$28 MONETARY TIGHTENING VS. BANK CREDIT TIGHTENING

Identifying the potential beneficiaries of last week's Fed decision

Executive Summary

Replacing monetary tightening with bank credit tightening leads to an uneven distribution of its impact across firms, markets & the economy

Effects of increasingly dovish Fed (lower rates) on valuations to be felt by all companies—yet disproportionately benefit certain sectors

At the intersection of these points there is a subset of beneficiaries experiencing smaller earnings / growth declines due to size and sector exposure that also benefit from lower rates going forward

This post discusses—implicitly or explicitly—investments in equities, rates / bonds, commodities (gold, oil, etc.) and FX.

Powell’s covfefe

Welcome back, everyone! Let’s jump right in today with some takes of last week’s FOMC that lead to a few ideas I’ve developed in past days.

Powell kicked the presser off (unknowingly) confirming his alignment with Blankfein’s ‘situation similar to a rate rise’ comment earlier in the week…

“The events of the last two weeks are likely to result in some tightening credit conditions for households and businesses and thereby weigh on demand on the labor market and on inflation.

Such a tightening in financial conditions would work in the same direction as rate tightening. In principle as a matter of fact, you can think of it as being the equivalent of a rate hike or perhaps more than that, of course it's not possible to make that assessment today with any precision whatsoever.

…, which paved the way for a single hike with a side of dovish covfefe1…

So our decision was to move ahead with the 25 basis point hike and to change our guidance, as I mentioned, from ongoing hikes to some additional hikes maybe, some policy firming may be appropriate. […] Really I would focus on the words “may” and “some”, as opposed to “ongoing”.”

Now, please take a few moments to peruse the quotes below and let’s play a little who-said-what game.

“The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.”

“So going forward, as I mentioned, in assessing the need for further hikes, we’ll be focused as always on the incoming data and the evolving outlook, and in particular on our assessment of the actual and expected effects of credit tightening.”

Bonus: and when?

If you know the answer you probably see where I’m going with this. Shoutout to the great Dario Perkins, who dug out this quote from Bernanke’s Fed dating back to when the Fed paused in 2006.

The similarities are striking. What today’s Fed is saying rhymes with what the previous Fed said to cap off the previous hiking cycle.

Markets have been interpreting the situation accordingly, by aggressively turning hikes (into cuts). Charlie.

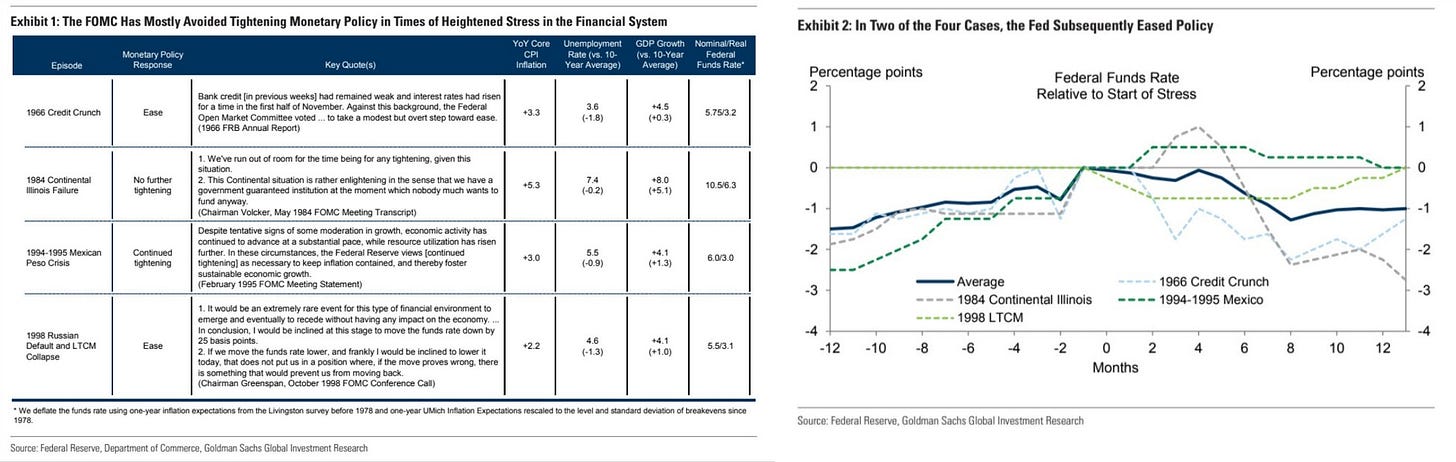

In the same vein, today’s situation seems to align with previous financial stress-related jitters, as Goldman Sachs indicates. The Fed’s preferred direction has often been easing, but those were hardly analogous inflationary predicaments.

