$27 NO PERFECT TIME FOR HIKES

Will these events curtail credit and how will this impact economic activity and inflation?

Executive Summary

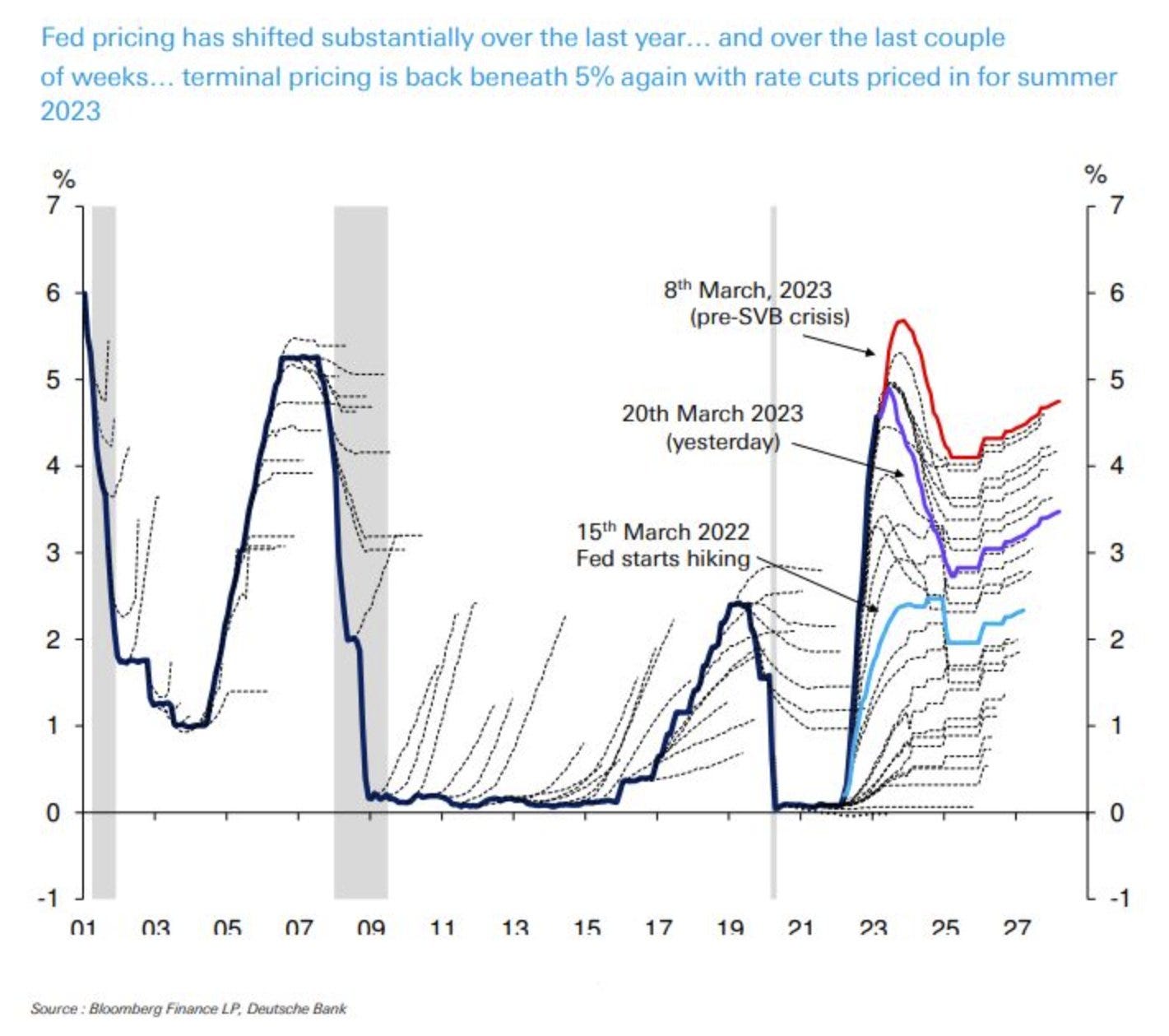

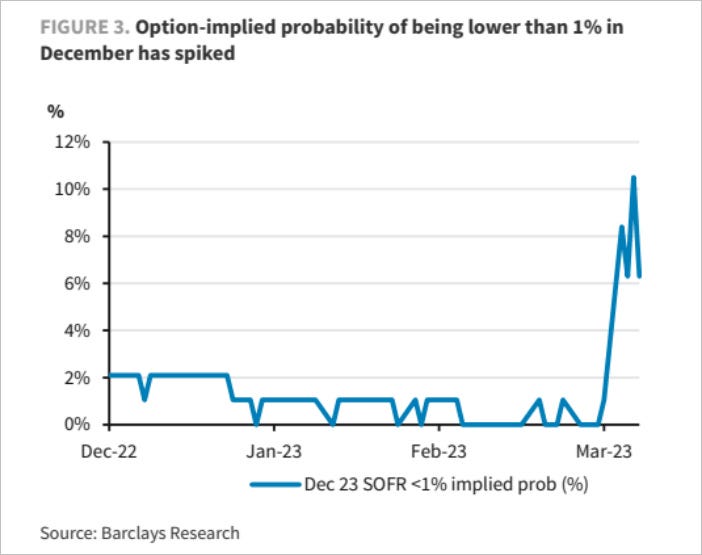

Fed rates and short-term interest rate markets cratered, fueled by concerns of systemic risk in the banking sector

