$6 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS) - PART 2/3

China tech offers tremendous growth at deep value. Careful though, if not a falling knife it definitely is a sharp object plummeting

Rare opportunity to acquire cash-rich, profitable, long-term double-digit growth companies at deep value

Perfect storm of regulation, macro, geopolitics and COVID has relentlessly battered China’s technology / internet names, creating an attractive entry point often >70% below cycle peaks

Asymmetric risk-return as the bottom seems in—downside scenario seems largely priced in and already-apparent catalysts and improving drivers offer strong re-rating potential

Having touched on historical performance, regulation and macro, this second installment of the now three-part piece on China tech centers around geopolitics (including Taiwan) and COVID—as the two other drivers of the investment thesis.

If you missed the first part you can find it here: #5 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS)

Geopolitics: China ≠ Russia

Geopolitical risk as it relates to financial assets revolves around China’s potential financial decoupling from the West. I like to separate tensions into three (somewhat interconnected) fronts, including Russia-Ukraine conflict spillover, de-listing risk and tariffs.

First, the Russia-Ukraine conflict greatly impacted China’s markets through direct and spillover channels.

The fact that the China-Russia partnership was described by the two nations as a “limitless friendship” this past February—prior to the invasion—raised concerns about China’s potential involvement in the invasion. China repeatedly denied any involvement in the invasion, stressing out their ties with Ukraine as well.

This friendship is not new. Russia’s largest trading partner is in fact China, with exports to China dominated by energy and basic metals—66% and 13%, respectively—and imports from China involving electronics, textiles, and home equipment.

The problem is that China is the largest trading partner of (checks notes…), basically everyone! Yes, look it up!

This did not avoid a strong sell-off in China assets when news broke about the West decidedly decoupling from Russia. Little did it matter that China’s metrics in a global context are often >10x those of Russia, including their share of Global GDP at ~10x.

A great investor never says never… so let’s just say that the impact of similar decoupling measures vs. China would unleash the (modern-day) Seven Plagues of Revelation (i.e., economic crisis, inflation, famine, military conflict, just for starters). Because of our Western-centric life experiences we often fail to recognize realities, such as this one:

It’s not even clear that many Western nations—the “good” guys (US, EU, Japan, et al), come on!—would adopt these measures considering China has become the main trading partner! Let alone Asian or African countries, where China is undoubtedly their most important partner.

I see the Taiwan conflict (“One China” policy) with the same eyes. History is long and winding, but—barring Biden’s latest misspeak—the US has remained publicly ambiguous / noncommittal at best.

The reality is that China is still massively dependent on semiconductors and foreign energy. (The latter is a story for another day, perhaps when I discuss nuclear / uranium.)

China’s demand for semis represented 70% of the world’s demand in 2020, with about half being exported back after assembly / repackaging. These exports often find their home in the West, making economies such as Germany’s incredibly dependent.

Barely anything important runs without chips these days. This is not Gran Torino—cars, for instance, don’t run without chips any longer… no chips, no car exports!

Taiwan is the world’s chip foundry—it manufactures ~50% of global semiconductors and >60% of the more advanced chips. For the top, leading-edge chips (5 nanometers or less)—the ones necessary for anything high-tech or involving 5G—the picture is even more clear. Taiwan’s TSMC and Samsung are the only manufacturers. TSMC by far the largest.

These incredibly tiny chips can only be produced using ASML’s proprietary, patented EUV technology, sales of which to China are banned by the US. Most experts agree that China is 5-10 years away from developing alternative technologies and even longer to achieve scale.

The bottom line is that Taiwan’s economy is vital to China and the rest of the world and its output cannot be effortlessly / immediately substituted. I don’t see how war on Taiwanese soil would not obliterate / fully impair global semi manufacturing capacity on a long-term basis.

I don’t want this to become a blog about geopolitics—nor do I claim to be an expert in the subject—so simply allow me to recommend you to read Vineyard Holdings’ fantastic takes for more on China’s push for semi independence and move on to the other two geopolitical issues.

Finally, Trump’s tariffs immediately took the backseat when COVID broke out and seem a thing of the past. At least that’s what the current administration thinks, considering increasing rhetoric around the possibility of winding them down.

Tariffs are inflationary and it would truly surprise me if we don’t see a summer relaxation. (There’s a terrible “dad joke” about holidays somewhere in there.)

COVID: Reopening Episode IV – A New Hope

The most recent Omicron spread in China raised significant questions about the economic costs associated with China’s zero COVID strategy.

China’s approach to containment is unique, in part because most developed nations are armed with leading-edge mRNA vaccines and novel therapeutics (no ultralight / disinfectant injections, no…).

With the efficacy of China’s domestically-produced vaccines (Sinovac) in doubt and low vaccination rates among the elder, the only way for Beijing dampen case numbers is through rolling lockdowns and closed borders.

