$7 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS) - PART 3/3

China tech offers tremendous growth at deep value. Careful though, if not a falling knife it definitely is a sharp object plummeting.

Rare opportunity to acquire cash-rich, profitable, long-term double-digit growth companies at deep value

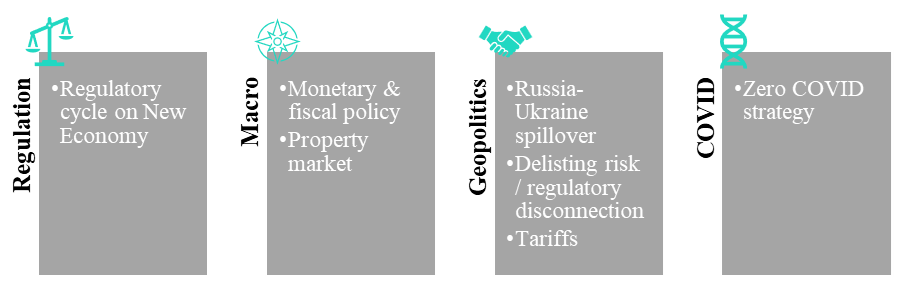

Perfect storm of regulation, macro, geopolitics and COVID has relentlessly battered China’s technology / internet names, creating an attractive entry point often >70% below cycle peaks

Asymmetric risk-return as the bottom seems in—downside scenario seems largely priced in and already-apparent catalysts and improving drivers offer strong re-rating potential

This is the third and final installment of a three-part piece on China’s “New Economy” tech, so let’s recap briefly.

In the previous two parts I laid out historical performance and talked regulation, macro, geopolitics and COVID, as today’s key drivers of the investment thesis.

In this final piece I offer my take on the best ways to express this bullish view and play the recovery through equities and ETFs.

If you missed part one and / or two—or if you are simply interested in finding out more about these drivers—you’ll find both pieces here:

#5 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS)

#6 WHATEVER IT TAKES (WITH CHINESE CHARACTERISTICS) - (PART 2/3)

Please note that since I posted part one of this piece, China’s technology / internet equities have rebounded extensively on the back of confirmatory news on the presented catalysts materializing (mainly on the regulatory and COVID front).

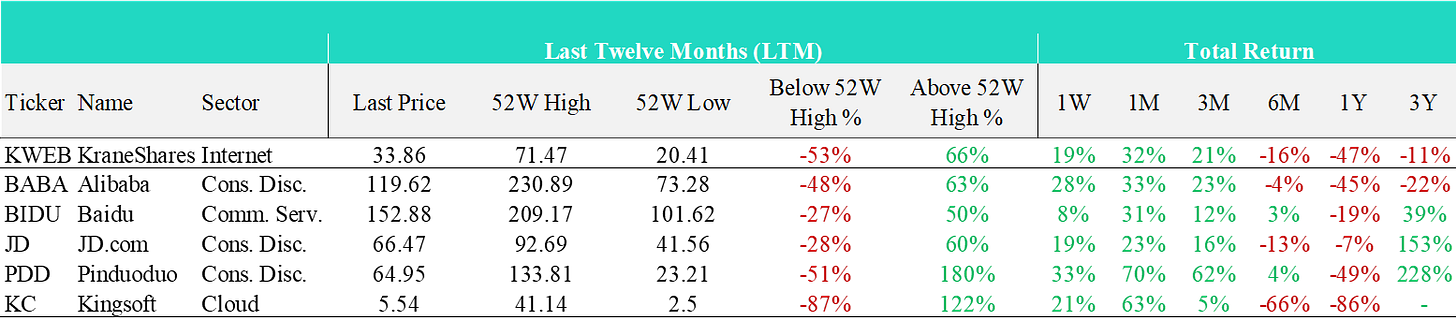

For reference, $KWEB—China’s largest internet ETF—has moved a whopping 19% in the past week! Alibaba ($BABA) has broken out of its longer-term trading range.

Don’t mistake this for a victory lap. What the market gods giveth, the market gods taketh away.

I mention 1W performance just to convey the message that while I believe the nascent rally still has legs—stocks don’t go up in a straight line so beware of potential pullbacks!

It’s worth mentioning at this point that China tech is positively correlated to US equities. This is one of the reasons why it was not advisable to go “all in” back in mid-March. If the global markets would have sold off—and that was a distinct possibility considering the Fed’s stance—China tech would have not been spared and lower lows would have been found.

Don’t go all in. No fun ‘til the Fed’s done.

Keep. It. Simple.

The acute reader has probably realized by now that I favor the ETF approach. In the current environment in China, it’s paramount to somewhat diversify away idiosyncratic / company-specific risks. It also allows monthly savers to easily allocate toward a long-term portfolio.