Macroprudential measures put in place stabilized / normalized markets… helping underwrite further hikes

US relies on depth / capillarity of the banking system to provide funding to the US economy, as most of that heavy lifting is done by small / mid-sized banks

This post discusses—implicitly or explicitly—investments in rates / bonds.

Global Financial Crisis PTSD

Our last post—aptly titled $26 HIGHER FOR LONGER—was published in early February, at a time when US equities had enjoyed a “grind up” fueled by the infamous “‘Fed pivot’ narrative (i.e., pause in Fed hiking on the back of rapidly decelerating inflation)”.

Back then, we pointed toward “small signs” of a “puzzling re-acceleration in economic data” that we saw “at odds with calls for imminent recession and significant monetary softening / rate cuts”. Market-implied terminal rates relentlessly rose in subsequent weeks— approached 6%—while 2Y Treasuries breached the 5% mark.

Then they proceeded to hit a brick wall. Or three1.

Fueled by concerns of systemic risk in the banking sector (and some PTSD), Fed rates and short-term interest rate markets jumped on the Tornado for a wild rollercoaster ride.2

The yield curve re-steepened, which Morgan Stanley’s Mike Wilson (and others) noted is a harbinger of recession:

“An inversion of the curve typically signals a recession within 12 months, but the real risk starts when it re-steepens from the trough, especially in cycles that exhibit high inflation where the Fed’s hands are tied—i.e., ’70s / ’80s.”

Today’s note focuses on how recent events may have factored into the Fed’s decision later today at the March FOMC meeting and their reaction function going forward.

Macroprudential measures + Monetary tightening

To hike or not to hike, that is the question. Or at least it was. For a brief moment.

Over the past few days, we have seen Central Banks (CBs) across developed economies coming together to shore up markets through the institution of newly-created programmes and enhanced facilities.3

These macroprudential measures have managed to stabilize / normalize markets (i.e., higher rates, lower volatility, rebouding bank equities, etc.)... helping underwrite further hikes.

Following a 50bps hike by the ECB late last week, it seems clear the Fed’s Committee will hike 25bps today.4

Investors will also fish for other hints:

Hawks will get their fix from comments around price stability remaining the main Fed objective today—particularly in light of re-accelerating economic activity data.

Doves will get their fix from references to renewed banking sector distress.

Second-order consequences

Data—however anecdotal—already reflects the impact of these events on deposits / cost of capital over the past days5:

Individuals and corporates have come to the sudden realization that their deposits are not as safe as they thought. Without a higher standard FDIC-insured deposit amount, deposits will continue to flow out of smaller / mid-sized banks into G-SIBs (i.e., J.P. Morgan, Bank of America, Citi and Wells Fargo).

Individuals and corporates will move their funds from deposit accounts into higher-yielding, protected accounts such as a mutual funds.

Both of these moves are facilitated / sped up by today’s technology. It’s never been easier to set up an account. Transfering funds across banks and different accounts is literally at our fingertips.

Access to information has also augmented / accelerated this exodus. It’s never been easier to gather information that allows individuals and corporates to maximize for protection and return.

Deposits are structurally less sticky than anticipated now. Lower levels of deposits at small / mid-sized banks increase a bank’s cost of capital, as deposits tend to be the cheapest source of funding available.

Now, what are the longer-term, second order consequences of these bank failures?

It’s increasingly clear that banks—particularly small / mid-sized ones—are starting to curtail credit, while tightening lending conditions.

As Lloyd Blankfein—ex-CEO of Goldman Sachs—put it, “this situation will act in a way that is similar to a rate rise”.

