$8 A “MEGAPINT” OF HIKES

A 75bps increment shortens the runway for a “soft landing”.

Executive Summary

CPI surprised to the upside, forcing Fed to recalibrate monetary policy at the upcoming (June 14-15) FOMC meeting and markets to sell off violently

Faster rate hikes increase the chances of Fed policy error (i.e., potential tightening into a recession) and shorten the runway for a “soft landing”.

Short-term rally is possible based on options positioning, but long-term fundamentals continue to point toward broad market downside

Postmortem

Last Friday came to a close with a “yuuuge” upside miss in the May US CPI print.

Not only did CPI miss across the board (core / headline, MoM / YoY), but there was similar breadth in the underlying components. Adding to concerns, we saw historical figures across the “stickiest” categories, including the highest shelter inflation (5.5%) since 1991 and the highest rent inflation in four decades (5.2%)!

For real-life updates feel free to add me on Twitter @GoingJGalt!

All market participants knew instantaneously what this upside surprise to the CPI meant: take cover, as the Fed will likely recalibrate monetary policy at the upcoming (June 14-15) FOMC meeting.

And recession anxiety returned. “Peak inflation” seemed officially postponed. The vaunted “pause narrative” that gave risk assets a breather? Simultaneously alive and defunct until the official FOMC statement. Schrödinger.

Across markets we saw bond yields surge, volatility ($VIX) spike and correlations go to 1. In an environment characterized by impaired liquidity and highly-combustible (options) positioning this translated to virtually everything selling off. S&P ($SPX) and Nasdaq ($QQQ) lost -2.9% and -3.5% respectively—elevating the weekly loss to -5.1% and -5.6% .

