$9 MAKE 75BPS HIKES GREAT AGAIN

The Fed let the central bank genie out of the bottle

Executive Summary

Voter discontent with the economy is pervasive and particularly concerning to democratically elected leaders with contested elections around the corner (e.g., US and Italy / Spain / Greece in Europe)

Central banks are tightening financial conditions aggressively to counter worrying signs of inflation entrenching and unanchored expectations

Europe is unable to fend off inflation by raising rates without encountering severe sovereign stress in peripheral countries—fragmentation risk is very real

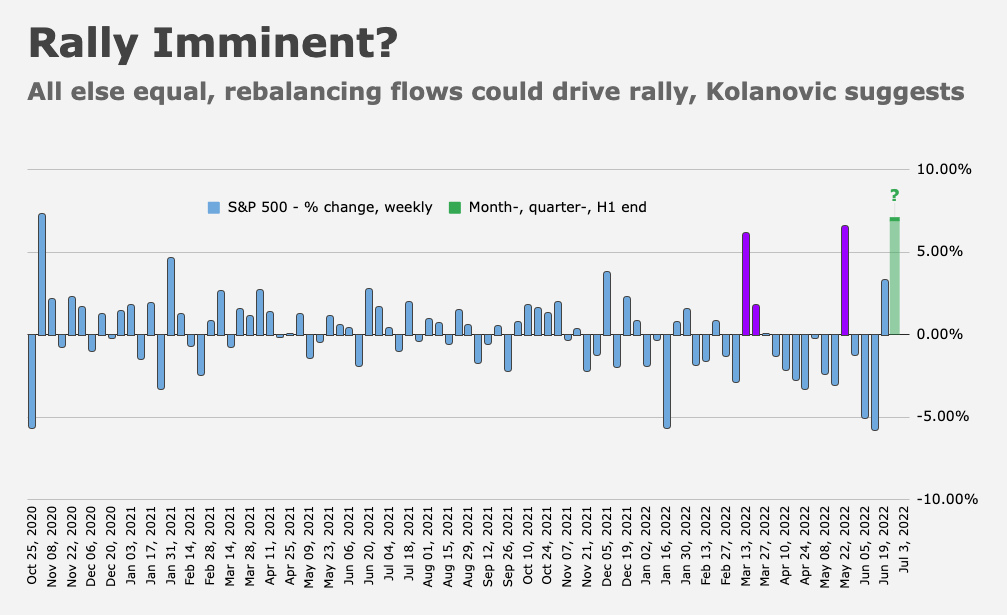

My previous note argued for the strong rally we are currently experiencing across markets. I continue to believe that the bounce which started early in the week after OpEx is due to positioning / flows and not necessarily fundamentals, as I explained in the note linked above:

Similar set-ups have seen markets rallying into OpEx or falling into OpEx and bouncing early in the following week. […] This tends to drive short-term action, so longer term the fundamental outlook should prevail. Lower lows are coming.

Read more: #8 A “MEGAPINT” OF HIKES

I no longer feel strongly about market direction after this considerable upside move, but slightly favor a (timid) continuation of the existing rally on the back of monthly, quarterly and half-year rebalancing flows (JPM’s Marko Kolanovic predicts a 7% rebound this week), which should be supportive for equities going into July.

At the end of this note you will find a few cues about how I’m expressing that view and a couple of actionable investments that remain my core strategic portfolio.

I try to be nimble and my views can and do change swiftly, so I’ll do my best to update readers consistently. Feel free to subscribe below so you don’t miss those updates and / or follow me on Twitter (@GoingJGalt) for additional resources / information.

Today’s note will be a tad more Euro-centric than usual, as I lay out the macro framework for the following notes, which will center around the impact of higher rates on residential / homebuilding / real estate and equities in general.

Central Bankers in the Hot Seat

I wish I had photoshopped the picture above, but Pauly D—of Jersey Shore fame—was actually invited by Fox News the other day to offer his take on inflation.

Fascinating. Sometimes life is stranger than fiction.

In hindsight and considering the inexorable rise in inflation obsession lately, it should have been obvious that eventually monetary policy would take the blame and central bankers would be in the hot seat.

The general public is experiencing an acute cost of living crisis and seems to be taking all their cues from Friedman, who famously stated that “inflation is always and everywhere a monetary phenomenon”.

