$10 IF IT BLEEDS, WE CAN KILL IT

The shadow of stagflation looms over the economy and markets

Executive Summary

Signs of recession anxiety permeating markets—pushing bond yields down, curbing home sales and even forcing a strong capitulation in this year’s best performing asset: commodities

US Housing particularly vulnerable after prices went up 40% since the pandemic broke out—keep an eye on housing starts alongside the more popular metrics (home sales and prices) for cues on market direction

Commodity prices may have disassociated from fundamentals yet the structural, long-term bull market story remains intact

Recession Anxiety in the Driver’s Seat

Signs of recession anxiety have permeated markets since my latest missive on June 26, as the shadow of stagflation looms over the economy. In this week’s post I try to make some sense of the recent price action across markets and venture a bit deeper into two of the most important asset classes: housing and commodities.

While equities have traded relatively directionless—with surprisingly muted impact from the aforementioned rebalancing flows—bond yields have dropped violently reflecting the dual forces of deteriorating demand and decelerating growth. A substantial portion of this move is driven by plunging inflation breakevens—the 2Y now trades below the level before the Russian invasion.

Moreover, volatility in bonds as reflected in the MOVE index—the bond equivalent of the S&P’s VIX index—is at historically elevated levels, strongly diverging from its equities equivalent.

Monetary policymakers across developed countries set out to bleed demand / throttle growth until inflation is reigned in. Or as Elizabeth Warren most recently put it in The Roast of J. Powell (on Capitol Hill, not Comedy Central), “driving the economy off a cliff”. Warren fans, enjoy that one as you won't find many of her quotes between these lines.

If you believe that purposefully engineering the right demand shock only after finishing overstimulating the economy in an effort to avert a public lockdown-induced economic slowdown is a farcical plan, you are not alone. The logic is Simpson-esque. In any event, supply-side price pressures are outside their remit and the market knows.

Across the Atlantic, the EU marches tirelessly toward stagflation and EURUSD parity, hitting 20Y lows this week. Bloc-wide economic activity indicators (PMIs) deteriorated markedly in June, with services reading well below the most pessimistic estimates (52.8 vs. 56.1 in May). On the subject of PMIs, the US print came in relatively unchanged, while China continuing to cheerfully perform the Kansas City Shuffle. Bullish.