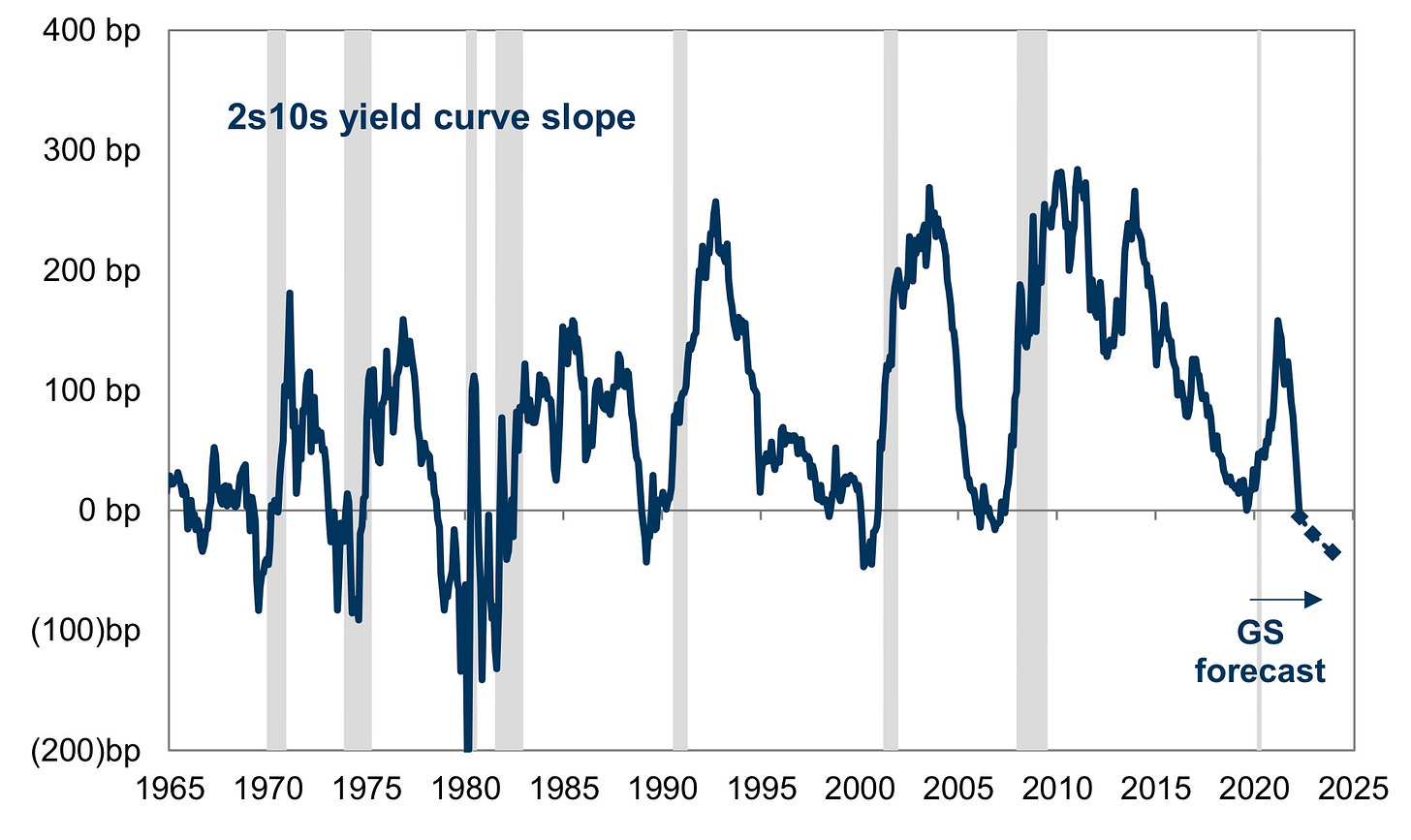

The icing on the cake was a barrage of yield curves inverting again—an event that has famously precluded almost every recession.

A “Megapint” of Hikes

Fast-forward to today. The week of the FOMC meeting is here, coinciding with two other important and often overlooked market events: quarterly options expiration (OpEx) days for the $VIX this Wednesday and for the three dominant index-ETFs (i.e., $SPX / $SPY and $QQQ) on Friday.

Going into Monday, markets were pricing a second consecutive 50bps hike in Fed funds rate, alongside incremental hawkish verbiage.