The latest wave of lockdowns is being lifted as we speak and that is reason for hope as supply chains recover.

That said, experts don’t expect broad COVID-related restrictions and rolling lockdowns to relax before the 20th National Party’s Congress (NPC) held this autumn.

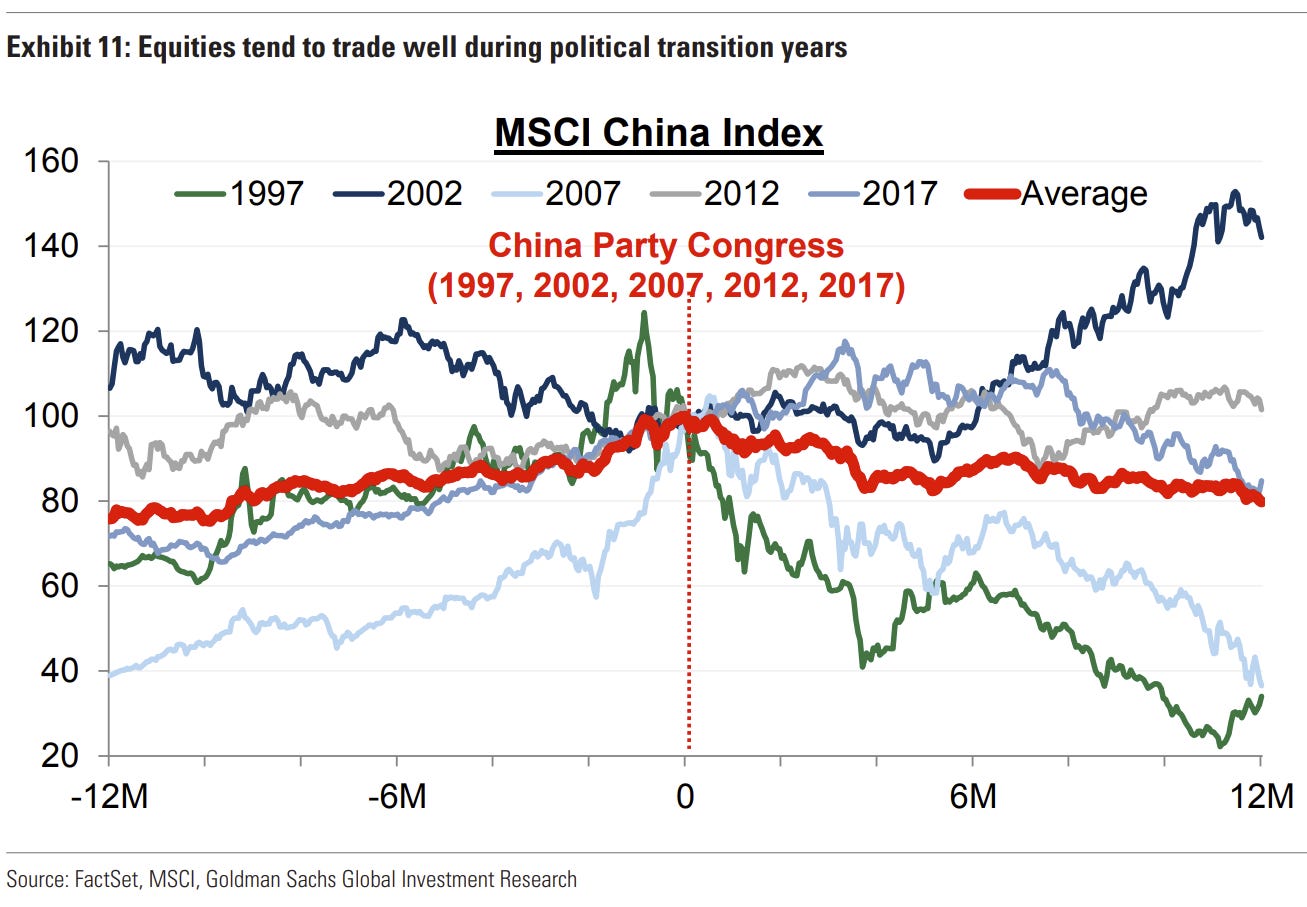

On the NPC—which takes place twice a decade—just note that the lead-up tends to be historically favorable for China equities’ performance. Growth momentum / macro policy is usually supportive of the economy running up to the event.

Quoting Goldman Sachs:

“Against that backdrop, MSCI China has tended to perform well on PE expansion, generating roughly 35% 9m and 25% 6m returns on average ahead of that event, with an 80% ex-post probability of positive returns”

In the third and final installment of this three-part piece, I will offer a take on the best ways to express the view and play this recovery through companies and ETFs.

Stay tuned / subscribe for more and please do share this with friends / colleagues interested in China, geopolitics (Taiwan), semiconductors, etc… it does make a difference!

$$$

Thanks for reading,

John Galt