$18 DRINKING RED BULL & VODKA

Countries have to choose between their bond market and their currency

Executive Summary

Years of compounding mistakes have resulted in an untenable situation that is / will be exceedingly costly for the UK and Europe

Countries rolling out pro-cyclical fiscal policies during today’s inflationary environment must be prepared to make a choice between saving the bond market or protecting their currency

Markets will continue testing their resolve until they adopt a credible fiscal stance and responsible monetary policies—in absolute terms and relative to other countries

This post discusses—implicitly or explicitly—investments in FX (USD, EUR, GBP), bonds and Vonovia (ticker: VNA).

Mistakes compound

Last Summer, my father and me set sail around the island of Menorca in Spain (near Mallorca and Ibiza). In the second day of navigation, we realized the rope which tied the dinghy to the sailing boat was slightly short and somewhat eroded. Not terrible news when cruising the tranquil waters of the Balearics, so we decided against its replacement. A few days later we were anchored in Cala En Porter—just in front of the famous Cova d’en Xoroi—when a summer storm broke out.

In the middle of the night, the rope we didn't replace broke. Mistake #1. We decided to lift the anchor and go after it. Mistake #2… and by far worse. In the end, our efforts came up short and we lost the dinghy. Yet we could have lost the sailing boat and much more...

I’m going a bit off-piste here, but it was a stark reminder of the compounding nature of mistakes… and the absolutely bizarre operating leverage imbued in some elements of our lives.

Pick your poison

“In Germany, $2 trillion of value added depends on $20 billion of gas from Russia… that’s 100-times leverage—more than Lehman’s.”—Zoltan Pozsar, Credit Suisse

