$26 HIGHER FOR LONGER

Re-acceleration in economic data at odds with market pricing of a Fed pause and cuts this year, an ominous sign for US equities

Executive Summary

Recent grind up in US equities rests on ‘Fed pivot’ narrative (i.e., pause in Fed hiking on the back of rapidly decelerating inflation)

In past days we witnessed a puzzling re-acceleration in economic data, at odds with calls for imminent recession and significant monetary softening / rate cuts

Latest repricing of rates increases odds of finishing the year (well) north of 5%, an ominous sign for US equities

This post discusses—implicitly or explicitly—investments in rates / bonds, US equities (tickers: MSFT, GOOG) and energy equities.

“STOP FORREST”

If you’ve been following our work you’ll remember how in Q4 we ventured off-piste and turned fairly constructive on US equities, indicating the most likely path forward for them was a “range-bound / slowly upward-sloping grind with substantial rotation within equities” ($23 A MORE BALANCED APPROACH).

The footnote called for “S&P trading from 3,500 to 4,100” and identified how going forward the “downside is more capped” and how “some great assets might have seen their lows”.

Fast-forward two months and a bit. For the most part, US equities ran in line of our expectations… then ran some more. Out of the stadium, out of our stated range.

It’s undeniable that (animal) spirits are running high. Junk has rallied. The GameStops of this world seem back in the menu. Even crypto. As investors we find ourselves in a deeply uncomfortable place, with some of us penning notes on how we “just don’t know”. John Snow.

In the past week, I’ve started to see small signs that the situation may start to revert. Something seems to be brewing across assets, driven by an emerging narrative. If you agree, note we are not alone.

“I think markets are already behaving far more rationally now even just versus a few days ago, and we see new pricing across the board in the rates / USTs / duration space, as terminal moves higher and further out [while] that legacy ‘imminent 2023 hard landing recession’ probability gets REKT and pushed into 2024.” —Nomura’s Charlie McElligott

Today’s piece examines what this nascent narrative looks like and where some of the latest developments fit in the context of the past months’ market action.

Pause? Possibly. Cuts? Highly unlikely.

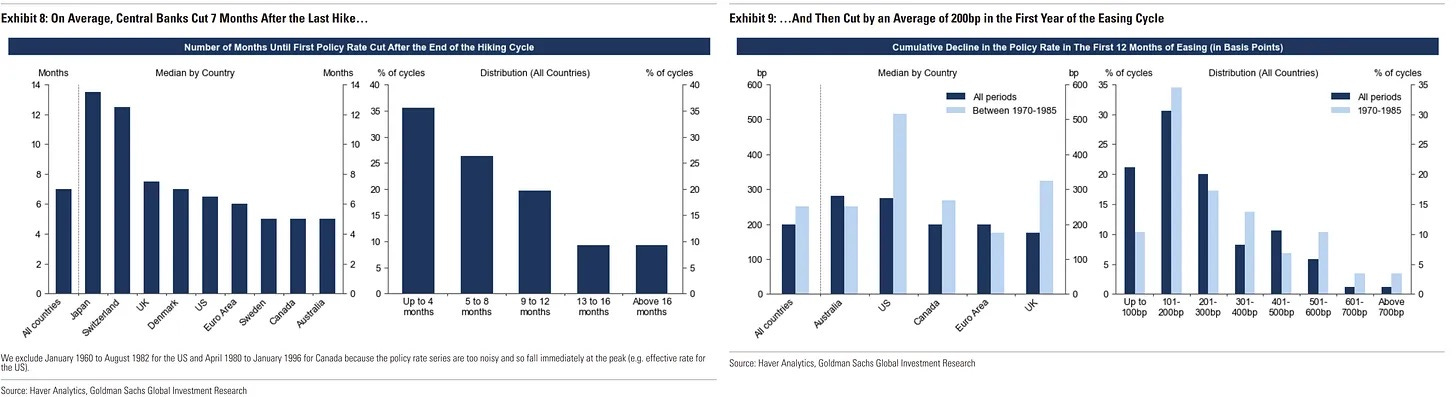

The recent grind up in US equities was predicated on the ‘Fed pivot’ narrative (i.e., pause in Fed hiking on the back of rapidly decelerating inflation), which took center stage starting in October. Weak economic data—including early signs of disinflation—allowed markets to swiftly anticipate a terminal rate just below 5% followed by the start of a new cutting cycle (7 months after and for roughly 200bps).