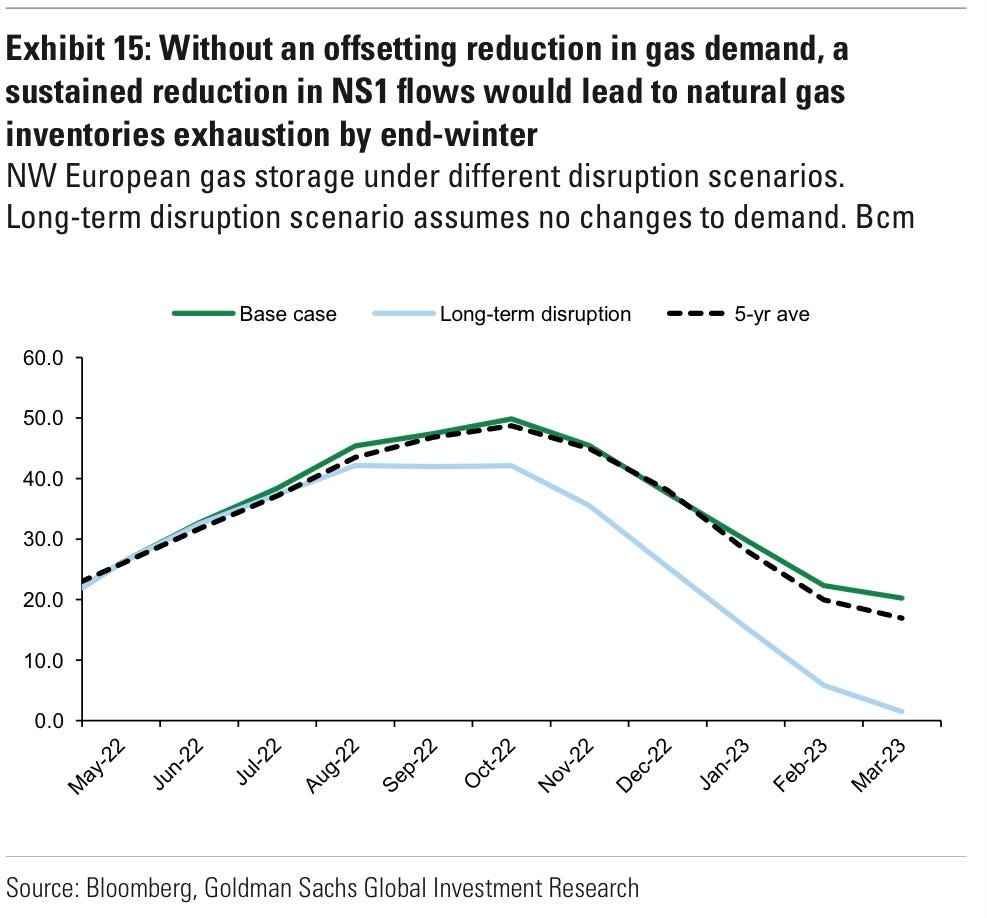

More importantly though, incremental tail risk continues to build up over European nat gas dependency. Germany suddenly recorded its first monthly trade deficit since 1991 in May—largely attributable to Russia’s latest gas curb1. Embedded in the lines of my previous post ($9 MAKE 75BPS HIKES GREAT AGAIN) was already a warning about Europe’s industrial reliance on cheap piped gas from Russia, particularly for aluminium, glass and chemicals manufacturing.

While I’ll concede that a single data point does not make a trend, the consequences of this are myriad and their impact on the EU, monumental. If flows from Nord Stream 1 (NS1) do not resume shortly and storage levels improve, rationing come winter become a distinct possibility.

US Housing rolling over

The point of rehashing the economic situation across different developed economies is to segue into the perils their consumers are currently facing, grappling with almost double-digit inflation and squeezed by negative real wages. Unsurprisingly, consumer sentiment declined to record lows in the US recently.

