$17 ALL HAIL KING DOLLAR!

What's going on in FX Land and what might be in the cards soon

Executive Summary

Asymmetrical stimulus and idiosyncratic, country-specific vulnerabilities are at the center of today’s diverging global interest rates / increasing interest rate differentials, which are the main driver of FX today

Relative attractiveness of USD-denominated "cash equivalents" sucks the air out of the rest of the sovereign bond and FX complex

Dollar likely to turn around when interest rate differentials (actual and expected) close and economic vulnerabilities abate

This post discusses—implicitly or explicitly—investments in FX (USD, EUR, GBP, NOK, CHF), bonds / cash equivalents, commodities and gold.

Do you know the feeling when something is so embarrassing / cringy you want to crawl under your desk…? If you missed Tesla’s ($TSLA) presentation, click on the tweet below for the clip.

Note that Boston Dynamics is owned by Hyundai since 2020—a company >25x smaller than $TSLA ($36bn vs. $919bn in MCap). Reposting these tweets reminds me of the terrible job I’ve been doing at “promoting” my own Twitter account, which boasts a lower subscriber count than this Substack… 😉

A F1 Analogy

Prior to the pandemic, each economy advanced at their own pace according to their own economic reality. Slower / negative growth in certain countries were offset by larger growth elsewhere, smoothening out the global economic cycle.

Enter the pandemic, which I find analogous to an accident happening in a F1 race prompting the Safety Car to appear—a vehicle that limits the speed of competing cars on a racetrack during a “caution period”. The distance between cars and their speed prior to the Safety Car no longer matters, as all cars are now stuck in a line behind the Safety Car until the race resumes. During the time the Safety Car is en piste pilots strive to calibrate the car for an optimal re-launch—managing fuel consumption and maintaining the optimal temperature in their brakes. mRNA vaccines allowed the Safety Car to leave the track, with all cars re-accelerating at the same time.

Back to the economy. Fiscal-monetary stimulus / coordination and vaccine deployment strategies were highly asymmetrical across countries. A stark synchronous economic recovery ensued across the globe with economies re-launching at different speeds. But countries / regions were no longer offsetting each other—instead pushing against the limits of their material economic constraints…

Blah blah blah… all-time high demand… reh teh teh… supply constraints... Inflation skyrocketing.

We all know the story.

Central bank genie is out of the bottle

Asymmetrical stimulus and idiosyncratic, country-specific vulnerabilities (i.e., energy policy, COVID policy, domestic political issues, sovereign debt levels and central bank reaction function / credibility / reserves) are at the center of today’s diverging global interest rates / increasing interest rate differentials (actual and expected)1. This in turn is the main driver of FX today.

The US stimulated its economy to the tune of $1.7tn in monetary (QE) and $3.5tn in fiscal easing (~$1.7tn of which has actually been spent so far) since the Biden's inauguration.

The world’s largest stimulus underwrote one of the largest core inflation figures (ex-energy / food) among developed economies, even exceeding Europe’s! Once the Fed finally realized this, it became one of the fastest tightening central banks, with other central banks scrambling to hike fast enough. TD’s Andrew Kelvin calls this “Keeping Up With the Jeromeses”, which I find both apt and hilarious.

Compounding choices

Marge: Homer you’re crazy. Reverend, tell him this is all crazy!

Reverend Lovejoy: Homer, you remember Matthew 21-27, "The Foolish man who built his house on sand"— The Simpsons

These economic vulnerabilities are a reflection of (often foolish) choices made by countries, compounded over time:

US: Pushed strongly for energy and food independence. As a result its economy is relatively shielded from the economic implications of the Ukraine invasion. It has also cost them a third of the Strategic Petroleum Reserve (SPR)… so not entirely sustainable.

Europe: Decades of increasing energy dependence, with Russia at the center2—in 2020, 27% of EU energy was gas, 46% of which imported from Russia. Gas stopped flowing—only Hungary still receives some today—and had to be procured elsewhere at much higher prices, pushing countries to institute costly policies (€250bn fiscal across the EMU-4, 2.7% of GDP) and curtail demand (i.e., factory closures, particularly in materials-based industries such as cement, steel, chemicals, glass, paper and ceramics).

China: Remained impervious to public outrage related to their zero-COVID policy. The result is economic stress, particularly in its weakest economic link (i.e., real estate). Things might be changing though, which would drive sentiment and household / business spending / investment3.

UK: Liz Truss got recently elected promising a large tax break. Truss’ government recently announced unfunded tax cuts raising the estimated debt ratio to ~104% in 2024 (vs. ~96% for March’ estimates)4. Bonds were obliterated—warranting an emergency intervention (buying) from the Bank of England (BoE)—and throwing the pound (GBP) under the bus in the face of renewed QE / ad minimum questions around the viability of QT.

