$12 FIGHTING OCKHAM

The Fed might have signaled a shift in their reaction function and markets continue to be driven by squeezy, systematic flows

Executive Summary

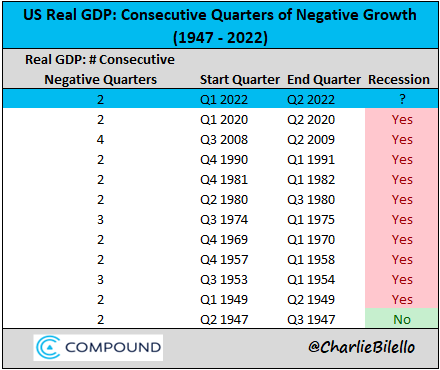

Past 10 periods with 2+ consecutive negative quarterly prints always marked recessions

Fed potentially signaled a change to their reaction function, but market direction will depend on path of inflation

Mechanical flows continue to “drive the tape”—through decreasing uncertainty from leaving FOMC / earnings season in the rear window, buybacks re-starting, subsiding volatility in equities / bonds, options positioning / dealer hedging, light investor exposure, etc.

The Economy of Words

Thought I might keep today’s post a tad less thematic than usual, in (the very likely) case it finds some of you sipping on a negroni by the beach. The economy of words…

I first weigh in briefly on the recession definition debate, then cover the ongoing rally in equities—including some FOMC-heavy commentary—and cap it off with what I consider to be the true driver of this bounce.

Defining Recession

“I can hear the sound of virtual typewriters spilling digital ink in the financial press about the oh-so-imminent recession”

My first note—aptly called $1 ONE FOOT IN THE SHADED AREA—coincided with the markets’ digestion of the first negative US Real GDP print in May and anticipated future discussions around the definition of recession once the second consecutive read was in.

While I continue to “not subscribe to the simplified ‘two negative quarters make a recession’ definition, opting instead for frameworks more aligned with NBER’s Cycle Dating”, data argues that the last 10 periods with 2+ consecutive negative quarterly reads always marked recessions.

Give me data or give me death.

Note that the first exception dates back to 1947—A Streetcar Named Desire had just been published (the book, the world had to wait until 1951 for the picture) and Jackie Robinson made his debut as the first African American in the MLB. It’s a long, long time ago.

The point I’m making is that the distinction being pushed is not as relevant… and that the US is probably already in a recession. Europe, too, by the way.

Shifting the Fed’s Reaction Function

Ockham's razor is a problem-solving principle which states that with competing theories or explanations, the simpler one—for example a model with fewer parameters—is to be preferred.

Market pundits have spent the past weeks wielding various—often contradicting and always oversimplified—narratives to justify the latest market rebound.

Many have identified Fed Chair Powell’s words during the FOMC presser following last week’s 75bps rate hike as the catalyst for the continued bout of market upside:

“While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then.”

“We're at 2.25 to 2.5% and that's right in the range of what we think is neutral” (i.e., the rate that supports the economy at full employment / maximum output, while keeping inflation constant)1.

“We think it's time to just go to a meeting-by-meeting basis and not provide the kind of clear guidance that we had provided on the weighted neutral.”

Taken at face value these potentially signal a change to the Fed’s reaction function, which could be interpreted dovishly.

Investors were concerned that Powell & Co would continue providing hawkish forward guidance (i.e., telegraph an unwavering, pre-planned path of rate hikes) and deliver on their tightening of financial conditions regardless of bad economic data evidencing a deceleration. They say it will all be data-dependent now.

No wonder market sentiment has recovered (equities up, bonds yields down)… if things are bad maybe hikes are over and the Fed is not hiking into a recession?

Not so fast—the problem is that Mr. Powell also added:

“I would say that's probably the best estimate of where the Committee's thinking is still. We would get to a moderately restrictive level by the end of this year, by which I mean summer between 3 and 3.5%, and that when the Committee sees further rate increases in 2023.”

“We do want to see demand running below potential for a sustained period to create slack and give inflation a chance to come down.”

“I think you pretty clearly do see a slowing now in demand in the second quarter. Consumer spending, business fixed investment, housing, places like that.”

“We know that the path [to a soft landing] has clearly narrowed, really based on events that are outside of our control. And it may narrow further.”

The second set of comments shows the Fed’s hiking intentions remain unchanged and curbing inflation, their main (even only) objective today.

The only difference is that they are unwilling to commit steadfastly to a rate hike path today considering the cracks in some corners of the economy. I argue that the underlying message is not positive for markets in the medium term, which is reinforced by markets pricing in rate cuts in early 2023!

