$16 ON CHIMERICA & EURUSSIA

A (fresh) perspective on the emergence of a multipolar world order and its implications for investors

Executive Summary

Lowflation regime was underwritten by globalization—it enabled the Fed’s Quantitative Easing (QE) programmes over the 2010’s

Abrupt disintegration of Chimerica and Eurussia’s confirms the emergence of a multipolar world order, where (new) alliances / blocks fight for control over commodities, technology (e.g., chips), production and safe geographical / physical connection

Ensuing re-arming, re-shoring, re-stocking and re-wiring will be commodity intensive, capital intensive, interest rate insensitive and uninvestable for the East

This post discusses—implicitly or explicitly—investments in commodities, bonds / bond proxies, TIPS, gold and FX.

War and Industrial Policy

Over the years I’ve grown quite fond of the “dispatches” of Credit Suisse’s Zoltan Pozsar. His ascension to eminence in the world of central bank commentators is the best that has happened to Credit Suisse in quite a while. Super Mario of market-plumbing1.

Avid Zoltan readers will not be surprised to hear me confess it has taken me a couple of weeks to fully digest his latest missive, aptly named “War and Industrial Policy” (available here for you free!). Nothing short of a masterpiece, it delivers a fresh perspective on the coming multipolar world order, today's trade environment / geopolitics and how these are set to shape economic policy going forward.

Last week’s note ($15 IF YOU BREAK IT, YOU BUY IT) focused on inflation, monetary policy and what I was broadly seeing across markets. Today’s is intended to summarize this new global framework and explain how it might affect investments at the most fundamental level over the coming decade.

Let’s jump right in!

On Chimerica and Eurussia

At this stage, we are all familiar with the three D’s (i.e., debt, demographics and disinflation from technology) that underwrote the multi-decade period of subdued inflation leading to the pandemic. Fortunes and careers were made on the back of strategies levering this concept of ever lower rates in different manners. Risk-parity. Dalio. Real estate. Trump.

In his piece, Zoltan identifies three disinflationary pillars on which the “low inflation regime” rested, which facilitated the collaboration of two distinct blocks he calls Chimerica and Eurussia2:

Cheap Chinese goods raising real wages / purchase power

Cheap immigrant labor keeping US nominal wage growth stagnant

Cheap Russian energy—natural gas in particular—fueling German industry and Europe more broadly

China and Russia would accept foreign currency (i.e., USD and EUR) and “recycle it into G7 claims” (G7 sovereign debt). This created an environment of common commercial / financial interests, incentivizing amicable attitudes and developing trust over time.

This lowflation regime facilitated by globalization was a key enabler of the Fed’s Quantitative Easing (QE) over the 2010’s. It’s now hard to imagine a Goldilocks regime without these disinflationary forces in play.

Yet, “when trust is gone, everything is gone”.

The emergence of a multipolar world order

Zoltan goes on to explain how these relatively old frameworks (Chimerica and Eurussia) have disintegrated abruptly, in the face of war in Ukraine. This conflict seems to be the straw that broke the camels’ back, since Germany and Russia were seemingly going ahead with Nord Stream 2 prior to that, effectively looking past Russia’s annexation of Crimea in 2014.

The fall of Chimerica and Eurussia’s has forced a re-arrangement between commodities and industry3. The largest commodity exporter (Russia) and today's factory of the world (China).

He foresees a continuation of the “unfolding economic war”, which is broadly about control:

“Control of technologies (chips), commodities (gas), production (zero-Covid), and straits—chokepoints like the Taiwan Strait, the Strait of Hormuz, or the Bosporus Strait.”

Control shaped through new alliances / blocks4, sometimes based on “the enemy of my enemy is my friend” or the “alliance of the sanctioned”:

“Russia and China hold naval exercises with Iran around the Strait of Hormuz; Iran has recently hosted talks between Russia and Turkey regarding grain shipments through the Bosporus Strait; not surprisingly, the first shipment sailed to the Syrian port of Tartus, which hosts a technical support point (not a base) of the Russian Navy; even more recently, Turkey and Russia agreed to clear bilateral trade flows, including gas, in rubles.”

