$20 ANOTHER BEAR MARKET RALLY?

Technical and fundamental factors are setting the market up for yet another bear market rally

Executive Summary

ChinaTech remains incredibly inexpensive and fully disconnected from fundamentals

Similar combination of market forces launched last summer’s bear market rally

Tactically constructive on risk today, favoring a bounce in the short term yet with lower lows in the cards in the medium term

This post discusses—implicitly or explicitly—investments in ChinaTech (tickers: KWEB, BABA, BIDU, JD, PDD, KC), US equities, bonds, FX (USD) and gold.

Disconnected fundamentals

Wow, what a rollercoaster the past few days have been in markets since I published $19 CHINATECH: RETESTING CYCLE LOWS on Sunday. Monday’s sell-off in Chinese equities—ADRs in particular—was truly egregious, with most ChinaTech stocks down 15% on the first day following the 20th National Party Congress. Hang Seng, party like it’s 1999.

Markets decidedly looked past China’s beat in economic figures—with GDP at 3.9% (vs. 3.3% est.) and industrial production at 6.3% (vs. 4.8% est.)—and the appointment as premier of the “capable pro-market and pro-growth politician” Li Qiang, as per Nomura’s Chief China Economist Ting Lu1. Underreported.

The drawdown was aptly described by JPM’s Kolanovic as “disconnected from fundamentals” and “present[ing] an opportunity”.

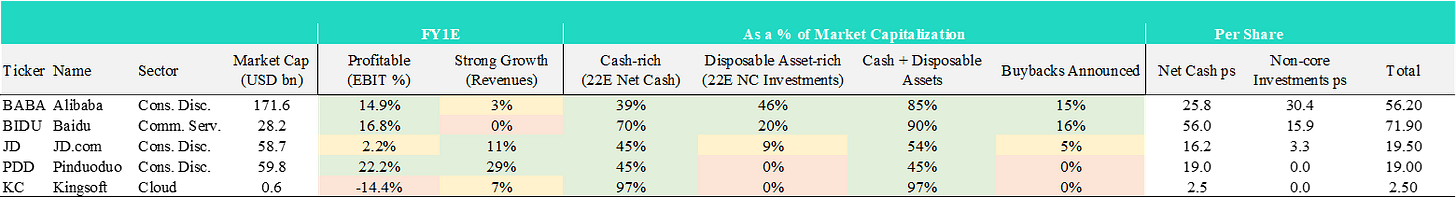

The table below evidences how big of “an opportunity” this is. Cheap AF.

In theory, should BABA, BIDU or KC decide to liquidate their non-core investments and buy back their stock, they could get very close to acquiring full ownership of the company (see ‘Cash + Disposable assets as % of Market Capitalization’ column). In theory communism works… in theory.

I rarely comment on my readership statistics. This time, however, it offers anecdotal evidence of how brutally polarizing the subject of China has become and how underloved this thesis is.

Four members unsubscribed from Going John Galt within 10 minutes of publishing—quite rare for a Substack with virtually zero churn (just one unsubscribed member in nearly 6 months live). Now, however polarizing the subject may be, the bigger truth is that investors love a bargain… and over 40 readers clicked the subscribe button since.

This proved to be a testament to what happened next. An aggressive, >10% rebound off the lows, sponsored by China’s national ‘Plunge Protection Team’. If you are wondering what happens now, simply consider what historically happens 60 days after such drawdowns…

Let’s leave it there for now, as I promised to speak about the market in general, including the ongoing earnings season. Let’s jump right in.

Up or down?

Looking at the various vectors exerting force in different directions on the market helps when it comes to determining direction. Below I’ve outlined some of these, split between technical and fundamental factors:

Technical factors

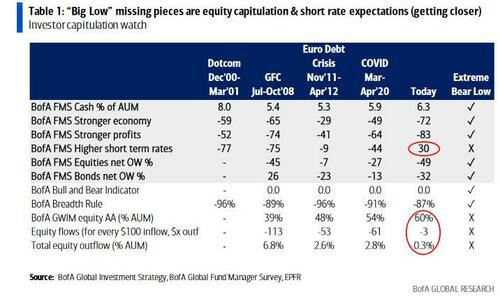

Investor positioning: Massively underweight with few indicators far from minimum, as per many different sources. It’s difficult for investors to be more bearish, potentially not many marginal sellers left.

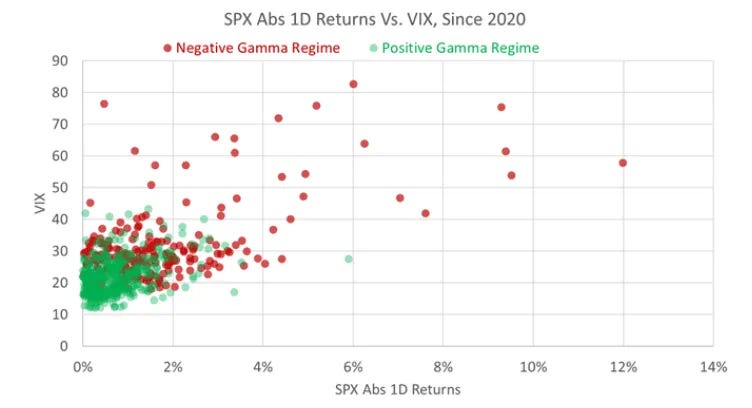

Options positioning: Today’s long gamma regime insulates market against outsized moves (up and down) and compresses volatility / reduces absolute range of daily returns.