Whatever the case, rampant inflation has swiftly become public enemy number one for incumbent leaders. Voter discontent with the economy and a potential recession is pervasive and particularly concerning to those democratically elected with contested elections around the corner (i.e., US midterms and Italy, Spain and Greece in Europe).

The figure below charts the amount of news coverage featuring the word “recession”.

If you followed the Roast of J. Powell—when he took the hot seat in the latest semi-annual testimony before congressional committees this week—you probably realize how pressure is mounting on struggling central bank officials to recalibrate monetary policy to contain inflation.

Fed releases Hawkish Genie

To some extent, monetary authorities are victims of circumstance.

The Fed openly admitted last week that their capacity to deal with the effects of largely exogenous forces on supply—particularly war-induced energy / food shortages and pandemic-related supply chain shocks—is virtually zero. At the risk of stating the obvious, central banks cannot print oil or corn.

The situation is exacerbated by the impact on global demand of a synchronous post-pandemic recovery in developed nations with access to leading-edge mRNA vaccines and novel therapeutics. People were locked down in most developed countries and all economies rebounded from substantial lows at the same time!

Don’t mistake this as an attempt to excuse central banks—they did pour gas on the proverbial fire. They did keep their foot on the gas pedal for too long. They did fail to move preemptively to prevent inflation from spreading. But color / nuance is important in understanding the full picture and Friedman probably hadn’t global pandemics in mind when he made his famous assertion.

Last week’s Fed meeting officially released the hawkish genie from the bottle, paving the way to “making 75bps hikes great again in the US”. On the other side of the Atlantic it was followed by a surprise 50bps increment from the Swiss National Bank (SNB)—the first in 15 years and unpredicted by any economist following the SNB—and the fifth consecutive 25bps move by the Bank of England (BoE).

Financial conditions are tightening rapidly, globally. But why the change in pace, what has changed?

We are witnessing unequivocal signs of inflation entrenching, as inflation has spread to goods and importantly services, unrelated to the Ukrainian situation and unaffected by the pandemic. Broad price increases are being passed on more swiftly by companies and are also being more readily accepted by consumers.

This push to slow down demand via rate hikes is unfolding amid growth concerns, too. History shows it’s difficult to solve one without exacerbating the other and the risk of policy error—overtightening into a recession—is increasing.

This is a very difficult spot. I can’t emphasize that enough.

The impact has been strongly felt in both equities and bonds so far. That much you probably know. What is interesting about the latter though is how the sell off has been brutal even by historical standards, according to Deutsche Bank. The worst start of the year for US debt since George Washington was about to take office in 1788.

Italy-exit

The situation in Europe remains more nuanced and convoluted. No news there!

Not because inflation and growth concerns are any better here than elsewhere. In fact, there are strong arguments to be made for the opposite, as the European economy struggles to replace Russian commodity imports.1

The Governing Council (GC) at the European Central Bank (ECB) was forced to call an emergency meeting on June 15 just days after their last meeting, where they had decided to leave rates unchanged and signal a 25bps hike in July likely followed by 50bps hikes in September and October.

The surprise meeting was called amid growing stress in the periphery, where a series of non-linear, disorderly moves widened peripheral bonds (i.e., Italy, Spain, Greece, Portugal, etc.) versus their core equivalents (i.e., Germany, Netherlands, Austria, etc.). The posterchild of these moves tends to be the BTP-Bund spread (Italian vs. German sovereign bond spreads) on the 10Y, which this time widened to >250bps (428bps and 175bps). For context, spreads peaked around 550bps during the EU sovereign crisis in 2012 and around 325bps in 2018.

The surprise meeting revealed the GC’s discomfort not only with the rapidity of the move, but with the absolute level. While it’s true that at >400bps Italian debt traded at a meager ~50-75bps above its US equivalent, the problem lies in its sustainability. At those levels and considering current fiscal policy, Italian debt can only decline in terms of Debt-to-GDP if the economy consistently grows above 2% nominally. A big if, that to some extent applies to the other peripheral countries.