In fact, my China tech portfolio is comprised of a majority position in $KWEB—the great, beleaguered proxy for China tech—and a fairly large position in Alibaba ($BABA), surrounded by a constellation of much smaller, different names including Baidu ($BIDU), JD.com ($JD), Pinduoduo ($PDD) and (sometimes) Kingsoft Cloud ($KC). Also, note that roughly 30% of KWEB is composed of those 5 stocks.

I try to keep it simple.

Depending on their relative moves, I trade around these positions or divest some of them in full. This is, for instance, the case with $KC. It was exceedingly cheap when it traded with a $2-handle, considering the $0.6bn in net cash in its balance sheet and despite the fact it remains non-profitable. I no longer own it, as its price doubled and it has by far the riskiest profile of the five.

Now, why these?

First, I prefer sticking to popular, large-cap “New Economy” ADRs, as it’s here where the greatest opportunities are found valuation-wise. These firms trade at wider discounts to historical valuation as they were geared towards international investors with lower cost of capital, hence their overseas listing in the Nasdaq via ADRs.

Marginal shifts in capital sponsorship from the US to China—as foreign investors decide to move away from a sector—often have these dramatic consequences in valuation.

“Investability” concerns—as analysts at J.P. Morgan put it in March, before reversing the call in May—effectively allow us to buy outside of institutional liquidity today, in the hopes of selling into institutional liquidity tomorrow. Figuratively… my investment horizon is further away.

Second, businesses need to be somewhat levered to the Party’s interests. A country transitioning from a “smokestack economy” to a consumer-led model requires efficient eCommerce companies with deep logistics / networks. Such an economy also requires increasing productivity and efficiency provided by Cloud companies. You get the point.

These are often “systemic” companies. Alibaba, for instance, served “one billion annual active consumers in China this past quarter and achieved a record RMB 8,317 billion in global Gross Merchandise Value (GMV)” in 2021. That's $1.2tn in GMV and ~7% of China’s 2021 GDP!

Finally, the ideal candidates are profitable / cash flow positive, offer strong growth and boast a solid balance sheet, while trading at relatively inexpensive prevailing valuations.

The balance sheet aspect is very important, as I’m looking for cash-rich, asset-rich companies with robust buyback-powered upside.

Let me be clear on valuations: these were an absolute steal in mid-March, but those prices are gone and at these levels—considering the metrics—the whole complex trades substantially below historical averages.

The following section (swiftly) summarizes the key aspects about the categories described above.

Finding Asymmetry

Profitable / cash flow positive:

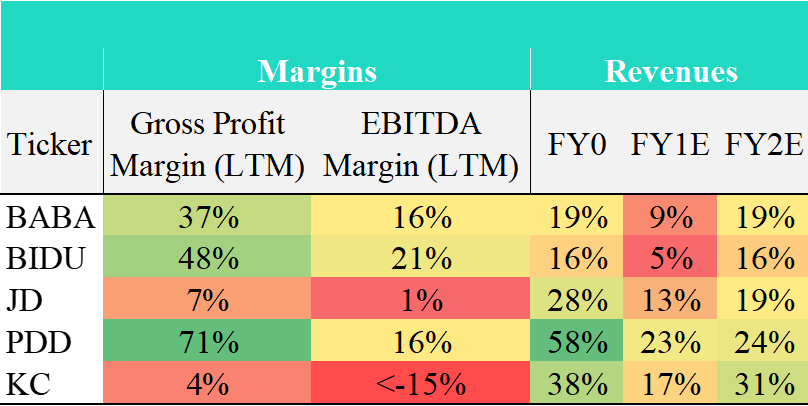

All companies are profitable in terms of Gross Profit margins (Last Twelve Months), yet not in terms of EBITDA margins (LTM). $KC remains deeply negative, as it’s less mature.

JD’s business model trades off margin vs. volume, which puts it on the verge of profitability.

$BABA, $BIDU and $PDD all have robust Gross Profit margins (37-71%) and good / adequate EBITDA margins (16-21%).

Strong Growth:

All firms enjoy double digit growth—$BIDU with the lowest (16%) and $PDD with the highest (58%).

When this fiscal year (FY1E) is over, growth is expected to reflect a slow-down, yet remain positive. Most companies will grow at double digits.

The country is recovering from the economic downshift brought by the tightening of macro / fiscal measures in 2021 and rolling lockdowns, so it’s expected that growth will resume at / close to its previous pace for the following year (FY2E).

Robust Balance Sheet: Cash-rich & Asset Rich

Measured by comparing net cash to market capitalization and non-core investments relative to market capitalization.

Non-core investments are stakes in businesses not central to the company’s main activity (i.e., spin offs, outside VC investments, listed companies, etc.). They can be quite liquid, as many of these are listed.

You could technically net these out of the share price—think of NC investments as cash, if liquidated—and know how much it would cost to keep the rest of the business. These levels also help establish a liquidation value at the lower bound.