VIX at ~27 and dropping should increase long participation of vol-related strategies and mitigate option dealers’ need for downside protection from delta-hedging, fueling the put rally.

Earnings season / corporate buyback flows: As companies report earnings, they leave behind the blackout period and restart share repurchases. 65% of the S&P will have reported by Friday, including the largest US tech companies. ~21% of buybacks are done from November to December—strongest two-month period in the year.

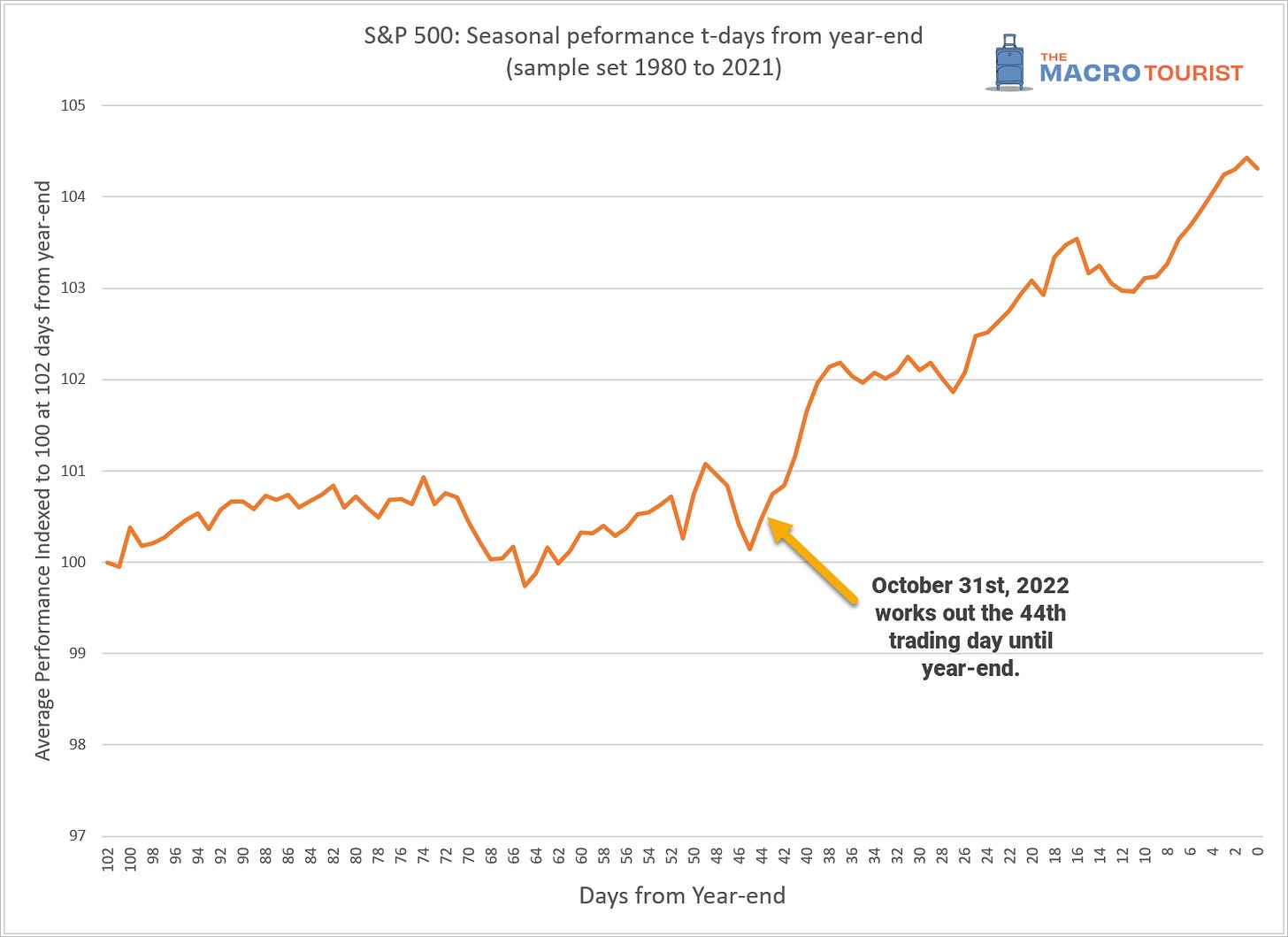

Seasonality: November to December tends to be a strong period for equities.

Midterms: This is even more so from the end of October up to the US midterm elections—average S&P return of ~1.7% from 1970 to 2018—and over the subsequent year.