OK, let’s take that at face value. Let's say it’s the last hike. What happens next?

According to BofA's Hartnett, adding risk after the last hike delivered strong positive 3-month (8.1%) and 6-month (13.1%) performance for the Dow Jones Index ($DJI) going back 35Y. The table below shows there is a path to higher equities from here.

On the other hand, “stocks fell in the three months after every last hike in the ’70s/’80s”, a more inflationary environment. It’s hard not to see merit in Hartnett’s expectation for today’s performance to follow that of other inflationary periods as “negative feedback loop from higher unemployment to day traders, retail, consumers and corporations is likely to be very pronounced”.

Hartnett specifically believes there will be a “final lurch lower” before the rebound.

Bank credit tightening replaces Fed tightening

Some thoughts on what's going on in equities today. Let’s start with the credit crunch.

Deposit outflows from smaller banks to G-SIBs are expected to constrain credit creation and impair economic growth. To wit:

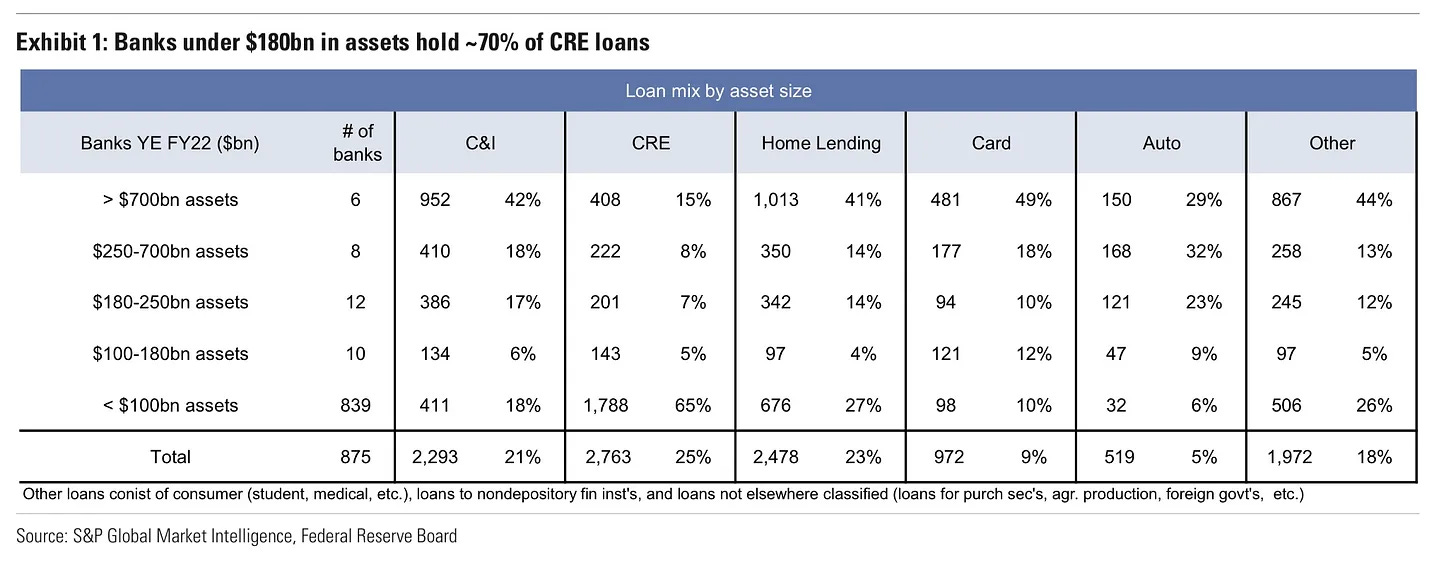

The problem is that the US relies on the depth and capillarity of the banking system to provide the lifeblood (in the form of funding) to the US economy. And most of that heavy lifting is done by small / mid-sized banks.