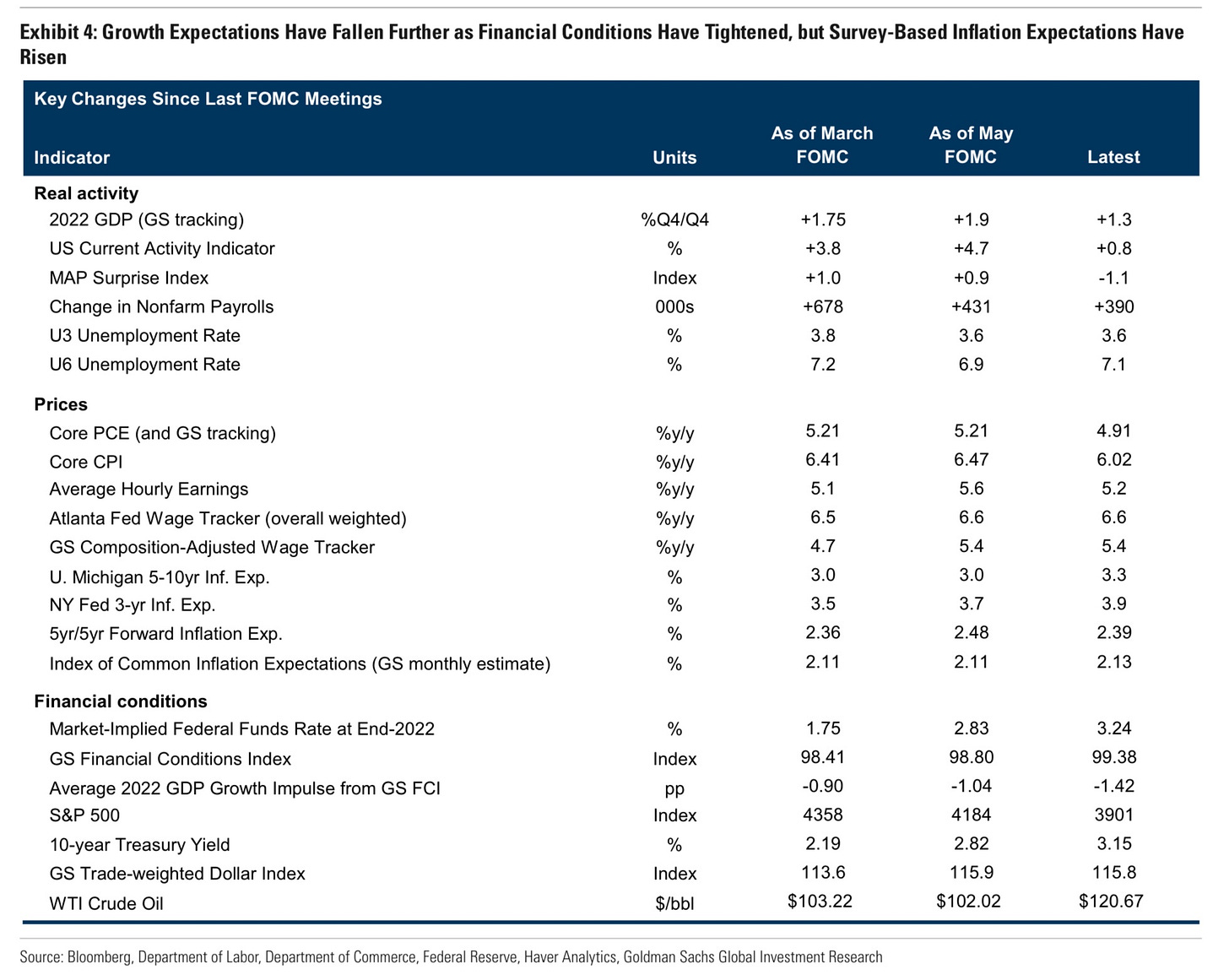

After all, most of the other figures the Fed cared about were actually showing encouraging signs of progress since the May meeting (i.e., financial conditions tightening, activity moderating, employment growth slowing, and wage pressures subsiding).

The market had found a sense of stability toward the second half of the session when something happened that took everybody by surprise.

Fed whispers.

Leading up to the FOMC, the Fed is in a “blackout” period, meaning they cannot publicly express their views and “guide” market expectations.

Enter Nick Timiraos. The intrepid WSJ reporter who—for reasons unknown—the Fed uses to broadcast its policy via press leaks when they are officially forbidden to do so. Oh, what a glorious institution!

In the article he penned it became clear that Powell was about to channel his inner Johnny Depp and pour himself a “megapint” (it’s a thing, apparently) of hikes.

And just like that… a 75bps hike became consensus. The first such hike since 1994, when Pulp Fiction was in theaters and Biggie had just dropped “Ready to Die”.

The chart below shows 96% probability of rates being at 150-175bps, up from today’s 75-100bps. Basically a done deal, it seems. Great tool by CME, by the way!

Markets can be very forgiving sometimes, but they truly despise surprises. The cycle we saw on Friday proceeded to repeat itself for yet another -3.9% drawdown on the $SPX.

All this is great, John, but what do I do with my positions!

Fed Policy Error

Longer term, faster rate hikes increase the chances of a Fed policy error (i.e., potential tightening into a recession) and accelerate the outcome overall.

I discussed the merits of smaller increments (25bps) in an earlier piece #2 FELIZ SINK-O DE MAYO!—I still believe this to be true:

The Fed knows its monetary policy generally works with a (12-18 month) lag and smaller increments allow them to lengthen the tightening cycle by buying them additional time in case Month-on-Month (MoM) prints remains higher for longer.

Some banks (e.g., Goldman Sachs) are penciling in two consecutive 75bps (now and in July), followed by 50bps in September and 25bps going forward (November and December).