As an example, you could technically buy $BABA’s core business—global eCommerce (including AliExpress, Lazada, Trendyol and their Ads business), Cainiao, Ele.me, Youku and China’s leading cloud provider AliCloud—for $70ps at yesterday’s closing price.

Situation is arguably different for $KC as you need the cash—it’s unprofitable / cash flow negative. It’s still a whole damn lot of cash in that BS though…

Robust Balance Sheet: Buybacks

I will finally spill a bit of digital ink here to discuss buybacks—it’s an integral part of the re-rating thesis and an important incremental source of marginal buying going forward.

It’s vox populi that buybacks have been fueling US equity markets for years… as I put it in #2 FELIZ SINK-O DE MAYO! back in early May:

Buyback authorizations reached $1.2 trillion last year (2021) and currently sit at $400 billion YTD—$919bn for the S&P. According to Goldman Sachs, that is “22% above the record pace at this time last year.”

There are many good and bad reasons for management to institute a buyback program. The good ones happen when buybacks are indeed accretive for existing equity owners as the company’s share price is below its Net Asset Value (NAV) per share, or when their Return on Equity (ROE) is higher than their market-implied Cost of Equity (COE).

While these situations likewise happen in Chinese corporates, buybacks are instituted only sparingly. Just ~2% of use of cash is spent on buybacks by MSCI China Index constituents vs. ~28% for US equities. Many reasons exist for this limited use, including regulatory differences, strong reinvestment / CapEx due to higher Return on Investment (ROI) elsewhere and relatively concentrated ownership / low free-float.

In 2021, share buybacks in Hong Kong (HK) hit record highs of roughly $5bn. In the midst of a challenging environment for valuations, it’s unsurprising to see cash-rich companies with healthy balance sheets (BS) ramp up their share buybacks to stabilize stock prices, shore up investor confidence and use this excess capital to attract new investors seeking to monetize the valuation dislocation.

Sector-wise, Financials and Property have passed the baton to Tech and Health Care, as China’s technology / internet companies boast >$350bn in aggregate cash (and equivalents) on their balance sheets.

By mid-February we had already seen ~$0.8bn year-to-date (YTD) in HK buybacks, as firms of the likes of Alibaba or Baidu topped up their already-ambitious share buyback programs. These programs have now reached ~8% of the companies' market capitalization!

We will continue seeing management teams promote buybacks if valuations remain compressed. This is why, statistically speaking, these periods of strong share buybacks commonly preclude positive investment performance and often coincide with market troughs.

Well… but what about the regulators, what do they think of buybacks?

The relevant authorities are cheering from the sidelines! They have been actively promoting buybacks, for years!

Back in 2018, the CSRC’s announced buyback guidance that advocated for increasingly returning cash to the shareholders of listed entities via buybacks. In April, we saw the CSRC renew their support.

Expect to see Chinese corporates make an increasingly aggressively use of buyback programs to defend their valuation, adding to the risk-return asymmetry. If valuations fall, buybacks will help balance supply and demand. If they increase, companies will continue buying back their stock steadily, raising the upside potential.

The trend is your friend

Just to recap. Despite the strong rally off the lows, I still believe there is an excellent opportunity to acquire cash-rich, profitable, long-term double-digit growth companies at deep value. The entry point remains fairly attractive—on average ~50% below the 52W peak for the discussed stocks and $KWEB.

The perfect storm of regulation, macro, geopolitics and COVID that relentlessly clobbered China’s technology / internet names is likely over. In fact, this week we got further proof as authorities finalized their probe into ride-hailing giant Didi ($DIDI) and lifted their ban on new video game licenses.

The market continues to price in a fairly dramatic scenario for these stocks, which differs greatly from reality. Barring a global recession, fundamentals should eventually guide prices closer to historical valuations.

With the bottom in, bad news in the back window and light investor positioning, there seems to be an asymmetric risk-return opportunity, where already-apparent catalysts and follow through on positive developments offer strong re-rating potential.

$$$

Thanks for reading,

John Galt

PS: I know some readers might miss some additional information (i.e., further deep-dive into the companies, additional work on $KWEB' metrics, Sum-Of-The-Parts (SOTP) analysis, FX commentary, etc.), but at this point the piece had become simply too long. I will briefly touch on these points in coming pieces if I see further benefit in it.

I'm not against these widely known large new economy Chinese caps and I agree with John about their valuations.

But I think the vast majority of those who buy such stocks ignore the diversification with smaller caps.

Are those smaller Chinese stocks less reliable? No, they are not if they are fully PCAOB inspected like Nisun International for example. So, a few of them are legit, while their metrics are ridiculously low:

The aforementioned NISN trades at a P/E below 1, P/S and P/BV below 0.30, it is growing fast, and it has much cash in hand with negative net debt.

Plus, as I said, NISN has U.S. based auditors, fully inspected by PCAOB.