This is not what you want to see less than a year away from an Italian general election where Euro-sceptic parties lead in the polls. Oh, and there are elections next year in Spain and Greece, as well. The fundamental fragmentation risk is very real…

More importantly though, this episode revealed, once again, Europe’s inability to fend off inflation by raising rates without encountering severe sovereign stress in peripheral countries. It’s increasingly complicated to maintain an actual monetary union without a proper fiscal union.

So the GC had to call an emergency meeting to provide some relief to peripheral sovereign stress in the form of a reaffirmation of its pledge to avoid fragmentation risk. They confirmed their intention to effectively backstop peripheral debt by “applying flexibility” in the reinvestment of the current asset-purchase programs (APP and PEPP), which means they will buy more peripheral bonds than core bonds. At the same time, they intend to design a new anti-fragmentation instrument to avoid “yields [to] rapidly diverge from economic fundamentals, causing financial instability and hence fragmentation”.2

Contrary to Lagarde’s “misspeak” in her first conference, the ECB has proven again it is indeed “here to close the peripheral bond spreads”.

Markets reacted positively of course, with equities rebounding and peripheral bonds trimming losses as spreads tightened.

Should the ECB decide to keep their balance sheet size unchanged (“sterilization”), we could see bonds in core countries sell off versus their peripheral counterparts. This would give way to all sorts of funky dynamics, but what is clear is that betting on a revival of the European debt crisis—peripheral spreads skyrocketing—is tougher to argue today than two weeks prior.

In FX land, the situation is all the more complex as an anti-fragmentation instrument significantly reduces the chances of an “Italy-exit”, which is EUR-positive. On the other hand, the economic cost of implementing such a tool is unclear yet and will depend highly on the details around sterilization. Partial / no sterilization or weakening fiscal control mechanisms would be EUR-negative. Finally, a weak currency supports economic activity, yet contributes to “importing inflation” as imports become more expensive.

I’m gonna go on a limb here to argue that Germany benefits greatly from the current European framework despite their very public criticism of southern European fiscal policy. Germany does pay for the party at the end of the day, but have no doubt that they wouldn’t be a top-3 exporter in the world if they still got paid in expensive Deutsche Marken. A weak EUR makes Germany’s industry extremely competitive.

Industry in southern European countries (i.e., Italy and Spain, but let’s not exclude France from this one) would be more competitive, if they controlled their own currency. Another point for Germany.

This point is often highly contested, so if you are an angry German feeling terribly offended by what I just said, feel free to leave a comment letting me know how big of an idiot I am 😉

All in all, with EUR close to parity with the USD, rampant inflation and growth slowing down, the ECB is in a distinctly difficult position.

The upside for US readers is that at these rates you can have the summer of your lives if you decide to visit Europe! I can already picture the summer cocktail parties…

I promised a quick update in the intro. Tactically, I’m tracking volatility to express my medium-term bearish view. If volatility subsides—I’m eyeing ~25 on the VIX, equivalent to ~1.6% daily implied volatility—put options will become cheap and a better instrument to bet on lower lows than outright shorting the market. I think the next leg down may close in on 3,500 on the S&P.

I’ve continue to hold the ChinaTech names ($KWEB and $BABA, predominantly)—which have fared really well since I highlighted the thesis in my three-part piece titled WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS). And have recently added to my positions in the uranium complex (i.e., Sprott Physical Uranium Trust, $URNM).

There is a uranium piece coming shortly, so feel free to subscribe if interested. I truly believe the Sprott Physical Uranium Trust trading below $14 and at double digit discount to NAV is the most asymmetric opportunity in the market. Can’t wait to dive into it.

$$$

Thanks for reading,

John Galt

It’s widely known that the EU imported ~40% of its gas from Russia cheaply via pipelines prior to the invasion, much of it used to fuel European industry (e.g., Germany, Italy). Gas flows are currently experiencing significant disruptions, with Nord Stream 1 running at ~40% and storage relatively depleted at 57% in Germany.

Little is known about the details of such instrument, but there is speculation that it will come with:

Unlimited size to maximize the “announcement effect”;

Significant allocation flexibility across jurisdictions and maturities;

Relatively weak conditionality (i.e., dependence on taking [fiscal] actions) beyond effective monitoring; and

Sterilization, which means the ECB would sell bonds from core countries as they buy bonds from peripheral countries with limited / no net impact on the ECB’s balance sheet size.