$15 IF YOU BREAK IT, YOU BUY IT

Equities remain under the tenuous authority of investor positioning and mechanical / systematic flows

Executive Summary

Inflation might be rolling over, but August’s CPI figures surprised to the upside—the stickiest CPI components show little signs of easing

“Hard landing” back in the cards for 2023, as Powell is expected to slam on the breaks harder and continue to tighten financial conditions (i.e., increase real yields, lower stocks, widen credit spreads and strengthen the dollar)

Options Expiration week, positioning and mechanical / systematic flows are currently exacerbating market moves (up and down), expanding volatility and amplifying the absolute range of daily returns

This post discusses—implicitly or explicitly—investments in bonds / bond proxies, TIPS, FX, housing, US Equities, options and volatility.

With HBO’s House of Dragons killing it on TV, I can see Morgan Stanley’s Mike Wilson no longer being able to monopolize allusions to “Fire and Ice”. Fintwit has stepped up its jokes since the post-GFC “Optimus Subprime” characterizations. Worst Transformer ever.

Inflation, the topic du jour

Having just made it (too) recently back from the island to the city and coinciding with the release of the latest set of inflation numbers for August, it’s only fitting I resume the missives where I left them. Price pressures remain the topic du jour.

In my last note, I half-heartedly praised July’s moderate CPI print—characterizing it as both bad (8.5% YoY) and better (0.0% MoM, following June’s 1.3% and May’s 1.0%). I paired this, however, with extensive commentary on how some onerous underlying signals might have been obscured by the headline figure:

Categories spearheading the decline are historically less sticky than their hotter counterparts—e.g., shelter as the largest contributor to services inflation increased 5.7% YoY in July, the highest since 1991. […] Core CPI (CPI ex. Energy / Food) was flat this month at 5.9% YoY. […] The bulk of the advances seen against inflation seem less rooted in the controlled demolition of demand the Fed’s is set out to pursue and more in exogenous factors that could turn on a dime.

Read more: $14 BAD AND BETTER

Fast forward a month and some of these warnings look prescient on the back of August’s CPI read. Headline and core came in hotter than forecasted, as inflation remained positive for the 27th consecutive month and core grew at twice the estimated rate.

Particularly disconcerting was the acceleration of the shelter (0.7% MoM, 30Y record high), food (11% YoY, highest since the 1970s) and healthcare (largest monthly increase since Q4 2019 and 5th highest in 30Y) components, in the face of substantial declines in energy (e.g., gasoline 10.6% down, following a 7.7% decline in July).

I see little added value in rehashing the intricacies of the print at this point. My previous assessment of inflation remains valid. The stickiest items show little signs of easing and—following four decades of lower inflation—markets will have to come to terms with higher for longer price pressures. To be clear, prices are rolling over, but the path will be slower than what's currently priced in.

A multi-year paradigm shift driven by entrenched inflation (e.g., wage-price spirals, unanchored inflation expectations, etc.), which fuels arguments in favor of outright shorting (US) bonds / bond proxies and buying Treasury Inflation-Protected Securities (TIPS).