This dampened / compressed volatility—with VIX and MOVE both peaking in October—and underwrote the current rally in everything.1

Now, over the past days we’ve witnessed a puzzling re-acceleration in economic data:

December JOLTS data showed US job openings at 11 million (vs. 10.4 in December), a 5-month peak

January Non-farm Payrolls (NFP) surprised to the upside: headline figure (517,000) was ~3x consensus, ~2x December’s number; Unemployment dropped to 3.4% (vs. 3.6% previously); average hourly wages accelerated to 4.4% YoY; the visual below underscores how much of an outlier this print was.

US ISM January services PMI back to expansion territory at 55.2 (vs. 49.2 in December)2; little disinflation seen in the ‘new’ “services ex-housing” component

Even within goods, items such as used car prices—a major component in inflation indexes, a poster child of this inflation cycle and one of the first experiencing disinflation—seem to be unexpectedly picking up again (2.5% in January)

Inflation pressures remained strong globally on the back of Europe’s economic recovery post-energy crisis and China’s reopening, with core inflation in the EU attaining peak levels and Japan’s inflation hitting >40Y highs

The economy is proving surprisingly strong. Labor markets, scorching. A recession is less imminent than what markets are pricing.

Now, where does this leave us?

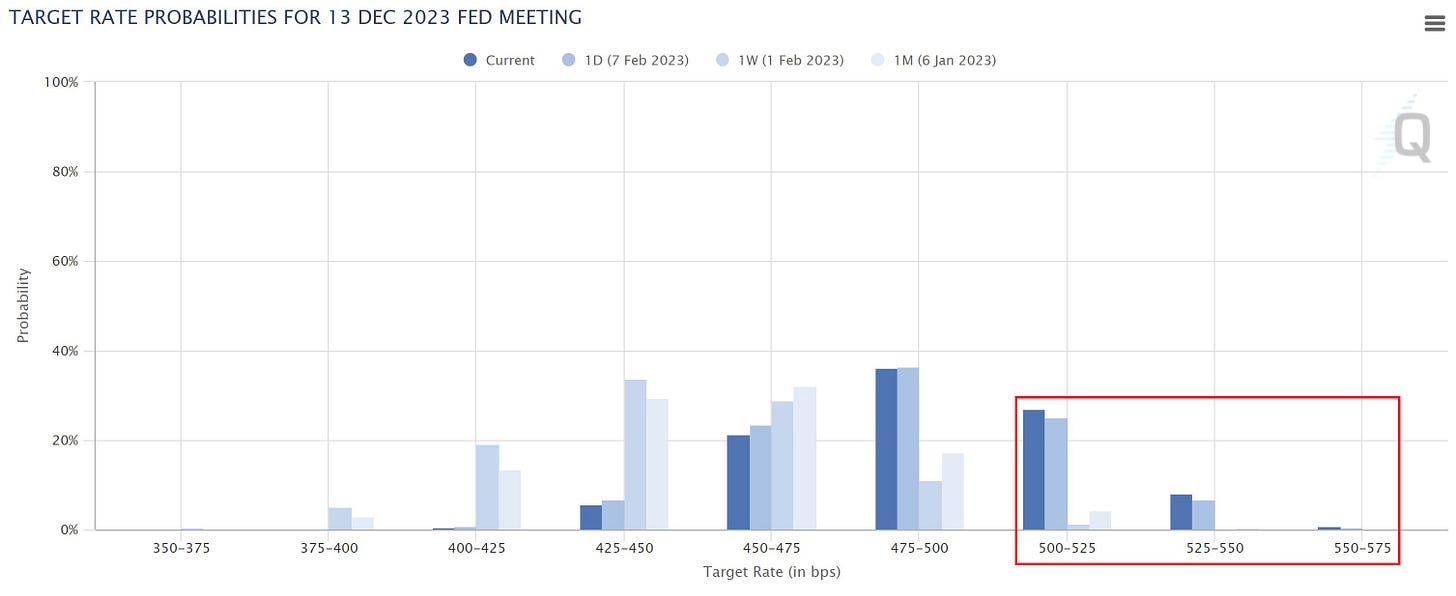

Latest data could cast doubt on prospects of a pause following 25bps increments in March and May and cuts this year. Inflation deceleration will potentially reverse course and go higher again soon (although not back to peak). Do you think an economy churning out strong data, where inflation is substantially above target (and re-accelerating) warrants rate cuts (and an 18x P/E multiple)? Pause? Possibly, for a bit. Cuts? Extremely unlikely. “And like that... it’s gone”.

