Build in Public (BIP) $1

Relevant metrics / KPIs, takeaways and the future of Going John Galt

This a brief ‘build in public’ note discussing my experience so far writing an anonymous letter about investing. I share some intricacies, including relevant metrics / KPIs, key takeaways and what the future holds in store for Going John Galt.

If this is not of interest to you, please do skip altogether. Note this post does not alter the delivery schedule of the usual content—a new piece will be published in coming days.

A bit over a month ago I set up a poll explaining how “I started this newsletter with the idea to offer a bit of ‘building in public’” and asking if you’d be curious to see what happens behind-the-scenes . The answer was an overwhelming “yes” (85%).

Few writers open up their metrics to their audience for somewhat of a backstage access, despite growing interest from readers to understand the business of market commentators. The reason for that clearly is avoiding the awkward conversation about audience monetization. Well, I’ve said this before…

“I wouldn’t consider myself a journalist… and nobody else would consider myself a journalist”—Carlyle’s David Rubenstein

I’m not a writer. I’m an investor. First and foremost. So let’s get this started.

Traffic & Subscriptions

For reference, Going John Galt launched as a fully anonymous blog roughly half a year ago.

Organically growing an audience while retaining anonymity is excruciatingly slow. It takes a while for readers to recognize you know what you’re talking about. It takes ages to get things just off the ground, particularly if you make a point of not trafficking in hyperbole. To drive traffic when your follower count truly is at the Zero Lower Bound, if you catch my drift. A veritable walk in the desert.

If you are anonymous simply for privacy reasons as it's my case1, I can assure you there's great temptation to renounce anonymity. If anyone is interested in growing quick, this ain’t the way.

Now, in my case I don’t really care. Eyeballs and clicks don’t change my life. I approach this as yet another game of compounding, yet one where I don’t take accelerating metrics too seriously.

Fostering a sense of community and establishing a relationship with these new investors pouring in via subscriptions is more important (i.e., reaching out to all of you individually, privately discussing investment viewpoints with many of you and responding to all questions in public).

A healthy community of 500 is better than a loosely held group of 50,000. With audience / readership as with many things in life, it’s more about quality than quantity.

What I get out of it today is two-fold (primary goals):

Writing was always part of my investment process—sharing my views is a natural step

Growing an audience allows me to meet new investors and exchange perspectives about investment topics. A larger and more qualified / educated audience creates better investment dialogue, which (hopefully) enhances performance. As I don’t have a team of fully-dedicated investment professionals behind me any longer, this is the next best thing.

Traffic

Traffic has grown steadily with help of two primary sources: word of mouth (“Direct”, 7.8k views since inception) and Twitter (3.7k views).

Word of mouth (“Direct”) entails readers directly sharing my content (i.e., forwarding the email to a friend or colleague or sending a link), while Twitter drives traffic depending on the amount / quality of interactions (i.e., your comments, likes, retweets) disseminate the content through the digital void.

Supporting Going John Galt is really easy—it only requires for you to engage… Please do so!

Other takeaways re: traffic are:

Spikes cluster around publication dates. My traffic seems to have substantially accelerated after the summer.

Metrics are better posting early in the week, as the audience mostly perceives this content as work vs. leisure (i.e., weekend read). It also increases the odds of getting picked up by other platforms / financial content aggregators.

Carrying an audience across platforms (i.e., Twitter and Substack) is very helpful.

Getting retweeted by a large Fintwit account can be a game changer. While this has rarely happened for me, I’ve gotten a taste recently of what those boosts can be like… shoutout to my buds @contrarian8888, @BrianTycangco and @quakes99, who I’ve met via Twitter and often discuss views with. To name a few.

Getting featured / re-posted or even cracking the “top” lists of aggregators / content sites, such as Harkster (I consistently make it into the top-5 most-read pieces), TalkMarkets or Commonstock can move the needle.

Subscriptions

The relationship of traffic and subscriptions depends mainly on your content’s fit with the audience exposed to your content and the ease of subscribing:

Most of my subscribers are sophisticated investors—easier to find / tap in niches than out in the open.

