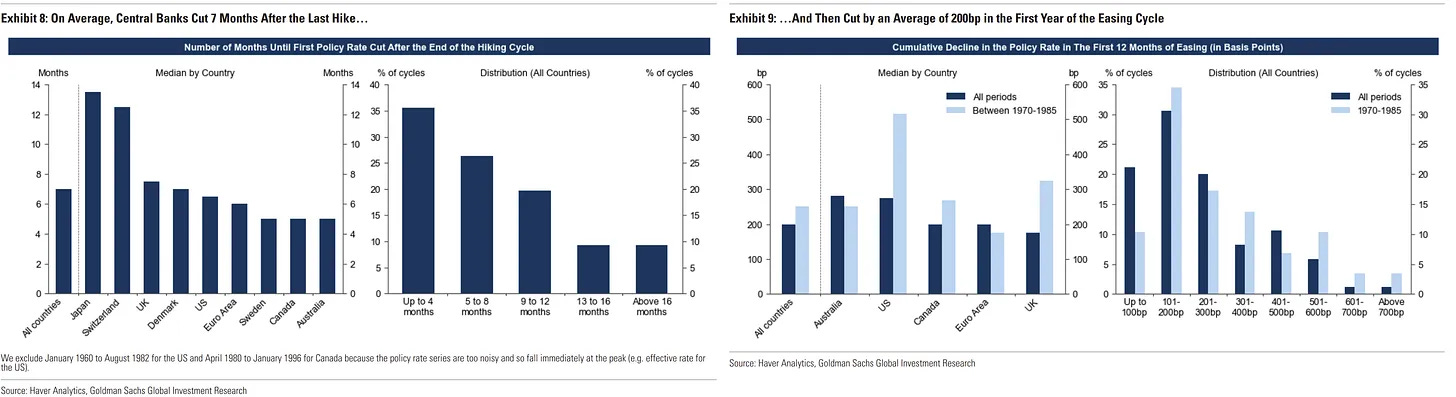

In 75% of cycles CBs cut within the first year since the last hike. Cuts generally arrive arrive 5-7 months from that last hike and average 200bps, with Canada and Australia generally leading the cutting cycle timing-wise. Inflationary periods exhibit only slightly larger cuts over the first year, despite averaging double the cumulative hikes.

Read more: $21 THE ‘EVERYTHING TRADE’

Enter October’s CPI miss—7.7% YoY and 0.4% MoM (vs. 7.9% and 0.5% estimated). Markets matched ‘peak inflation’ and ‘Fed pivot’, fuelling the ‘Everything Trade’. All positions touted in previous notes responded as expected.

Now, where from here?

Dr. Strangelove or: How I Learned to Stop Worrying and Love the Fed Pivot

The TL;DR of this is that I’m not sure I’m there yet. Loving the Fed pivot, that is. Doubts are starting to creep into my forecast for ‘lower lows’. Hear me out.

There’s a good chance this is just a relief rally built on top of some strong—yet temporary—technical and fundamental factors:

There certainly was a cathartic feel to this rally. Markets found the relief they were looking for. Expectations of further rate hikes repriced down significantly in the aftermath of the CPI print, driving a sharp relief rally. But expectations have since trended up again toward the ~5% mark, peaking in June 2023.

It historically takes a few months (5-7) from the last hike to the full pivot (i.e., rate cuts), making me skeptical of this rally. It's simply too early. Normally, lows align with actual Fed pivots following proper economic pain. Today's Fed is still working on their controlled demolition of demand!

The problem however is that we have seen Mr. Market look past these kind of issues before, anticipating an often wildly distant recovery.1 Some elements supporting the reflation narrative include:

Markets have dropped quite a bit already, including one of the largest unwinds across fixed income in history. Everyone is already expecting earnings to drop on the back of next year’s recession, it may be priced in. Ask your banker / dentist / mechanic—they know this, too.