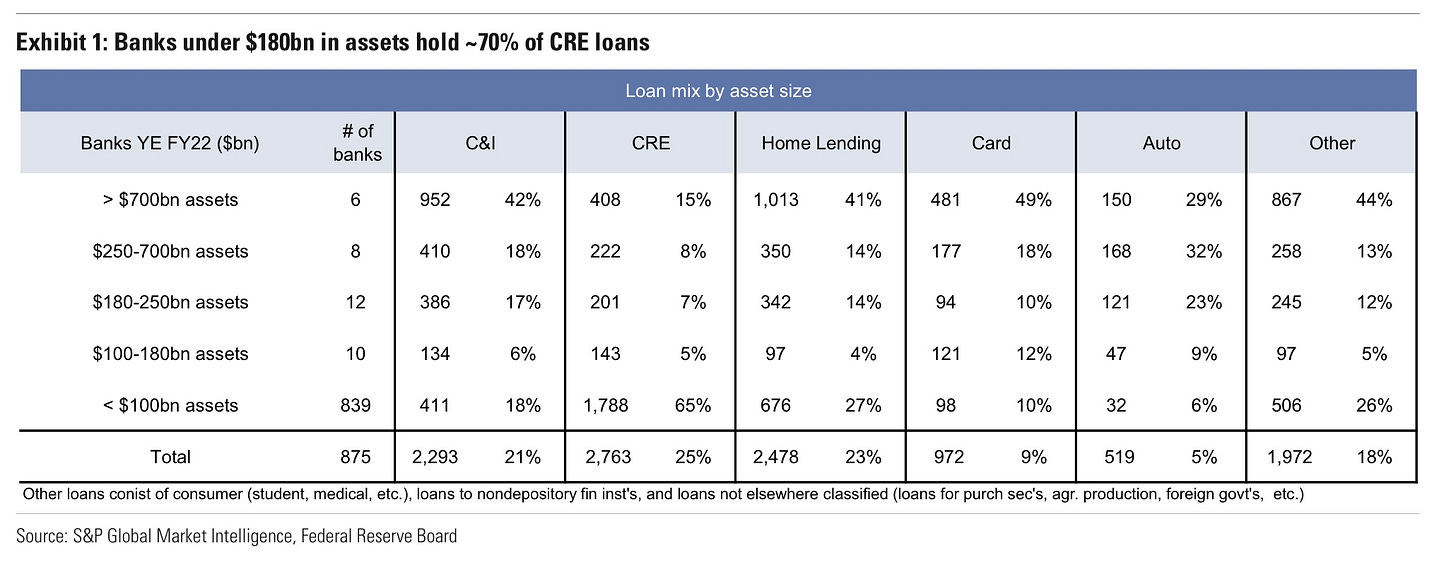

The problem is that the US relies on the depth and capillarity of the banking system to provide the lifeblood (in the form of funding) to the US economy. And most of that heavy lifting is done by small / mid-sized banks.

Per Goldman Sachs, “banks with less than $250bn in assets account for roughly 50% of commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

The biggest question today is when and to which extent this curtailment of credit from small / mid-sized banks will be felt and how public authorities will react.

It seems fairly clear that economic activity should be negatively affected by these events, a positive vis-a-vis inflation. Lower activity and milder inflation data should lessen the need for additional hikes.

Please do let us know what you think.

$$$

Thanks for reading,

John Galt

*Sponsored Content*

One app, all things money. No exchange fees, get the real currency rate.

John Galt is an avid traveler and a superuser of Revolut. For years. I really love it! It’s for this reason I’m particularly excited that our friends at Revolut came through with their sponsorship for this post.

“For some people, money is... money is a foreign film without subtitles.” —Matchstick Men

Revolut is a regular, licensed bank, with great technology behind. But—on top of all the usual features you can expect from your bank—Revolut allows you to automatically convert the balance in your account from one currency to another using the interbank exchange rate (!) and avoid exchange fees. Trust me, complete transparency in FX exchange rates is a valuable asset.

Sign up here (it’s quick & easy!)—use my link to support Going John Galt

Many investors were caught off guard—in particular of the non-carbon based variety, with CTAs posting historical losses. Finally, note that volatility jumped substantially across asset classes. Depth / liquidity was severely impaired and breadth at record lows.

In the US, a new programme (Bank Term Funding Program) was put in place for banks to avoid the sale of assets marked (Held-To-Maturity, HTM) in the face of deposit outflows. These had become a problem, forcing authorities to step in and guarantee all deposits at the two failed US banks, yet falling short of guaranteeing the safety of deposits across all banks. After all, you have to think twice before taking on insuring $16tn… maybe raising the FDIC-insured amount instead?

The Fed and most major CBs agreed to enhance access to currency swaps to curtail the need for foreign CBs to sell treasuries for USD.

50bps would bring back questions about Powell’s golf game, while no hike would encourage inflation anxiety and raise the usual ‘the Fed knows something we don’t’ examinations. 25bps in the current environment makes as sufficiently strong point about inflation remaining the #1 enemy of the Fed.

The question was especially relevant since April is an ‘inconsequential’ month for monetary policy in the US. Famous last words…

The Fed’s Balance Sheet is also increasing again mainly due to increasing discount window borrowing and the new lending facility.

Great, as usual(!)