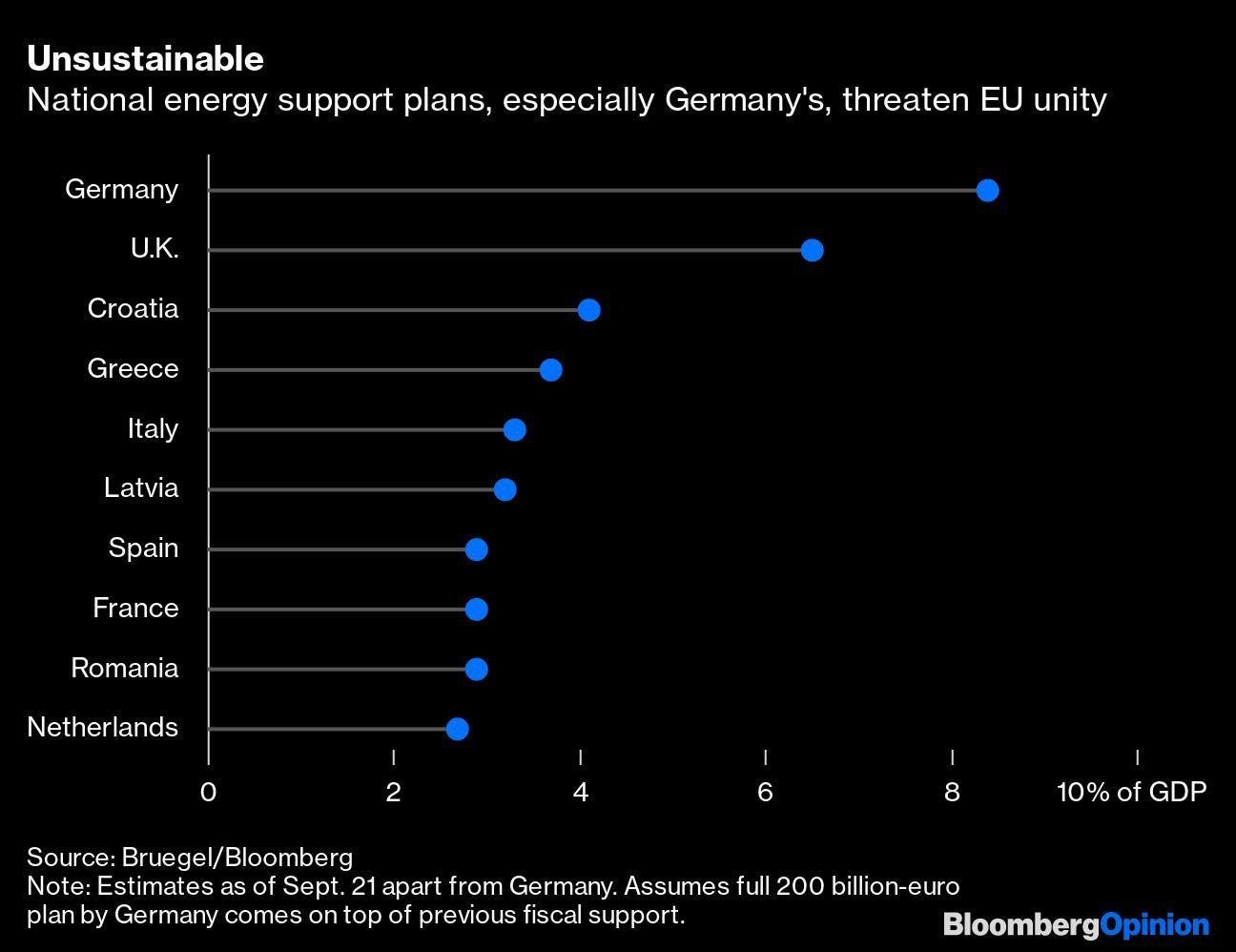

Avid readers probably see where I’m going with this—the mistakes and the operating leverage remind me of the current situation in the UK and Europe. Years of compounding mistakes have resulted in an untenable situation that is / will be exceedingly costly. The table below is self-explanatory.

My note $17 ALL HAIL KING DOLLAR! from a few days ago, described how these fiscal moves (i.e., energy support plans, tax breaks, etc.) add to economic vulnerabilities, which together are hurting sovereign bonds and / or domestic currency.

Countries rolling out pro-cyclical fiscal policies1 during today’s inflationary environment—these days, everyone really—must be prepared to make a choice between:

Saving the bond market through central bank intervention and let their currency take the plunge

Let bond markets trade (relatively) freely and potentially crash, but protect their currency

A Tale of Two Economies

“So here we are, with the BoE mixing ‘uppers’ with their ‘downers,’ drinking Red Bull and vodka as they simultaneously hit the gas and brakes in chaotic fashion.”—Charlie McElligott, Nomura

A few weeks ago, the UK got a taste of economic reality. They decided to pursue several unfunded tax breaks2, on top of an expansive energy support plan unveiled in September. They then proceeded to go down the second route (#2 above). They took the red pill.

Markets didn't like it one bit. It only took authorities a few days and an almost collapse of the pension system—one of the main owners of these bonds3—to revert their choice and (temporarily) save the bond market through central bank buying. Mercifully and unlike in the Wachowskis’ masterpiece, it seems you can take both pills.

Since then, authorities have sent mixed signals (i.e., cutting somewhat back on the tax breaks, while telegraphing the end of the “emergency bond-buying program” this Friday and the start of quantitative tightening [QT] in the coming weeks). Drinking Red Bull and vodka.

I find it more likely that the dollar turns around when interest rate differentials (actual and expected) close down and the economic vulnerabilities abate.

Read more: $17 ALL HAIL KING DOLLAR!

Markets will continue testing their resolve until they adopt a credible fiscal stance and responsible monetary policies—in absolute terms and relative to other countries. The latter potentially referring to a deceleration in US tightening vs. the UK’s, closing down the infamous interest rate differential.

The story is analogous to Europe’s.

On the fiscal front, European governments are unveiling varying energy support programs. No tax breaks, luckily.

On the monetary front, the ECB continues hiking and doing QT… yet buying peripheral bonds (i.e., Italy, Spain, Greece, Portugal, etc.) at the same time, attempting to close down core-periphery spreads (see below Italian vs. German bonds).