Existing Substack readers are easier to tap as they will open the content directly on the platform and simply click “Subscribe” vs. putting their email into a yet ‘unknown’ platform (i.e., there’s less friction in the process).

In line with these two points, Substack may not be great at driving traffic, yet it surely is at generating subscriptions, with a whopping 22.4% Conversion Ratio! It also helps that some great publications actively recommend Going John Galt on Substack. Shoutout to my buddies Investment Talk, Capital Notes and Invariant!

Twitter offers a great combination of eyeballs and clicks. My audience has grown from zero to >650 followers in six months. Apparently, it all depends on how much the algorithm likes you that week. Whatever the case, I found it’s the best place to interact.

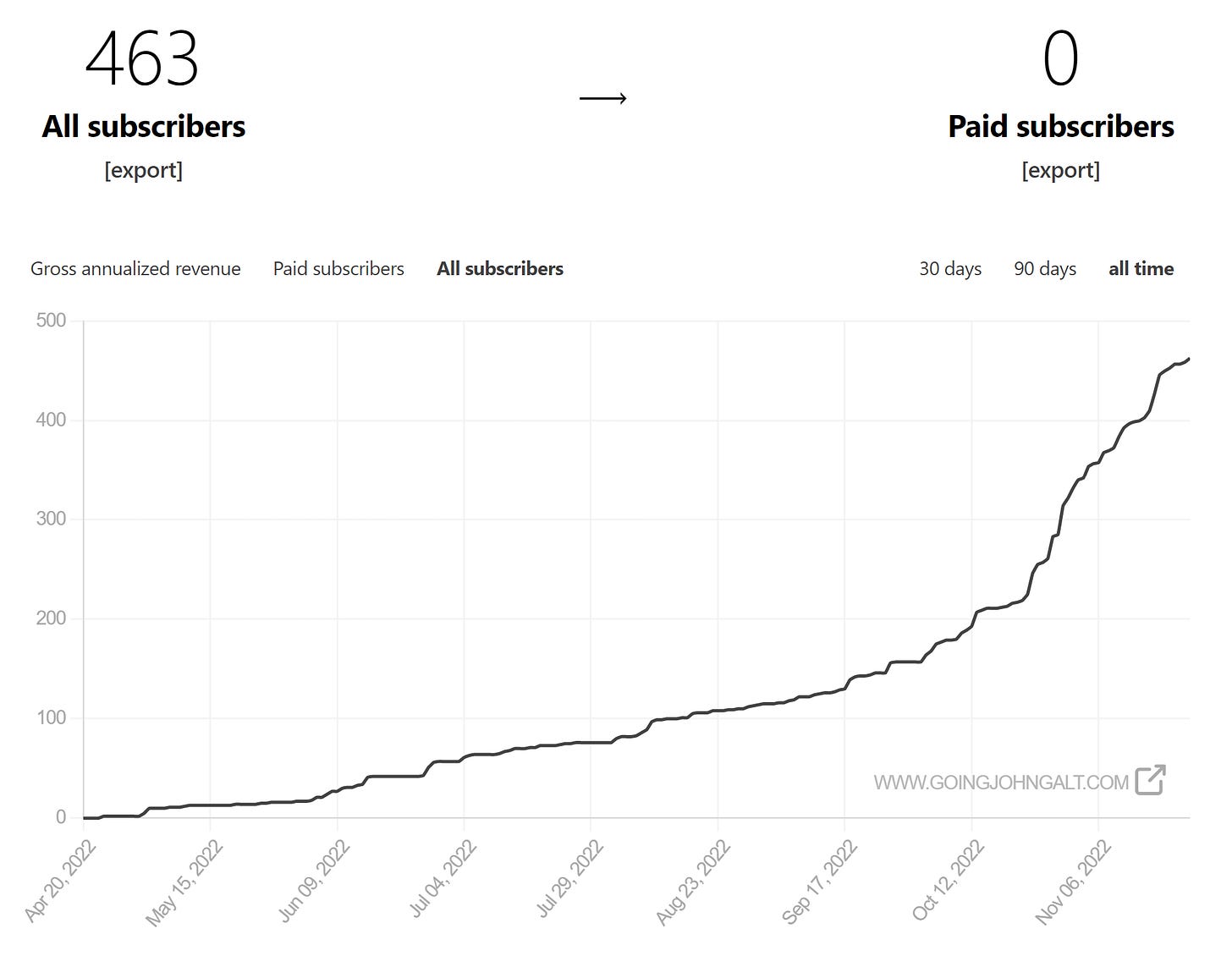

Following the traffic profile, there’s been a dramatic uptick in subscriptions after the summer. Churn is virtually non-existent—I’m very thankful that only a handful of subscribers have unsubscribed so far.

All things considered, my subscriber count organically doubles each month-and-a-bit and we’re currently close to 5002.

With an expanding subscriber base, growing outreach via increasing “shares” and and a stable Open Rate at 50-55%, my pieces currently approach 2k views in many cases. =ROUNDUP()

Finally, my top-5 countries by subscribers are USA (33%), Great Britain (12%), Spain (6%), Australia (5%) and Canada (5%). Most readers subscribe using personal email vs. corporate (83%). The majority are players in the financial industry, with great representation from investment banks / investment managers, often in executive positions.

The future (of Going John Galt)

Content will continue to flow as usual, with a few tweaks.

Audio / Podcasting

If you are anything like me you probably consume quite a bit of content via audio. John Galt is a big fan of audiobooks. I hesitate to tell you what platform I use for that, as I want to steer away from free publicity… not that Audible needs it anyway! For podcasts I use Spotify, btw.

Many have reached out asking me to consider recording my posts for consumption via audio. Some version of this (podcasting?) is in the cards in coming weeks.

Monetization?

John Galt believes in capitalism and money as a tool of exchange. The fruit of his work for somebody else’s. He also values his time.

Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who deal with one another must deal by trade and give value for value.