A cacophony of Fed voices—only in the past 24h we had Williams, Waller, Kashkari, Cook and Powell—have flagged the possibility of ‘higher for longer’ in the past days.3 So much so they might have engaged Timiraos to parrot their talking points! McElligott is right, investors are “not taking a Fed ‘higher for longer’ path at face value”.

If you agree with the incomparable Kevin Muir—of The Macro Tourist fame (great resource, btw!)—that markets are forward discounting and have been anticipating / pricing the pause all along, the terminal rate moving ‘higher for longer’ should be an ominous sign for US equities.

Well, the repricing of terminal rates seems to have already started and accelerated in the past couple of days. The odds of finishing the year (well) north of 5% in rates is markedly higher.4 It has coincided with rebounding volatility indexes (i.e., MOVE and VIX), mixed results in US bond auctions (some atrocious, some stellar) and broad weakness in equities.

I mention in the “About” section that I always expect people to state how strongly they feel about any given call. Just to be clear, this one truly rests on a couple of data points. This nascent narrative resembles the Death Star in that it’s spectacularly vulnerable5 if these few “data points [truly] don’t make a trend”. It’s early. Caveats.

A couple of ways to play it.

As JPM’s Kolanovic put it, I’ll be using “current strength in order to reduce exposure” across my book. This does not mean the S&P is going to 3,000 in a heartbeat. It only means I'm comfortable we’ll meander back to our range.

On the other hand I think compounders / dividend / shareholder remuneration plays should be fairly well positioned in this ‘higher for longer’ world, where a recession is not imminent. I continue to like energy in particular—some of these names are almost literally printing money ($25 GREAT THINGS HAPPEN TO CHEAP ASSETS). BP's FCF is 25%?!

Finally, I suggest you keep an eye on the AI wars. Seems Microsoft ($MSFT) truly has something special in their hands with the integration of OpenAI’s technology (ChatGPT) in their browser and MS Office products. Google’s ($GOOG) monopoly in search (>90%) might be at stake… and that’s a lot of billion in market cap.

$$$

Thanks for reading,

John Galt

*Sponsored Content*

One app, all things money. No exchange fees, get the real currency rate.

John Galt is an avid traveler and a superuser of Revolut. For years. I really love it! It’s for this reason I’m particularly excited that our friends at Revolut came through with their sponsorship for this post.

“For some people, money is... money is a foreign film without subtitles.” —Matchstick Men

Revolut is a regular, licensed bank, with great technology behind. But—on top of all the usual features you can expect from your bank—Revolut allows you to automatically convert the balance in your account from one currency to another using the interbank exchange rate (!) and avoid exchange fees. Trust me, complete transparency in FX exchange rates is a valuable asset.

Sign up here (it’s quick & easy!)—use my link to support Going John Galt

Back then I flagged that “if terminal rate peaks, […] it will drive what I call ‘The Everything Trade’ (i.e., long bonds, short USD, long equities, long gold)” ($20 ANOTHER BEAR MARKET RALLY?).

PMIs are diffusion indexes—when they come in over 50 they are in expansion territory and below 50 represent contraction.

Go to my Twitter account (@GoingJGalt) for numerous examples of recent hawkish Fedtalk. A stark reminder that the Fed does not only traffic in puts, but also in calls…

FWIW, Citi just suggested 6% is possible.

There are many reasons to be bullish equities should the Goldilocks narrative of “immaculate disinflation” / soft landing continue (i.e., inflation decelerating toward 2% on top of strong economy) and sustain earnings. Beyond fundamentals, positioning would continue normalizing under such a scenario, while share buybacks remain particularly strong (this year vs. other year starts).

Great post and I agree, VVIX spiked 13% yesterday, abnormal move and might have to do with economic acceleration, the #bigflip macro narrative on Fintwit , Fed should have done 50 bps and Powell push back on loosened financial conditions, now inflation battle is going to take much longer than market expects which means higher for much longer turning this battle into a prolonged war.

Market also thought Ukraine-Russia war would be over sooner too 😅