At the core of this is the US’ fading position as the preeminent, global economic partner, in favor of China.

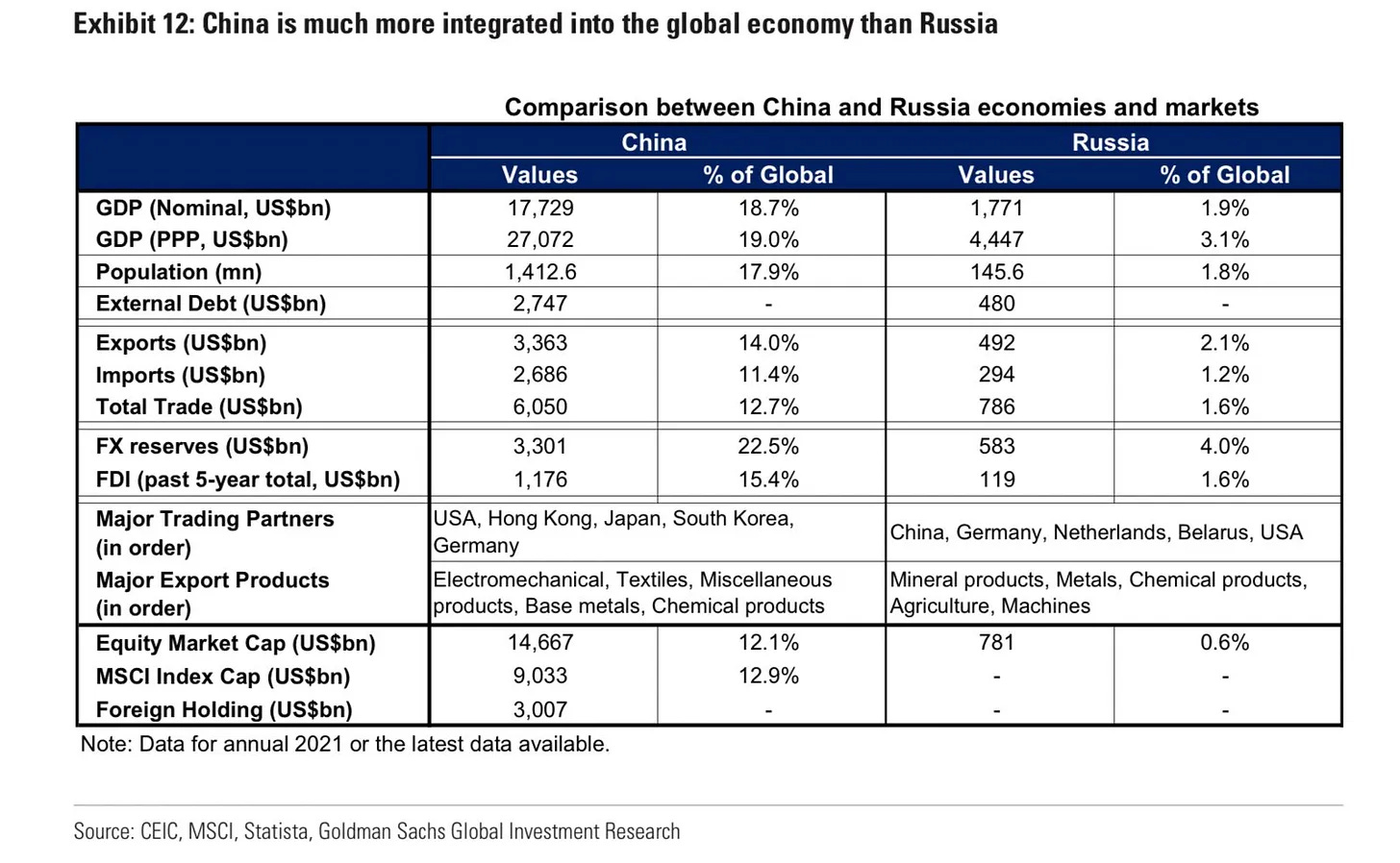

The reality is that China today is the largest trading partner of (checks notes…), basically everyone! We need to acknowledge the emergence of a multipolar world order. Putting our western biases aside for a minute will allow us to perceive the world as it truly is. Rosling. Papic.