Developed Economies: Structurally underinvested in natural resources in the name of ESG, leaving them in short supply of energy / commodities / food today. This is particularly the case in Europe, but not only.

The cleanest dirty shirt

Considering interest rate differentials (actual and expected) and the economic vulnerabilities laid out above, it’s clear the US is the “cleanest dirty shirt” in the pile as it offers the highest-yields across the entire spectrum of “cash equivalents” (“cash”, proxied below by the US 1Y Treasury Bill below, for simplicity).

The relative attractiveness of USD-denominated "cash" favors the sale of foreign assets to buy these instead, sucking the air out of the sovereign bond and FX complex5.

Does this impact commodities?

Higher yields on “cash” raise the opportunity cost of carrying (holding) non-yielding assets such as commodities. Hence the current situation, where a basket of commodities can be up by ~20% YTD in USD-terms, yet >50% in JPY-terms. Gold has actually appreciated in value across some currencies, just not in USD-terms.

An indirect channel of FX impact on commodity prices results from the fact that most are produced / mined in foreign currency-denominated countries deflating the cost of production (i.e., local labor and input costs) in USD-terms.

Lower commodity prices in USD-terms press US real incomes and rates higher, favoring US economic growth and re-enforcing the “cleanest dirty shirt” narrative.

All Hail King Dollar!

I believe FX will regain its importance in investors' portfolios in coming quarters. I would be very surprised if I don't find compelling arguments to short the USD fairly soon.

Read more: $15 IF YOU BREAK IT, YOU BUY IT

The global economy is unlikely to be able to cope with the USD at near all-time highs for long. International organizations (including the UN today) are pleading for a policy change that saves emerging economies. Being King in FX Land can be problematic.

It's also clear that central banks around the world are growing uncomfortable and starting to intervene. Japan’s BoJ and China’s banks did so in their FX markets in the past weeks already. The UK's BoE intervened in their bond market.