Imagine the Fed follows that rate path and we start 2023 at 3.25-3.50% and—because policy works on a lag—inflation remains persistent. What next? How long can the economy operate >100bps over “neutral” without entering a policy-induced recession?

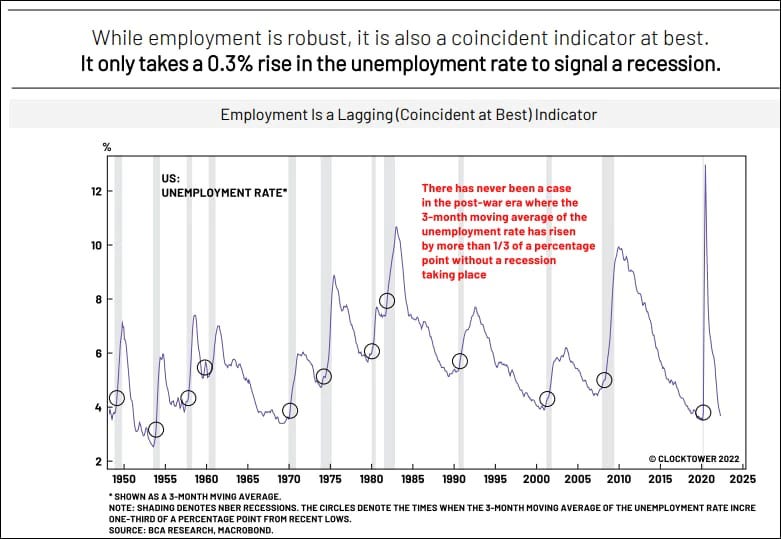

The Fed will provide economic projections alongside the FOMC statement. I intend to study very carefully how much they expect unemployment to rise. The Sahm Rule—and some iterations of it—has a sterling track record in predicting recessions, after all.

My point is that QT has barely started. Monetary policy space is needed on the rates side and the balance sheet side. If QT is cut short by a recession, the US will enter it ~$9tn “in the hole”. A 75bps increment shortens the runway for a “soft landing”.

Oh and, by the way, note that’s 225bps of recession-inducing hikes prior to the US midterm elections. Draw your own conclusions.

The tail wagging the dog

I suggest you skip this final part if you’re not somewhat familiar with basic OpEx dynamics, as this will be too wonkish. I promise I will explain these notions at a later point in time!

I mentioned this is a special week because the FOMC coincides with two option expiration days. Well, the tactical (short-term) direction of the market will likely be dictated by what finally happens in tomorrow’s FOMC vs. current market expectations in the context of the current options backdrop.

It’s a humongous ($3.4 trillion notional), very put-heavy OpEx ($SPX, $SPY and $QQQ) only two days after the FOMC, with put positioning as large as it’s ever been. It’s over that period—FOMC to OpEx—that options will have the largest impact on the markets. The tail will wag the dog.

The strike price of the majority of options is above current levels, leaving substantially more puts “in-the-money” than calls.

As these in-the-money puts expire on Friday, option holders start to unwind them in order to protect their profit. The dealers / option sellers who are short hedges against those puts (e.g., short positions against the respective indexes) no longer need the hedges so they start buying back those short positions. As put options are unwound, markets tend to move up, which pushes more put holders to unwind them. Positioning turns more gamma neutral which contributes to lower volatility.

We could start seeing some short-covering of those option hedges after the FOMC and going into OpEx. Similar set-ups have seen markets rallying into OpEx or falling into OpEx and bouncing early in the following week.

What happens afterwards really depends on investors putting those hedges on again / rolling those forward or puts simply dropping off.

This tends to drive short-term action, so longer term the fundamental outlook should prevail. Lower lows are coming.

$$$

Thanks for reading,

John Galt

PS: I’m humbled by the amount of new subscribers, thank you all! I’m slowly adding / unlocking some new features, such as the new website www.goingjohngalt.com where you’ll find all the content!