$32 UNFORCED ERRORS

Bond vigilantes may no longer be fossilized remains of ‘90s and ‘00s financial Americana

Executive Summary

Trade policy has become a source of systemic uncertainty

Markets are waking up to fiscal risk

Risk assets float on muscle memory and hope, bonds struggling

This post discusses—implicitly or explicitly—investments in US rates, bonds, equities and FX.

King of Clay and Unforced (Trade Policy) Errors

Roland Garros is underway, my favorite tournament. Mostly because it’s where fellow Mallorcan Nadal built his myth not by brilliance, but by outlasting. One more shot, one more rally. Win by attrition. Let the other side commit the unforced error.

That brings us to the U.S. economy, where Trump 2.0 has so far shown a near-religious obsession with tariffs—on, off, back on again. (Have you tried turning them off and on again?)

What was expected to be a business-friendly administration has so far introduced significant uncertainty and volatility around trade policy, complete with daily covfefe and a now-infamous press conference that felt clearly written by AI—as opposed to this text—and introduced new tariffs on islands populated solely by flightless birds.

Markets are noticing. So is the economy.

The ISM manufacturing print missed yesterday… now at 48.5, the weakest since last November. Imports have collapsed to levels not seen since 2009. Prices stayed sticky. Forward commentary wasn’t glowing with the term “tariff” showing up often and not in a positive light.

The takeaway is mechanical, not moral: friction is rising.

Bond Vigilantes: no longer fossilized remains of financial Americana

Meanwhile, fiscal spending remains wide open — as expected, and consistent with what I noted in my last missive. The “One Big Beautiful Bill” locks in strong outlays well into 2026 and 2027. And yet, when you're running 6–7% deficits and still posting soft numbers, it says less about stimulus and more about resistance. This is an economy that, on paper, should be flyin’ — but instead feels jammed by policy volatility and ambient uncertainty.

Fiscally, the US will maintain its aggressive support stance, irrespective of political leadership. While I refrain from taking sides in the political arena, it’s clear that the current candidates resonate with today’s Zeitgeist.

Read more: $30 GOLDILOCKS (2.0) AND THE THREE BEARS

Enter Moody’s and it’s recent downgrade of the U.S. credit rating from the top level of Aaa (negative) to Aa1 (stable). Moody’s downgrade didn’t tell us something new about deficits. None of this is radical in terms of fiscal / debt math, the U.S. position did not meaningfully deteriorate only last month.

I recently got my boat license. One of the first things they teach you: when a storm approaches, you can confront it or try to outrun it. Increasingly, voices around the administration are confirming their choice. Outrun the deficits, the debt. The bond market’s patience. A bet on nominal growth, with hopes that markets won’t blink.

What has been and is changing is perception. The market is starting to care again. It’s in the public eye—podcasts, pundits, prominent investors. And credit is about trust, not arithmetic.

Bond vigilantes may no longer be fossilized remains of ‘90s and ‘00s financial Americana. Are we seeing a comeback?

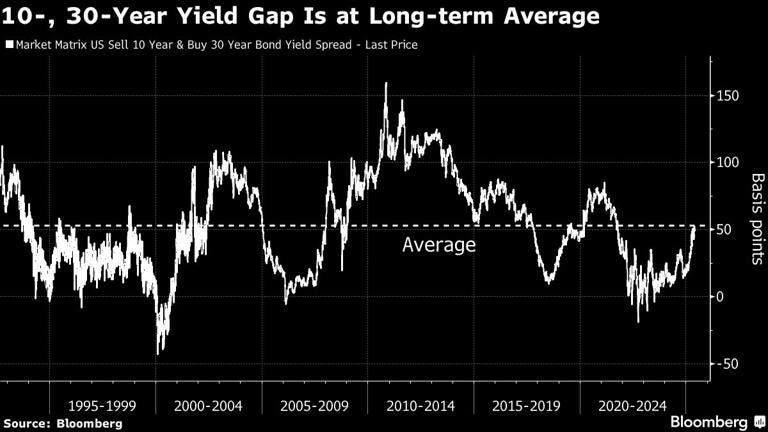

The notion that debt levels matter—a concept so foreign during this past MMT-heavy lustrum—seems (re)nascent today. I may have written about this before. It was theory then. It’s curve structure now.

The rates market has responded with a steepener. The long end is almost untouched—Bloomberg led with “Buyers’ Strike Rocks US Long Bond”, and for once weren’t exaggerating. Pimco and DoubleLine are fading duration. The 5s30s spread hit 100bps for the first time in years.

The long bond now is Bessent’s and everyone’s problem. Cracks are “going to happen”. Jamie.

Equities: nihilistic & expensive

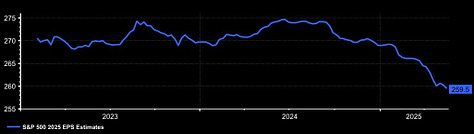

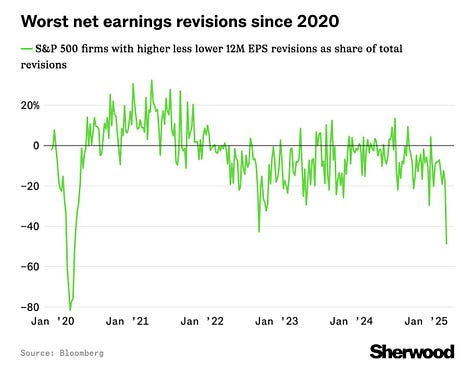

Equities remain somewhat nihilistic and expensive. Earnings estimates are drifting lower and valuations are stretching. On some metrics, net earnings revisions are the worst since 2020. The market’s paying more for less.

Part of that is the belief / muscle memory, that this entire episode is one tweet away from being reversed, despite the growing question mark around the lasting impact of these trade policy blunders, both economically and geopolitically. But is it? As per Nomura, you could literally trade it IRL like that. Stone’s throw, ATHs.

The Fed, meanwhile, remains flat—boxed in between inflation that’s too sticky to ignore and momentum that’s too soft to provoke a hike. Every meeting feels like a placeholder. Powell & Co. can’t move without triggering a tantrum on one side or fueling doubt on the other. So they sit, watching the data drip in—the paint dry—, hoping that “wait and see” eventually turns into clarity.

Markets, for their part, aren’t offering much help. Growth is ambiguous, labor is lagging, and inflation expectations are stuck in a gray zone. In other words, it’s not a moment for bold positioning.

No hero trades here. Just Nadal logic: stay in the point. Let the other side take the risk.

$$$

Thanks for reading,

John Galt