Money is not the tool of the moochers, who claim your product by tears, or of the looters, who take it from you by force. Money is made possible only by the men who produce. Is this what you consider evil?” —Atlas Shrugged

Now, I have a strong preference for not putting any content behind a paywall! Mercifully, there are other ways for me to find support, though.

To be clear, writing here is net cash negative for me, it costs me money. While making money is not my primary goal here, relevant third parties are interested in sponsoring the content and revenues will compensate for expenses related to data, research and tools and will allow the content to grow in terms of quality, quantity and delivery channels. For instance, John Galt is not well-versed with editing audio, so he might have to request some external help! It would also be great if it pays for a few beers every now and then.

Now, I will never sell your data. I will strive to find only the right sponsors and I will never spam you. Ever.

Without a paywall, if you wish to support the content, it's very easy. Just click on the brief sponsored content every now and then! Click, done… Think of it as buying me a beer!

I would like to hear from you, the reader.

Finally, borrowing from my bud Conor McNeil of Investment Talk fame, below you’ll find 3 questions. I encourage you to click on one of the options to help me understand my audience better! It’s 100% anonymous and should only take a second or two, and you’ll get to see the polls update after you answer. Thanks in advance, this will be very helpful.

While I hope this piece was useful—I will provide updates every now and then. Also, in the coming days we’ll go back to the usual content. A new piece is coming soon, so make sure you stay tuned.

Make sure you reach out for any comments or inquiries via Twitter or at john.goingjohngalt@gmail.com.

$$$

Thanks for reading,

John Galt

This stems from exposure to / understanding of technology and the possibly unfounded / exaggerated fear that adding more data to my name creates ammunition for a future, still-shapeless weapon. I also travel often to some funky jurisdictions, where the price of life seems mired in a sustained bear market. Only the paranoid survive.

I could have waited a few days to post the graph below over 500, but… frankly I’ve got plans this weekend. “Fuck it Dude, let’s go bowling.”

Great thoughts here my friend!

Keep it "Going" and thanks!