Talking about curbing inflation through the reverse wealth effect…

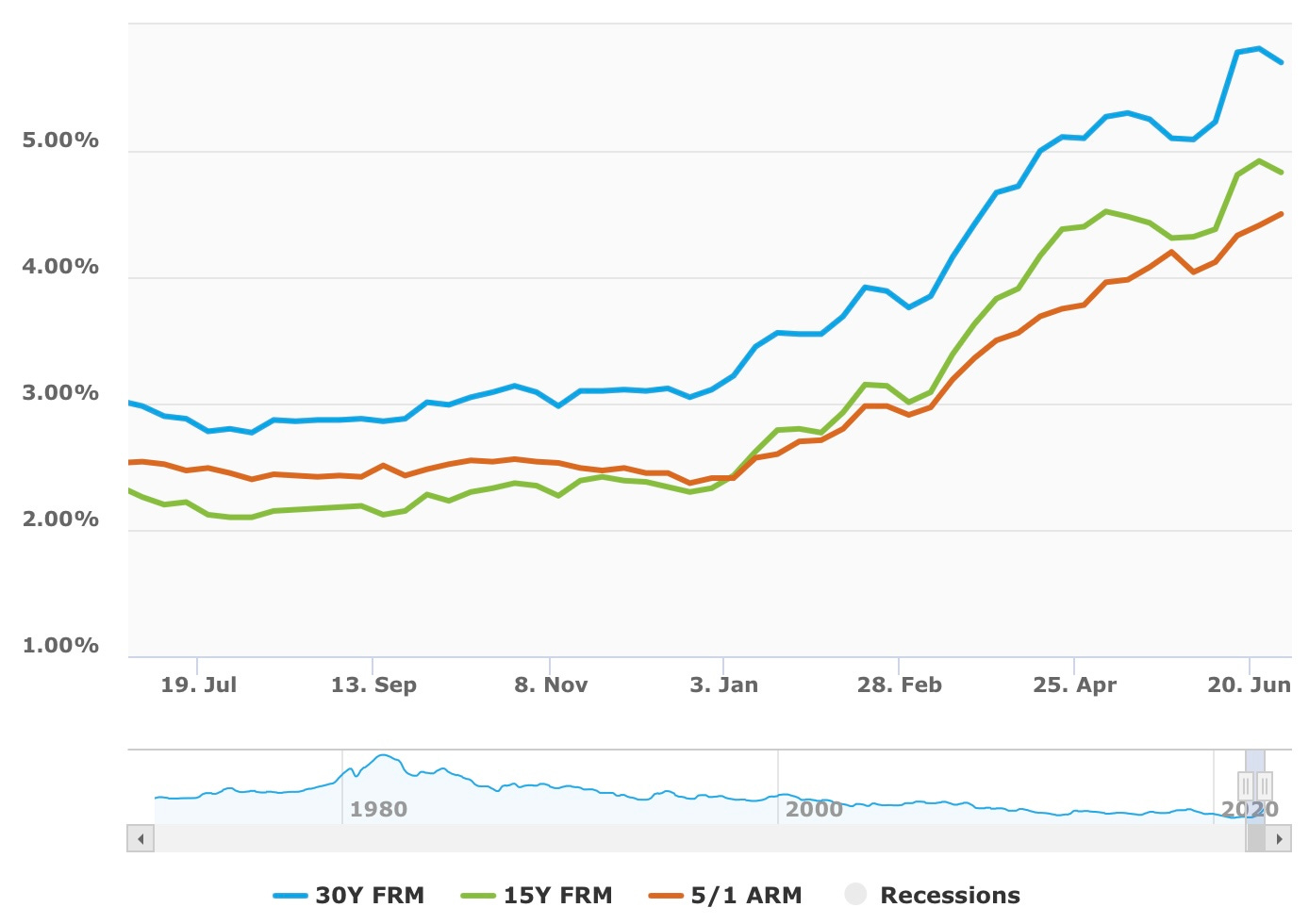

The velocity in the 2022 global bond yield rise is virtually unprecedented and has started to trickle down into residential real estate markets. US housing is particularly vulnerable after prices went up 40% since the pandemic broke out, but we see similar situations across developed nations.

The stimulus days are over and the Fed is tightening financial conditions (including the roll off of MBS as part of QT), rapidly doubling mortgage rates from sub-3% levels last year on the 30Y to 5.7%, as per the latest Freddie Mac data. This includes a 55bps weekly increase a couple of weeks ago—the fastest pace since 1987.

Housing data is notoriously volatile and noisy—don’t take monthly figures at face value—but the point is that existing home sales are mean reverting towards their pre-pandemic levels (now >17% below pandemic peak). Areas suffering the most are the Midwest, West and South.

According to indicators, housing affordability has not been this stretched since 2007 and is underscored by receding first-time buyers (27% vs. 31% a month ago).

Inventory remains relatively tight below 3 months, which explains why prices continue to go up (c.21% YoY for S&P/Case-Shiller 20-city index and 19% YoY for FHFA) despite the deteriorating environment. Average home prices hit $570k in the US.

Anecdotally, some early alternative indicators—mind the ridiculous Twitterhandle—tell a different story.

Back in serious territory, this low-stock environment encourages homebuilders to keep building and masks some of the issues developing below the surface. As read in a housing research note back in April, “a 100bps increase in mortgage rates slows housing starts by 13% when the housing vacancy rate is above 2%, but starts are essentially unresponsive to changes in mortgage rates when the vacancy rate is below 1%.”

Keep an eye on housing starts alongside the more popular metrics (home sales and prices), as recessions historically have always come with declines in starts.

Few know this, but the subject of homebuilder equities is very near and dear to my heart as in a previous life I took public (IPO’d) a homebuilder in Europe. Whatever the case, they have been anticipating an implosion in housing for a while. The main Homebuilders ETF ($XHB) has seen a relatively orderly decline of >30% from the highs, which coincided with the change of the year. This is the worst decline since the GFC.