Fundamental factors

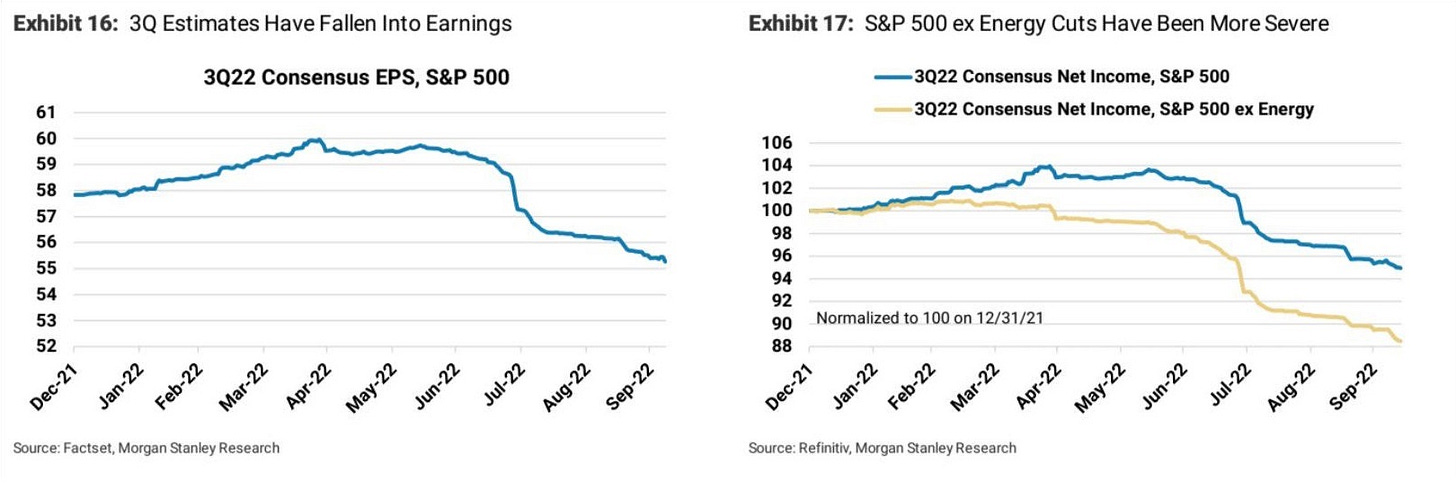

EPS: Earnings won’t be great, however these have been slowly adjusted downward already (sandbagging), leaving a low bar to clear. Nominal GDP in excess of 10% represents a potent tailwind for corporate revenues. Pricing power and a relatively strong consumer will likely not be enough to avoid some (mild) margin compression. Forward earnings remain incredibly above trend, but it’s early for full earnings capitulation. Inflation tailwinds.

There should exist a strong divergence across sectors—with energy still king—but there are good chances it will disappoint bears.

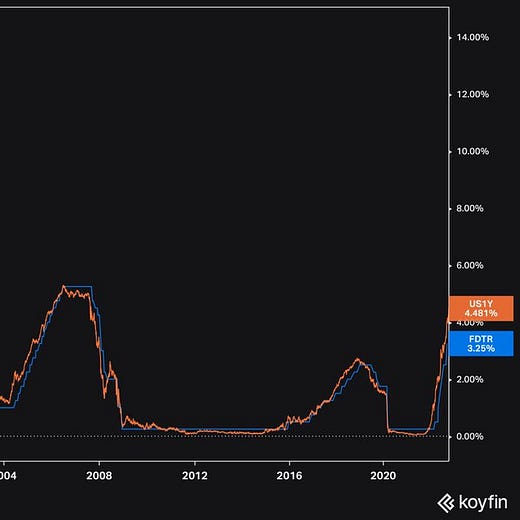

Monetary policy / Fed: The infamous ‘Fed pivot’ narrative (i.e., deceleration / pause in hiking, lower terminal rate or rate cuts / end of QT soon after terminal) could take off again, should peak inflation be re-established. Fed Whisperer Nick Timiraos has continued telegraphing the Fed’s intentions and they seem set on softening their messaging around further hikes. If terminal rate peaks, the chart below becomes more relevant as it will drive what I call ‘The Everything Trade’ (i.e., long bonds, short USD, long equities, long gold).

Louder calls for softer Fed policy (i.e., US politicians, IMF, et al.) should have an impact on the margin, along with unforeseen developments across other jurisdictions (including central bank interventions).

We saw a similar combination of forces launch last summer’s bear market rally, as overshooting EPS were turbocharged by bullish technicals. All things considered, I’m tactically constructive on risk and favor this outcome (bounce) in the short term, yet continue to think lower lows are in the cards in the medium term.

I've liquidated my shorts over the past weeks while the S&P was in the 3,600s and have more recently started (slowly) nibbling on my preferred longs.

$$$

Thanks for reading,

John Galt

Ting Lu added that Li “has extensive experience in managing some of China’s richest and biggest provincial economies”, including the province BABA is headquartered in (Zhejiang).