This combination of policies punishes bonds and the Euro. Anything that ameliorates the energy situation and / or reduces inflation could create a steep rebound in the short term, as the Euro seems quite oversold (-20% Year-To-Date [YTD] vs. USD).

Beyond this and in the longer term, Europe’s biggest risk is derived from the collapse of Eurussia ($16 ON CHIMERICA & EURUSSIA)4. Europe’s energy support programs could be here to stay, unless they are able to find an economic (i.e., cheap) alternative to those energy flows.

Finding a price

European companies—good and bad—are getting hammered in this environment and some are reaching long-term attractive levels.

Remember, I’m not trying to find the price, but a price.

For instance, I’m currently looking at Vonovia (Ticker: VNA), the largest real estate company in Europe. Vonovia manages 621k residential units and owns 550k of them, primarily in Germany (89%). A few additional company highlights:

At today’s share price (€19.2 ps), the company sits at the bottom of this year’s trading range (€19.2-52.61, down 64%) and at Q4 2014 levels

Market cap is ~€15bn vis à vis an Enterprise Value (EV) of ~€59bn; its high leverage (16.5x Net Debt / EBITDA, mostly long term and very cheap) amplifies any negative impact on the equity piece

Independently valued at ~€99bn (EPRA NTA, Net Tangible Assets) or ~€63 per share (ps), offering deep value at hefty (~70%) discount to NTA

Revenues this year of €2.75bn, EBITDA of €2.65bn and Net Income of €1.96bn

Dividend yield of 8.6%, Price to Earnings (PE) of 8.1x, Free Cash-Flow (FCF) yield of 12.4% with projected Revenue growth of ~17% and EBITDA growth of ~24%

This is a bet that Germany makes it through the crisis.

Markets are clearly not buying the current valuation of ~€63 per share. The only catalyst beyond improving macro relates to the fact that the company has put ~€13bn in assets on the market for sale, likely a Q1 event though. Macro-wise, not all is bad…

If these are disposed of anywhere close to their valuation—the use of those funds would go toward delevering—we might see a strong repricing to the upside.

A final housekeeping note. The last piece on the US dollar had the largest traction out of all the pieces I’ve written so far… for this I'm very grateful, thanks.

I’ve not shared this before, but I started this newsletter with the idea to offer a bit of “building in public” (i.e., sharing the intricacies of the newsletter, my takeaways, including KPIs and metrics).

I would be more than happy to do this in the interest of transparency, yet wonder if readers are curious / interested.

I’ve set up a poll for you to vote on this. Depending on the outcome of the poll and also—very importantly!—the amount of engagement (i.e., shares, likes, comments and subscriptions!), I will make a decision next week!

To be clear, this would be just a post every now and then and would not affect the delivery of my usual content.

$$$

Thanks for reading,

John Galt

I'm not arguing against these policies, they are probably necessary (to some extent). I'm not interested in what should be, only in what is.

It often is a matter of perception. The markets perceived this as fiscally irresponsible, particularly coming from a new administration that ran on cutting taxes. It does not necessarily have to do with strict fundamentals.

If you are interested in receiving these updates live, feel free to follow me on Twitter. Click below!

I’m blatantly oversimplifying the matter. It is quite complicated and would take several posts to get anywhere close to explaining what went on that day.

Understood as the economic collaboration between Europe and Russia, where cheap Russian energy—natural gas in particular— would fuel Germany’s industry and Europe more broadly in exchange for funds. Foreign currency recycled into G7 claims. This is one of the pillars of the lowflation regime that underwrote the expansionary monetary policy from the 2010s.

Read more: $16 ON CHIMERICA & EURUSSIA

All credit to Zoltan Pozsar. This is his framework—summarized from one of his missives—aptly named “War and Industrial Policy” (available here for you free!).

"Markets will continue testing their resolve until they adopt a credible fiscal stance and responsible monetary policies"

I'm doubtful credible fiscal stance and responsible monetary policies will ever happen again.

Great piece, thanks!