Per Goldman Sachs, “banks with less than $250bn in assets account for roughly 50% of commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

Read more: $27 NO PERFECT TIME FOR HIKES

Replacing monetary tightening with bank credit tightening—as the source of negative economic pressure—will likely lead to an uneven distribution in the impact of tightening across firms, markets and the economy.

This will disproportionately affect companies’ earnings depending on:

Small vs. large firms: Smaller firms are more likely to bank with smaller / regional banks than larger companies… and feel the crunch more intensely.

Listed vs. non-listed: Stock markets are populated by larger companies, which benefit from enhanced access to more Baja and capital markets. Listed firms should be less affected than smaller, non-listed firms.

Capital intensive vs. capital light, cash flow positive vs. negative: The more capital required to operate, the weaker its position.

Sectors: Sectors with higher consolidation—few, large companies dominate the market—should fare better than less consolidated / more atomized sectors teeming with small firms. Sectors more directly influenced by credit issues (e.g., housing, autos, (C)RE, etc.) will underperform. Finally, note sector weights vary across countries (e.g., US has substantially more tech than EU, as do its indexes).

Wild dispersion across sectors are common in earnings recessions:

The largest earnings declines were highly amplified by concentrated sector weakness, as it was the case in 1990 due to Autos (only -10% EPS ex. Autos), in 2001 with Info Tech (-9% ex. Tech) or the most recent example in 2008 when Financials ultimately sunk index EPS to a record decline (-19% ex. Financials).

Read more: $11 'TIS THE (EARNINGS) SEASON

Similarly, the impact of an increasingly dovish Fed (lower rates) on valuations / valuation multiples will be felt by all companies, but disproportionately benefit certain sectors.

There is a subset at the intersection of both of large, (often) listed, companies that will likely experience smaller earnings / growth declines due to size and sector exposure, while benefitting from lower rates.

That is in fact what we have commenced to see in past weeks across equities:

Growth (i.e., tech, communications) / duration proxies2 and defensives (i.e., consumer staples, utilities and health care) remain in positive territory, outperforming their more cyclical counterparts (i.e., financials, real estate, materials, energy, industrial and consumer discretionary)…

…, while large caps and growth have fared better than small caps and value.

Where do we go from here?

A few closing words.

Markets have moved substantially already—particularly in rates and bonds. These are discounting substantial damage from lower credit creation and reduced inflationary pressures.

With systemic risk concerns abating, data needs to start reflecting this damage soon or public discussion will shift back to inflation, reverting / scaling back some of the latest moves.3

Such a reversion would see a U-turn in equities, while interest rate-sensitive assets such as bonds / gold / certain, FX currency pairs4 sell off and oil / energy / commodities go bid.5

$$$

Thanks for reading,

John Galt

PS: The first quote is Bernanke’s.

Seriously, we saw some financial stress on the back of three bank failures—two tech-heavy, mismanaged banks and a historically beleaguered investment bank—and no real evidence of an economic slowdown… and the Fed automatically went from 50bps to 25bps and guided dovishly.

These are the guys you expect not to drop rates (to zero) when data even starts to turn sour? These are the people you expect to watch the economy crater and let it burn in the name of price stability? Potentially in an election year?

Exclude cyclicals disguised as growth…

Going into earnings season with pervasive short-positioning there’s a good chance for a tactical reversion in some of the most downtrodden sectors. Financials, for instance, kick off the earnings season early and the current negative carry on some of these shorts has the potential to rip a face or two at today’s valuations.

The ones driven more by rate differentials.

At that point—should inflation not be anywhere close to target (2% core PCE)—the Fed will resume tightening.

The Fed will never openly admit it, but there are good reasons to believe they may accept a slighly higher level of inflation. Paraphrasing Druckenmiller’s comments on this topic a few of years back, what are a few bps here and there?

Thanks for insights into conditions affecting performance across various sectors

I think this exactly illustrates the benefit of BTD over shorting. FED has asymmetric reaction to inflation vs. economic stress/recession. What is strange to me is the repricing of rates higher really didn't affect duration equities much it was the banking crisis that did and it lasted about one week before ripping higher. I can see a similar situation playing out when the fed really does start cutting rates, new ATH would come despite a slowdown.

These are the guys you expect not to drop rates (to zero) when data even starts to turn sour? These are the people you expect to watch the economy crater and let it burn in the name of price stability? Potentially in an election year?