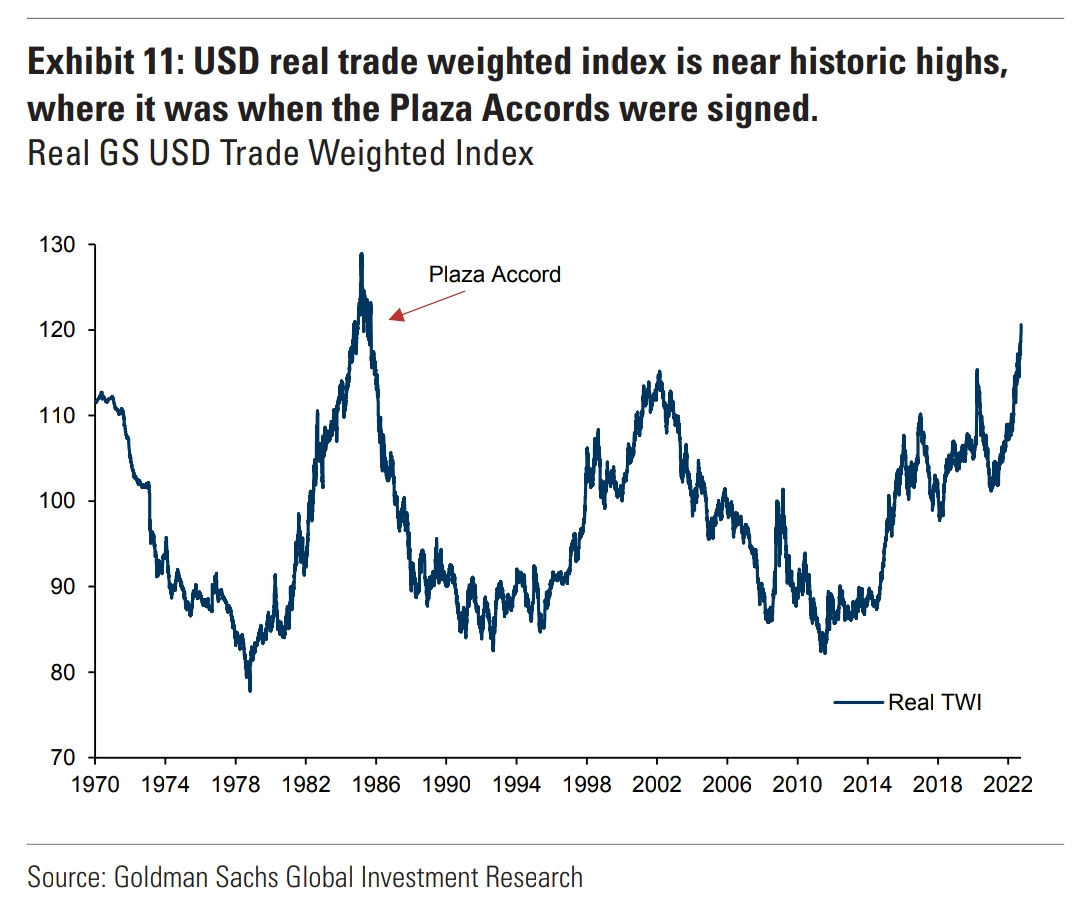

One way in which this dollar run could theoretically end is through coordinated central bank intervention à la Plaza Accords in the ‘80s. I question, however, the long-term viability of such coordinated response, as the underlying fundamentals would persist. I also struggle to see what's in there for the US—note the US was part of the original Plaza Accord and any such coordinated intervention would require their cooperation. I assign higher probabilities to independent interventions the likes of which we’ve seen in past weeks.

I find it more likely that the dollar turns around when interest rate differentials (actual and expected) close down and the economic vulnerabilities abate.

This could take several forms, some of which I outline below:

US peak hawkishness (i.e., hike expectations see the top) is reached

Rest of World (RoW) central banks outhawk the Fed

Resolution to Russia-Ukraine conflict

China moves on from zero-COVID policy

Milder winter in Europe and steps toward more sustainable energy policy (i.e., nuclear reopening, new LNG terminals, intra-EU grid interconnection, growing capacity from Northern Africa, etc.)

UK decides against the new fiscal package; by the way, this actually happened while writing this piece, pushing the GBPUSD to 1.13 from 1.0379 at the cycle lows

Depending on the type of relief, the turn could prove more sustainable or not. Let's not forget the Plaza Accord was preceded by over half a decade of USD appreciation. A long term pivot may take a while, but it won't be a straight line up. Guaranteed.

This is the lens through which I intend to look at all developments in coming weeks, in search for the vaunted USD reversal. FX is becoming increasingly relevant and, ad minimum, investors should spend some time reviewing their own exposures.

I’m based in Europe, but have been lucky enough to have the majority of my assets denominated in USD and CAD. I’m not planning on giving up those gains. I’m mulling a pivot toward NOK (energy independent, strong central bank with credibility and reserves) and CHF (responsible inflation-targeter, safe-heaven, all-around well-run country), even in the absence of a USD reversal.

Hope this was helpful and don’t forget to subscribe!

$$$

Thanks for reading,

John Galt

PS: If you haven’t checked out OpenAI’s Dall·E 2, you’re missing out. Click here for a quick, practical explanation on how the technology works. Below, the outputs generated in 3 seconds after typing in “Palma de Mallorca painted by Georges Seurat”.

Now, Seurat never painted these from his studio in Montmartre! Breathtaking technology with long-term ramifications... OpenAI is already in a partnership with Microsoft Azure ($MSFT). You can try the free beta version here.

Again… would appreciate a follow on Twitter for live updates on investment ideas, portfolio updates and breaking news!

Interest rate differentials being Country A's rate, minus Country B's rate.

One might argue it started with West Germany’s Ostpolitik starting in 1969. Vast pipeline networks toward Europe through today’s Ukraine were built over the 80s and with the push to integrate Russia’s economy with Europe’s after the fall of the Soviet Union. A bigger push happened subsequently in the 2000s with Schroeder’s Nord Stream 1 and 2010’s with Nord Stream 2 to bypass Ukraine. There’s a great paper discussing this (available here).

Ever wondered why Gazprom spent the past ~20Y sponsoring the UEFA / European soccer teams / leagues? Lobbying.

Hong Kong has already erased quarantines and there is speculation about China’s mainland following. Senior official, including Xi, are increasingly being spotted without wearing masks—something unthinkable even a few weeks ago.

Note the UK’s debt ratio is lower than most G7 countries and the average maturity is substantially higher. Bottom line, the level is not dramatic, the size and the fact it’s unfunded is.

Rates are still rising as buying pressure today is insufficient to counter the negative effect of QT (i.e., reduction of central bank balance sheet), new issuance and pricing of rate hikes.

Another large source of demand obviously relates to the fact that USD-denominated debt requires dollars to pay the instalments. Today’s dollar wrecking ball is a huge problem for emerging market economies and a veritable risk to global growth.

Thanks for the Welcome email. I like your sections on what we will find and not find in the subscription and your statement; "Managing money is hard. So is managing risk. Expect me to treat it as such." Looking forward to more of your content!

When you say your considering a pivot toward NOK and CHF, would that mean leaving USD and CAD?