$30 GOLDILOCKS (2.0) AND THE THREE BEARS

Goldilocks 2.0 possible with a resilient economy and investor-friendly monetary / fiscal policy supporting top-line growth and valuations

Executive Summary

Our last post suggested all time highs were a possibility, but just wow!

Even if the economy slows down, monetary headroom helps underwrite the vaunted Fed put

Chinese stocks are the cheapest we have ever seen them on most metrics and it seems to be attracting the most opportunitistic / tactical investors

This post discusses—implicitly or explicitly—investments in US rates and equities, energy and Chinese equities ($KWEB, $BABA, $JD, $BIDU, $NIO and Linklogis).

Happy 2024, everyone.

I’m genuinely honored to appear in your inbox again.

I enter 2024 with a clear intention to share my thoughts more often than what i have in the past year. I also intend to tweak the format a bit to make them a bit shorter, where I do not feel like a major change in stance is warranted to briefly show up in your lives.

This year, I'm setting a goal to share my insights more frequently than in 2023. I hope that a shorter, somewhat less ambitious format allows me to provide more updates. We’ll see.

On a broader note, I’m happy to live in Switzerland now that it’s becoming increasingly apparent that ideology is starting to overshadow common sense in much of the decision-making landscape.

This trend presents both challenges and opportunities for us as investors and observers of the market. I look forward to navigating these complexities together with you.

What landing?

It’s entirely possible that expectations for a cooler core CPI going forward could force rates lower. Such rate drop could happen even if the slowing of headline CPI stalls, as long as the market is able to digest the reasons (i.e., positive base effects fading, ‘temporary’ uptick in commodities’ prices). […]

This exercise suggests that we might see even loftier S&P levels going forward, even before looking at other positives. Perhaps even all time highs? Never say never.

Read more: $29 WHAT LANDING?

We ventured into Q4 2023 with a constructive view on equities, touting the possibility of all time highs for the S&P. We must admit this rip to the upside took even us by surprise! Not sure about Goldilocks, but the three bears cannot be happy.

Today, we continue to ask ourselves the question “what landing?”

This is how we see things:

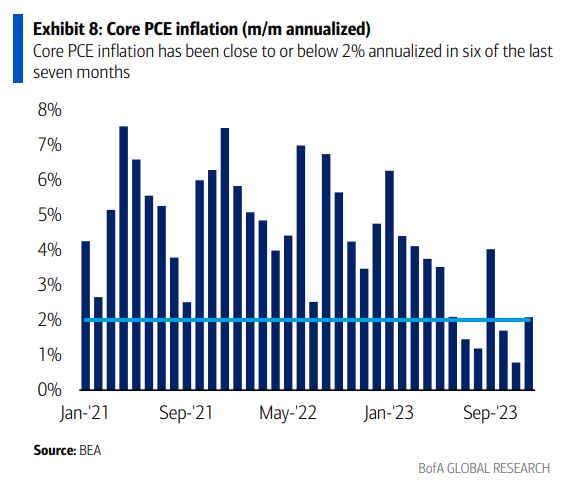

Recent data reveals a significant shift in inflation metrics, with the 6-month annualized Core PCE rate stabilizing at 1.9% for two consecutive months, and the MoM annualized Core PCE hovering close to or below 2% in six of the last seven months.

The impact of tightening measures may now be fading into the background with the US economy exhibiting robust growth (3.3% GDP growth in Q4). This growth encapsulates a bifurcated economy where interest-rate sensitive sectors are experiencing challenges, while others demonstrate remarkable resilience and strength.

On the monetary front, the Fed’s balance sheet has been shrinking, creating some monetary headroom.

With policy rates currently restrictive and the most sensitive sectors feeling the pinch, there’s growing discourse around the need for "normalization" (towards the neutral rate, r*). The market anticipates roughly six rate cuts in the coming year, yet I believe these expectations boil down to two distinct scenarios: an economic recession that warrants 300-400bps in cuts or gentle (50-100bps) ‘insurance cuts’.

Fiscally, the US will maintain its aggressive support stance, irrespective of political leadership. While I refrain from taking sides in the political arena, it’s clear that the current candidates resonate with today’s Zeitgeist. If you don’t like these wait until you see who’s next in line.

All this boils down to potentially Goldilocks 2.0, with a resilient economy and investor-friendly monetary / fiscal policy supporting top-line growth and valuations. And even if the economy slows down, I believe the monetary headroom (i.e., higher rates and somewhat lower balance sheet) helps underwrite the vaunted Fed put. Famous last words…

A quick note on energy, which we continue to like in the current environment. We have been massive uranium bulls over time ($22 IT’S PRONOUNCED NUCULAR), but have consitently reduced our exposure as the risk-return is different now with uranium at $106 / lb vs. $60-65 / lb cost of production1.

“The biggest contrarian long trade on the planet.”

Contrarian investing is tough.

Only a year ago, were all riding high with our ChinaTech investments, the market seemingly on our side and optimism at its peak. Tides always turn, however.

While some, skillfully exited near the market highs (shout out to Contrarian8888, always gracious!), a portion of my portfolio became value-trapped for over a year.

An expensive reminder of the unpredictable nature markets and the razor-thin line between timely exits and prolonged entanglements.

Today’s sentiment is succinctly captured by BofA's Harnett’s quote above.

But why now?

China's real GDP did grow by 5.2% in 2023, outperforming many others. However, its nominal GDP increase was a more modest 4.6%, lagging behind Japan (5.4%), the Euro Area (6.1%), and the US (6.2%). China's GDP in USD terms actually shrunk as the CNY depreciated >5% vs. the USD. No bueno.

Authorities seem to recognize the importance of delivering on the fiscal and monetary support promises that market participants have been since the pandemic. Testament to that is last week’s recent 50bps RRR cut, the first double cut in >2Y.

Chinese stocks are the cheapest we have ever seen them on most metrics.

It also seems to be capturing the attention of, well… the same investors that exited surfed this wave circa a year ago.

Interestingly, it’s starting to show in the numbers. BofA reported a record influx of capital last week with a massive $12.1bn to EMs…

… $11.9bn of which actually went into Chinese stocks. Furthermore, $FXI and $KWEB call volumes exploded over the past 10 days.

I’m long a basket including $BABA, $KWEB, $JD, $BIDU, $NIO and Linklogis.

Only for the brave. Only for the foolish.

That’s it for today, hope you had a great start to the year!

$$$

Today more than ever, thanks for reading,

John Galt

Or $50 / lb when we wrote the piece. Note we’ve been bullish uranium since the $20s.

Great to have you back John! Looking forward to more in 2024!

Thanks for the new article. Based on a repeat of 2023 mag7 (except tesla) particularly real AI driven companies, seem likely to keep going higher. Based on asymmetry China seems primed for 2024