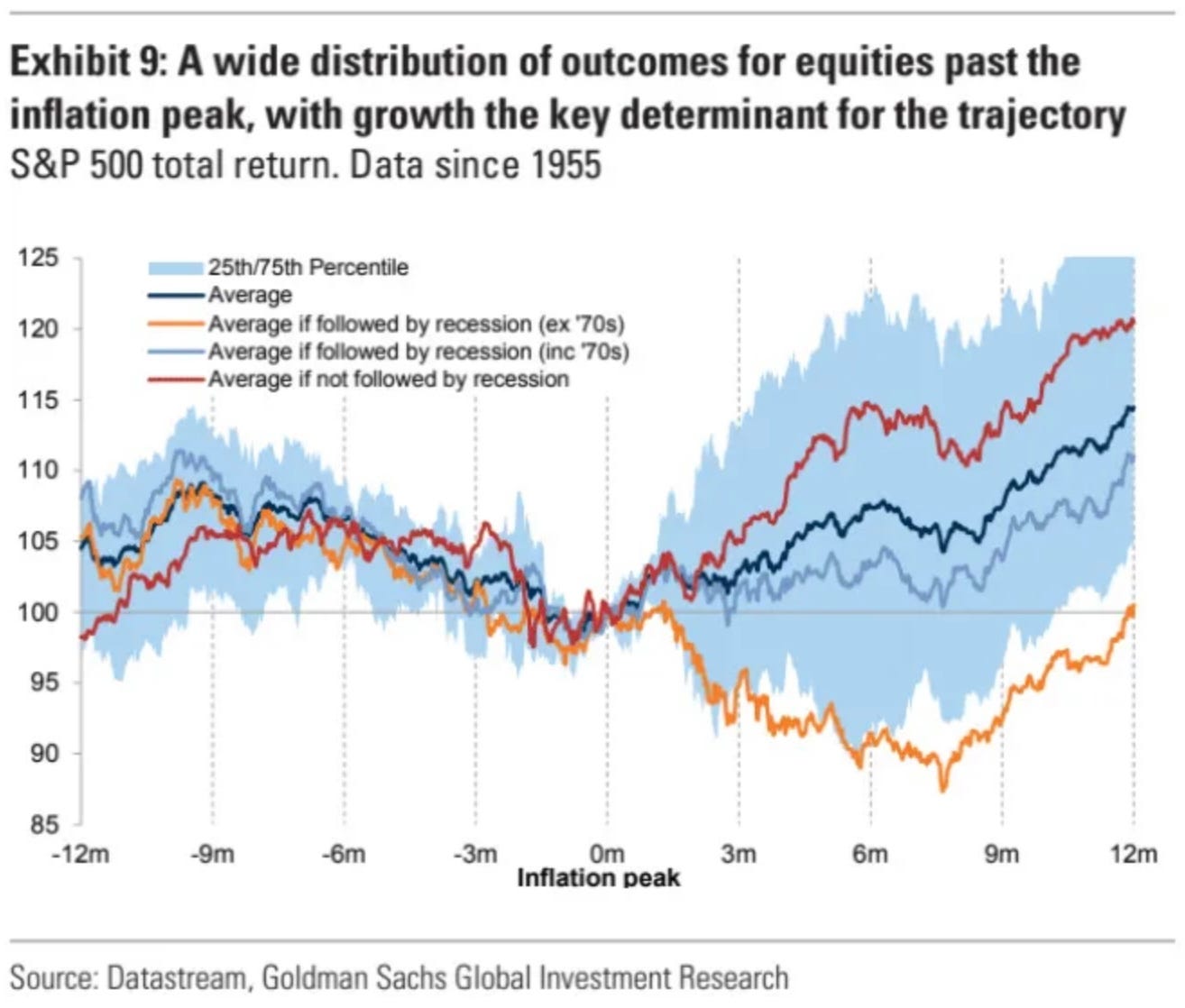

If inflation has peaked, every in-line, downward-trending, monthly datapoint for CPI / PCE will fuel the market recovery. By the time we find a floor for inflation (i.e., a hard-to-break level, perhaps in the 3-4% range), the market may have run substantially.

Furthermore, I didn’t expect Fed officials to take it seriously when I half-jokingly hinted in a previous note they might be willing to “move the inflation target / goalposts from the arbitrary 2% in a dispassionate exercise of cold, economic realism”. From the Fed Whisperer himself…

China’s reopening is happening—I feel very strongly about this. Extrapolating the South Korean and Taiwanese re-opening experience, we might see some initial supply disruption from early wave of infections, but domestic demand will swiftly ramp up afterwards. China’s re-opening thesis turbocharged by fiscal / monetary stimulus underwritten by globally decelerating inflation could put a floor on global demand and somewhat offset the lack thereof elsewhere, as seen post-GFC.