Implications of growing mistrust

“If trust drove globalization, and globalization drove “The Great Moderation”, distrust will drive de-globalization, and de-globalization “The Great Reflation”.

For Zoltan, the disintegration of Chimerica and Eurassia entails that expectations of “a rapid deceleration of inflation are naively optimistic”. Crediting Pax Americana with enabling globalization and globalization with structural lowflation, he sees that “inflation is a big risk” today.

The key economic consequences of mistrust are:

Decreasing structural disinflationary forces curtail the Fed’s ability to pursue expansionary monetary policies without a cost (e.g., inflation).

Countries / blocks need to become increasingly self-sufficient, driven by investments sponsored / funded by governments. Wars—economic and hot—can only be sustained by industrial self-sufficiency, as “global supply chains only work in peacetime”.

Fracturing of global supply chains mean flows of goods need to be re-drawn. “Re-drawn. Not blocked or eliminated”.

Again, it’s all going to be about access to commodities, technology (i.e., chips), production and safe geographical / physical connection (i.e., straights, trading routes, etc.).

How do you win? Slow down the opponent and accelerate build out.

Slow down through traditional economic warfare, including tariffs and sanctions.

Build out through implementation of a new industrial policy focusing on “pour[ing] trillions into four types of projects starting ‘yesterday’”.

Zoltan understands these items will be5:

Zoltan’s piece is quite long and includes a few very interesting ideas that I’ve not even touched on (i.e., analogy to the pre-GFC / Too Big To Fail system, hints of Bretton Woods III, quite specific examples of the ideas laid out above, etc.), so I would strongly recommend to read it in full. (I’ve given you access to the piece in the intro.)

I’m aware that what I brought for you today was something a a little different, as it’s more of a broad framework… a new pair of glasses through which to look at the investment world.

The longer term implications of these changes are gargantuan and encompass various fields. Over the coming weeks I intend to refer to Zoltan’s framework in the context of more actionable investment ideas.

$$$

Thanks for reading,

John Galt

PS: Please share this post if it was helpful to you. We’re extremely grateful for all the support we get from our readers!

Hope nobody misinterprets this—I have nothing but the utmost admiration and respect for him. Zoltan, if you are reading this I’m sorry it’s just another terrible millennial joke!

Note that while these are the countries at the core of those relationships, there are many other countries and regions that similarly benefitted from these kinds of forces. In other words, it’s possible to derive somewhat of a global framework by extrapolating this analysis to other countries.

Revamped is likely a better term than new, as China and Russia have been friendly for quite some time.

The fact that the China-Russia partnership was described by the two nations as a “limitless friendship” this past February—prior to the invasion—raised concerns about China’s potential involvement in the invasion. China repeatedly denied any involvement in the invasion, stressing out their ties with Ukraine as well.

This friendship is not new. Russia’s largest trading partner is in fact China, with exports to China dominated by energy and basic metals—66% and 13%, respectively—and imports from China involving electronics, textiles, and home equipment.

Read more: $6 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS) - PART 2/3

Shifting and often unlikely alliances will force prioritization of objectives, adding a degree of complexity to the geopolitical Risk game. For instance, the US might have to prioritize between NATO’s footprint, access to chips, oil & gas, climate change, etc.

Zoltan finds this supercycle analogous to the one sparked by China’s adherence to the WTO in 2001. With the caveat that it's analogy “happened in the context of a peaceful, unipolar world order in which great powers had positive expectations of the future trade environment. But that’s not the case anymore.”