If you break it, you buy it

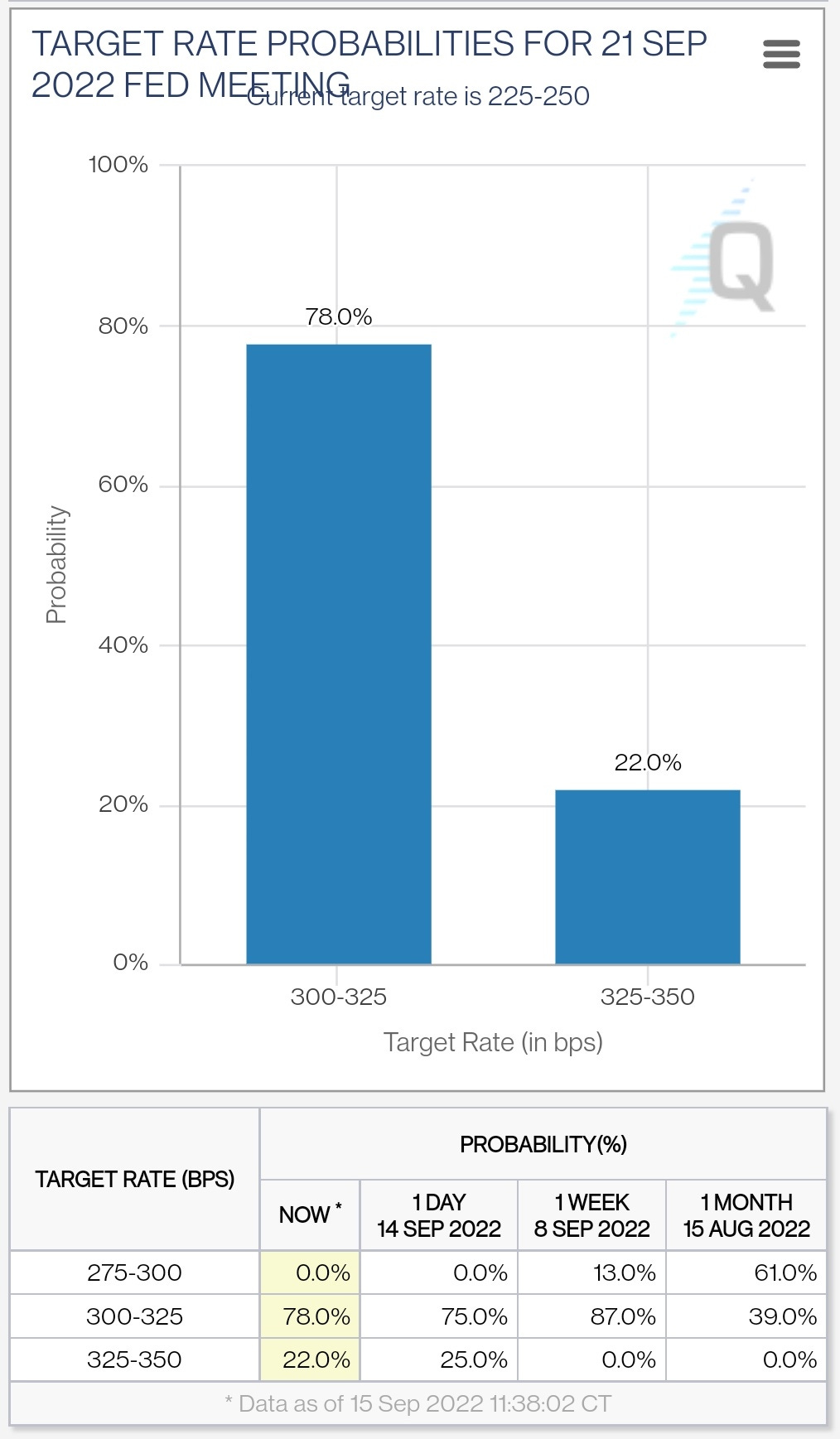

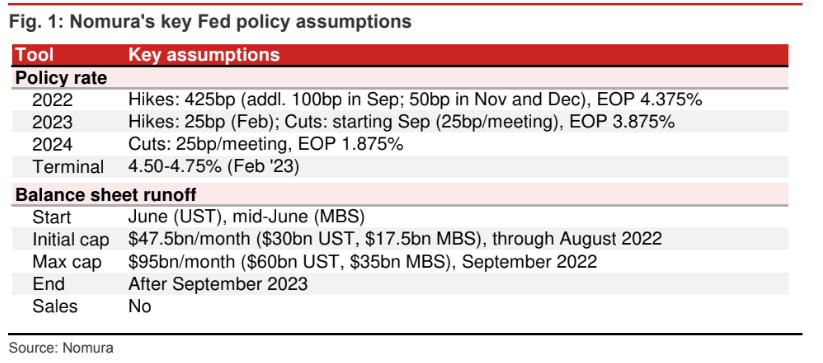

A 75bps hike from the Fed in the upcoming FOMC meeting on September 21st—resulting in the 300-325bps range for the Fed funds rate—has been in the cards for over a month, yet markets have recently repriced the second most likely outcome from 50bps to 100bps (now 22%)1.