Should the economy look past the financial tightening cycle and effectively accomplish Powell’s vaunted “soft landing”, $XHB should be one of the great beneficiaries. Conversely, if we careen into a recession we might see $XHB half in price (and possibly beyond) as in previous recessionary episodes, making homebuilders a compelling short.

Commodities: “If it bleeds, we can kill it”

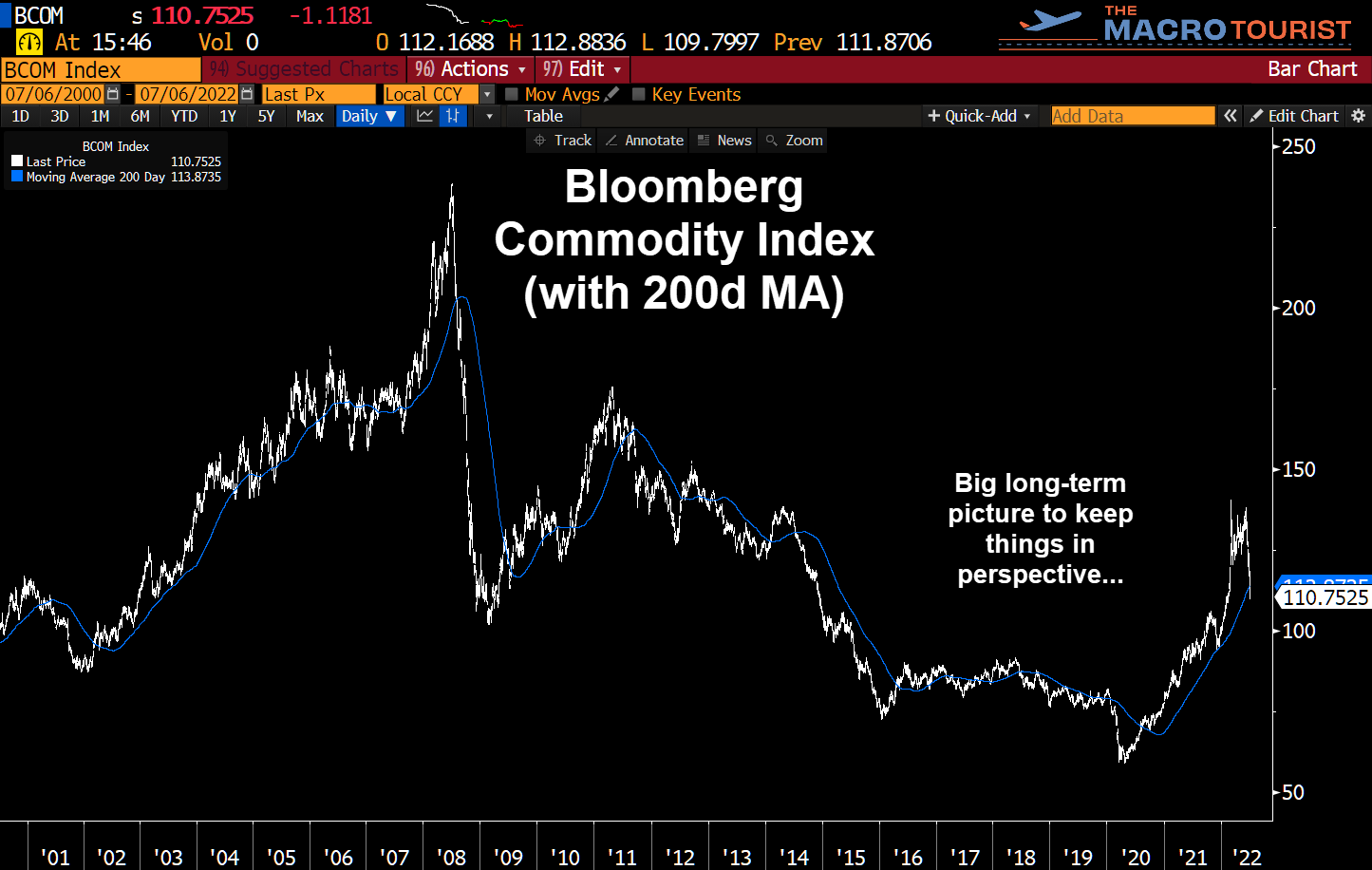

Hard-landing concerns and USD+ safe-haven flows were met with a bout of ubiquitous financial liquidation pressures across the commodities complex over the past month.