I get it—data dependency is better. The Fed’s reaction function might have been tweaked. The presser certainly helped market sentiment on the margin.

There was speculation for the Fed to guide the market towards a softer hiking path and many of us were calling for a bounce under that scenario. Below you’ll find my exchange with my bud Brant Hammer of Capital Notes fame.

If you don’t follow me yet on Twitter, feel free to do so (@GoingJGalt) by clicking below.

The current rebound could potentially extend in time particularly if the next inflation readings surprise substantially to the downside.

ISM Prices index slumped from 78.5 to to 60—the fourth biggest fall since 1948. These lead CPI by 4 months. Hang on tight.

Fighting Ockham

Instead of single-handedly crediting the Fed for this bounce, I believe there are more important factors that tend to be overseen.

I often fade Ockham’s razor, as I try to distance myself from established, oversimplified narratives that foster the kind of false sense of calm from having a clean-cut answer. The reality on the ground is always messy. These are highly reflexive environments, where crosscurrents abound, vectors constantly cross and details matter. It’s never only fundamentals—flows matter tremendously.

In $11 ‘TIS THE (EARNINGS) SEASON, I argued that mechanical / systematic flows were “driving the tape” and explained how I could find “powerful arguments for a continuation of the rally, which makes me wary”:

Kudos to our colleagues at Spotgamma—who just celebrated 3Y proverbially pounding the table on Twitter about the importance of (option) flows—and who perfectly flagged the rally-inducing setup going into FOMC.

A repeat of the March rebound, with similar setup.

The economy will continue to decelerate, there is no question about it. Now, the more exciting question is if the lows in equities are in. What we know that we know today (known knowns):

Equities always bottom before earnings trough2.

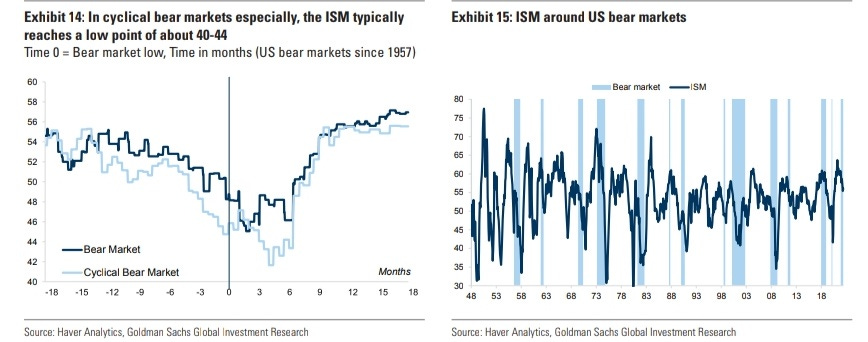

We know equity markets usually trough within 6 months prior to the ISM lows (40-44)—we sit north of 50.

Latest ISM PMI moves do not bode well for equities.

The Fed always answers easing monetary conditions (rate cuts, QE, etc.). The last hawkish Fed during a bear market was Paul Volcker’s in the early ‘80s.

Bonds have actually started to go lower, consistent with previous recoveries.

The biggest hole in any bearish thesis today is that most bad news might already be priced in. We all need to stay humble and not get married to any thesis. Again, data-dependence is good!

I still believe we will see lower lows, but this train of thought somewhat explains why I’ve been paring down my outright shorts on the way up and added hedges (put options) instead, while retaining my substantial equity long book.

Considering we are entering peak summer season, I want to wish everybody a fantastic time. Make sure you take some time off to unwind, your future self will thank you.

$$$

Thanks for reading,

John Galt

PS: Greetings from Cortina D’Ampezzo in the Dolomites. The height of the mountains is reminiscent of Italian bonds these days.

I’ve alluded to the 2.25% range for interest rates as “neutral” in previous posts (e.g., $4 THESE MARKETS ARE NIHILISTS, DONNY). I’m not making any claim of being right here, just highlighting how this is common knowledge among investors and was priced in.

Only after several months (9 months median, range 6-12 months) do earnings find the bottom (peak to trough -18% median, range -5% in 1980 to -43% in 2008). Read more: $11 'TIS THE (EARNINGS) SEASON.

As usual, great post. I really appreciate the perspective.

So many are so sure we will ultimately see a lower low, including myself. I was just talking with a friend last night about how maybe we need to rethink our confidence in the lower low narrative and see where it leads us.