As investors, when facts change we need to reassess.

After recent events I'm leaning toward a more balanced approach vis-a-vis my ‘lower lows’ forecast for equities. I'm no longer as convinced of seeing a big drop below the previous lows (~3,500 on the S&P500) and acknowledge increasing odds of a range-bound / slowly upward-sloping grind with substantial rotation within equities2.

From a long-term perspective, the current situation makes me a tad more comfortable with my current equity longs and happier to add opportunistically, if I find a right price for a great asset3:

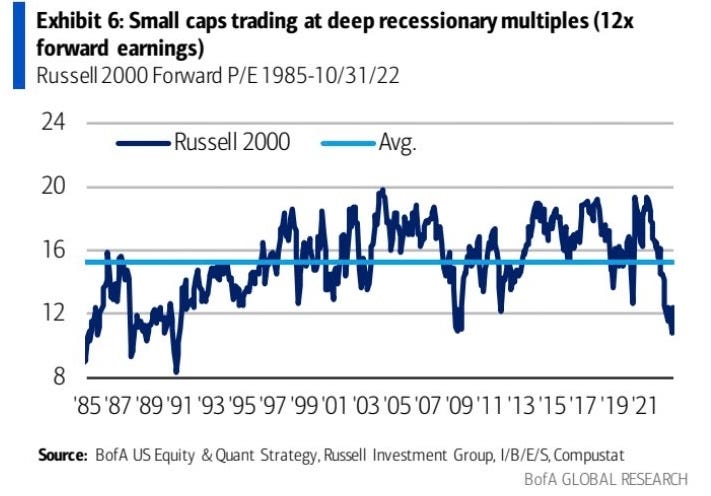

In general, I’m starting to like small caps here—they seem particularly inexpensive relative to historical valuations. They also outperformed their large-cap counterparts over the inflationary mid-70s and early-80s.

For reference, the Russell 2000 (i.e., the main US small-caps ETF) trades at >30Y lows in terms of forward P/E at ~12x, in line with GFC lows and below COVID and 2001 lows. I get that earnings can get scary fast, yet this seems overdone. The simplest way to play it is via the iShares Russell 2000 ETF (ticker: IWM), but there are some great industrials, mining and energy names trading fairly cheap, too.

On the other hand, I increased my exposure to uranium (ticker: SRUUF, U-UN.TO), as explained in my last piece titled $22 “IT’S PRONOUNCED NUCULAR". I also remain bullish oil names as laid out in $13 THE BOOK OF MUIR.

I ringed the register on some ChinaTech on the way up—the main ETF is ~33% up since my original piece $19 CHINATECH: RETESTING CYCLE LOWS—and started reloading a couple of days ago, when news out of China (i.e., public revolt and subsequent shift in their COVID policy stance) proved they were running against their material constraints. Papic.

I wish I could offer a cleaner narrative—one which unequivocally hints in one direction, but unfortunately it would be intellectually dishonest to do so. That's not how markets work, it's often about probabilities and paths. I can only offer you my thought process.

In the face of uncertainty we all need to re-assess our views. Shifting toward a more balanced stance seems the right move for me, today. Let’s see what happens with Thursday’s PCE figure...

$$$

Thanks for reading,

John Galt

Many of us still seem to have PTSD from the incredible two-year, post-COVID rally. This likely includes Stan Druckenmiller, by the way.

We have already seen this equity rotation. Earnings were roughly flat this quarter, with energy and some defensives outperforming vs. InfoTech for instance. We may see more of these offsets, with less of an impact impact on index-level earnings.

In a range-bound market as I envision it (think: S&P trading from 3,500 to 4,100, I know it's a wide range but the bulk of trading would be in between) some assets can still lose 10-20% from here, but the downside is more capped.

With a longer term perspective, buying some assets within that range increasingly seems attractive. I'm afraid some great assets might have seen their lows, such as Vonovia (ticker: VNA) when we flagged at $19.2 (now ~$25).

Very interesting...as usual. Thank you!