Commodities remain the best performing asset class this year despite the Bloomberg Commodity Index lining up for a fourth consecutive weekly drop, entering technical bear market levels (20% correction). From a technical perspective we sit at the 38.2% retracement. Don’t lose sight of the big picture, though.

Investors cut their exposure when volatility jumps, so liquidity drops. In this environment, positioning might have been overextended and investors swiftly jumped ship… or went outright short, in a move reminiscent of the movie Predator:

At least that is the story pushed by banks of the likes of Nomura, whose models show investor net long exposure plummeting from 99%-ile to 35%-ile in a heartbeat. The bank’s Charlie McElligott described it as “recession gap-risk repricing hard and fast”.

The reality is that fundamentals remain strong in a tight physical market (as opposed to the financial market). Contrary to financial assets, commodities are spot assets, where pricing does depend on current supply relative to demand.

Prices may have disassociated from fundamentals yet the structural, long-term bull market story remains intact. Economic activity in decelerating, but indicators are not recessionary yet (PMIs >50, remember: expansionary!), so I have somewhat added to my commodity longs over the past week, (partially) funded by the sale of some outperforming assets.

If you don’t, feel free to follow me on Twitter (@GoingJGalt) for additional updates and resources / information.

Barring a recession, there are sufficient catalysts to argue for a bounce in relatively short order, such as subsiding volatility, countercyclical monetary stimulus from China, relatively less aggressive central banks—if / when inflation reverts—or a resumption in the drawdown of existing stocks / inventories.

Today, my commodity longs are primarily concentrated in uranium (i.e., Sprott Physical Uranium Trust or simply “$SPUT”). There are several reasons why I believe it to be the best risk-return out there, including:

Spot trading at ~$50 per pound, well below cost of production (est. >$60)

Uranium vehicles (i.e., $SPUT, $YCA) trading at ~15-20% discount to NAV

Huge supply-demand imbalance driven by post-Fukushima underinvestment (200mn pounds per year demanded vs. 135mn pounds supplied); the entire industry has shrunk from >$150bn in to >$30bn

Highly-inelastic demand from operators (regardless of a recession materializing or consumer preferences), alongside increasing demand from financial players / vehicles (i.e., $SPUT, $YCA) and miners

Rapidly changing public perception about affordability, safety and clean-energy potential driving nuclear renaissance in developed countries (i.e., Japan, South Korea, US, Europe via its new taxonomy approved yesterday, etc.)2

Non-developed nations fully embraced nuclear—new nuclear reactors (56 under construction with 26 being completed this year, 96 in advanced planning and 325 proposed) will double current fleet (439 operable reactors) in the coming years

If you are interested in receiving materials—in .pdf format—about nuclear / uranium, feel free to reach out via Twitter (@GoingJGalt).

Great things happen to cheap assets. Trust the process.

As you can see, lots of moving parts in the economy and markets over the past few weeks. If you have reached this point in the note, congratulations! I hope this was as helpful to you as it was for me in structuring my thoughts.

This is the 10th post, so I also wanted to kindly thank all new (and existing) subscribers for their (continued) support—within less than two months we have grown a community of 60 investors… and growing!

Onwards and upwards.

$$$

Thanks for reading,

John Galt

It’s not the only casualty, by any means. Germany’s largest Russian gas importer, a listed company called Uniper, has withdrawn earnings guidance and socialized the possibility of a government bailout. It’s estimated they lose >€30mn a day as they replace missing gas volumes in the open spot market.

Nuclear waste is dense. All waste generated from commercial facilities since the 1950 would fit on a football field stacked 30 feet tall. Modern recycling / reprocessing technically allows up to 97% of waste to be reutilized.