The new terminal rate is now higher at 4-4.25% (vs. 3.75-4% prior to the CPI), signaling an increasingly hawkish Fed in November followed by a policy pivot next year (already ~40bps cut priced in for H2 2023).

Markets are effectively expecting Powell to slam on the breaks harder now and continue to tighten financial conditions (i.e., increase real yields, lower stocks, widen credit spreads and strengthen the mighty dollar)… So hard, in fact, he might need to reverse policy in 2023, as the old Pottery Barn rule proves to be true: “if you break it, you buy it”.

This movement is negative for bond prices (with a steepening undertone), as yields on 2Y T-notes have skyrocketed to 2007 highs and mortgage rates have surpassed 6% for the first time since 2008.

For what it’s worth, the latter continues to force the air out of the housing market, where transactions are already in steep decline in the most typical fashion:

Increasing mortgage rates > sellers unwilling to cut prices, yet buyers demanding discounts > number of transactions decline > housing repricing. Hiss.

Finally, the Fed’s relatively stark monetary stance—compared to its softer counterparts (i.e., ECB, BoJ, BoE, etc.)—allows the dollar to retain its crown and the US to export stagflation worldwide. This is the bane of emerging markets and especially of those with the largest share of dollar-denominated debt (e.g., Argentina, Indonesia, Colombia, etc.).

I’m following these currency pairs alongside the usual developed countries’, as I believe FX will regain its importance in investors' portfolios in coming quarters. I would be very surprised if I don't find compelling arguments to short the USD fairly soon.

Behold: Modern Market Architecture

Equities remain under the tenuous authority of investor positioning and mechanical / systematic flows.

On the former, investor positioning is extremely low according to multiple different measures, as cash levels remain at historical highs dating back to 9/11 and investors’ net underweight in stocks reaches -52%.

Regarding mechanical / systematic flows, regular Going John Galt readers probably know we find ourselves in a (quarterly) Options Expiration (OpEx) week. The large downside move to the CPI print (-4.3% in the S&P) left the market in negative gamma regime (short gamma) and “implied a breathtaking de-allocation of -$17.9 billion forced mechanical exposure reduction”, 2.7%ile 1D change going back 10Y, as per Nomura’s Charlie McElligott.

The negative gamma regime leaves markets less insulated than usual against outsized moves (up and down), as it tends to expand volatility and amplify the absolute range of daily returns2.

This phenomenon is exacerbated by thin liquidity provision, which is conducive to self-reference / reflexivity as it adds fuel to outsized price swings in both directions. Wax on, wax off.

The point of all this wonkish verbiage and Greek letters is just to underscore the notion that there are many forces fighting below the surface of a market that has moved sideways since my latest missive. In this environment in particular, relevant data or market moving news / events can very automatically create gigantic moves in markets, catching investors off guard.

Imagine the market reaction, if Ukraine and Russia reach an agreement to halt this very inflationary war… Even if you’re fundamentally bearish, you're not alone. Lows in positioning often coincide with troughs, so tread (and trade) carefully.

I wanted to pen a shorter / less thematic note today to get back to the fold and very briefly touch on how I’m seeing markets in general, while I structure my thoughts around energy (including Europe’s lack of joules) / geopolitics in preparation for some movements in my portfolio and a few notes coming in very short order.

$$$

Thanks for reading,

John Galt

PS: Hope everyone had a great summer break. I’m a big fan of the freedom it often brings, allowing us to jump into new projects.

Please give this post a ‘Like’ at the bottom of the page if it was helpful to you. We’re very grateful for all the support we get from our readers.

Larger market moves often trigger mechanical flows (i.e., vol control / targeting funds, trend following strategies, etc.), which—depending on options positioning / hedging—can force dealers into taking liquidity vs. providing it.

This is effectively what happens when dealers are short gamma. A phenomenon where dealers’ hedging activity exacerbates price action in both directions, as these sell into downturns and buy into rebounds.

If you are interested in learning more, Spotgamma is a great place to start. But make sure you subscribe to Going John Galt, as there will be more options-related content coming in the coming months!

Glad to see you back. I’ll be returning shortly myself. 👍