$4 THESE MARKETS ARE NIHILISTS, DONNY

Markets rarely fall in a straight line, so exercise extreme caution and beware of a potential market bounce

Recession narrative no longer out of consensus—after recent market action a considerable bounce may be due

Supply should somewhat normalize and summer demand could surprise to the upside, supporting such market recovery

Recovery likely fleeting—the economic end game sees the Fed keeping their foot on the brake until something breaks, structurally bearish for markets

I try to beware of clean-cut narratives. Things seem often only simple in hindsight and it’s easy to get sold on oversimplified narratives. Crosscurrents abound, vectors constantly cross and details matter.

Investors who successfully called the bottom of the COVID crash in April 2020 tell us it was awfully clear that the Fed would pump the market “to the moon” (BRRRRRRR!). As someone closely following the markets back then, I can tell you things were not as simple.

Fast-forward to today—a cacophony of voices warns us about an impending crash beyond current levels. The recession story is definitely no longer out of consensus.

In my past posts I’ve shared the reasons behind my broad-based, bearish stance, which can be summarized through the abstract below:

“Inflation is proving persistent—one year form the onset of the “transitory” debate— and economic growth is swiftly decelerating. Renewed supply-side deterioration fostered by the Russian invasion of Ukraine (impacting food, energy and metal exports) and the latest COVID wave in China (creating factory shutdowns and shipping delays) is pushing current and future prints to the upside.”

Read more: #1 ONE FOOT IN THE SHADED AREA

The point here is this: a large bounce across markets may be due. I’m concerned that everyone and their mother has suddenly rushed to the same side of the boat. And markets rarely fall in a straight line.

It’s a time for extreme caution, especially if short.

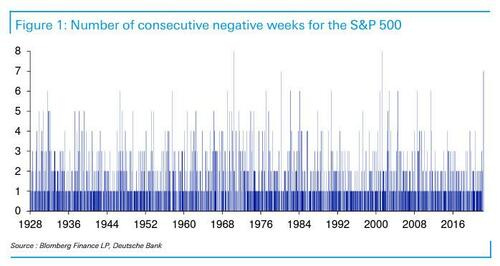

The Dow Jones Index has sold-off for 8 successive weeks (most since 1923), while the S&P has seen 7 weekly declines for the first time since March 2001 (-16.9% over the period) and only for the third time in history (-21.5% in May 1970 and -15.8% in March 1980 being the other two).

“It’s often what you know to be true that creates your biggest losses.”

I cannot find the exact quote, or I’d attribute it.

Despite any conviction I’ve learned the hard way that it’s necessary to deeply understand the other side of the trade. It takes two to make a market… who is selling what you’re buying / buying what you’re selling?

Be nimble and don’t get married to your beliefs / opinions. Don’t forget that “these markets are nihilists, Donny”.

Developing a balanced view is key, so I’m tracking the different “conflicting” narratives that could potentially “rock the boat” in coming weeks / months.

I continue to believe that inflation—in itself and relative to estimates—is the most important factor in determining market direction today. It defines the Fed’s path, which dictates where the economy and markets are headed.

We need to ponder the merits of the “peak inflation” hypothesis, which sees supply normalizing on the back of China’s reopening / relaxation of its Zero-COVID Policy, renewed monetary stimulus in China, Sino-American tariff reductions, the Russia-Ukraine conflict unwinding and food protectionism declining.

Additionally, a strong post-pandemic summer could really push demand to surprise to the upside. People—especially younger generations—seem desperate to enjoy their first summer after the world’s reopening. Summer of Love redux.

There’s a non-zero probability of some of these actually materializing in short order, which would induce a steep drop in today’s stubbornly high inflation, laying the ground for an incrementally less hawkish Fed supporting a sustained market recovery.

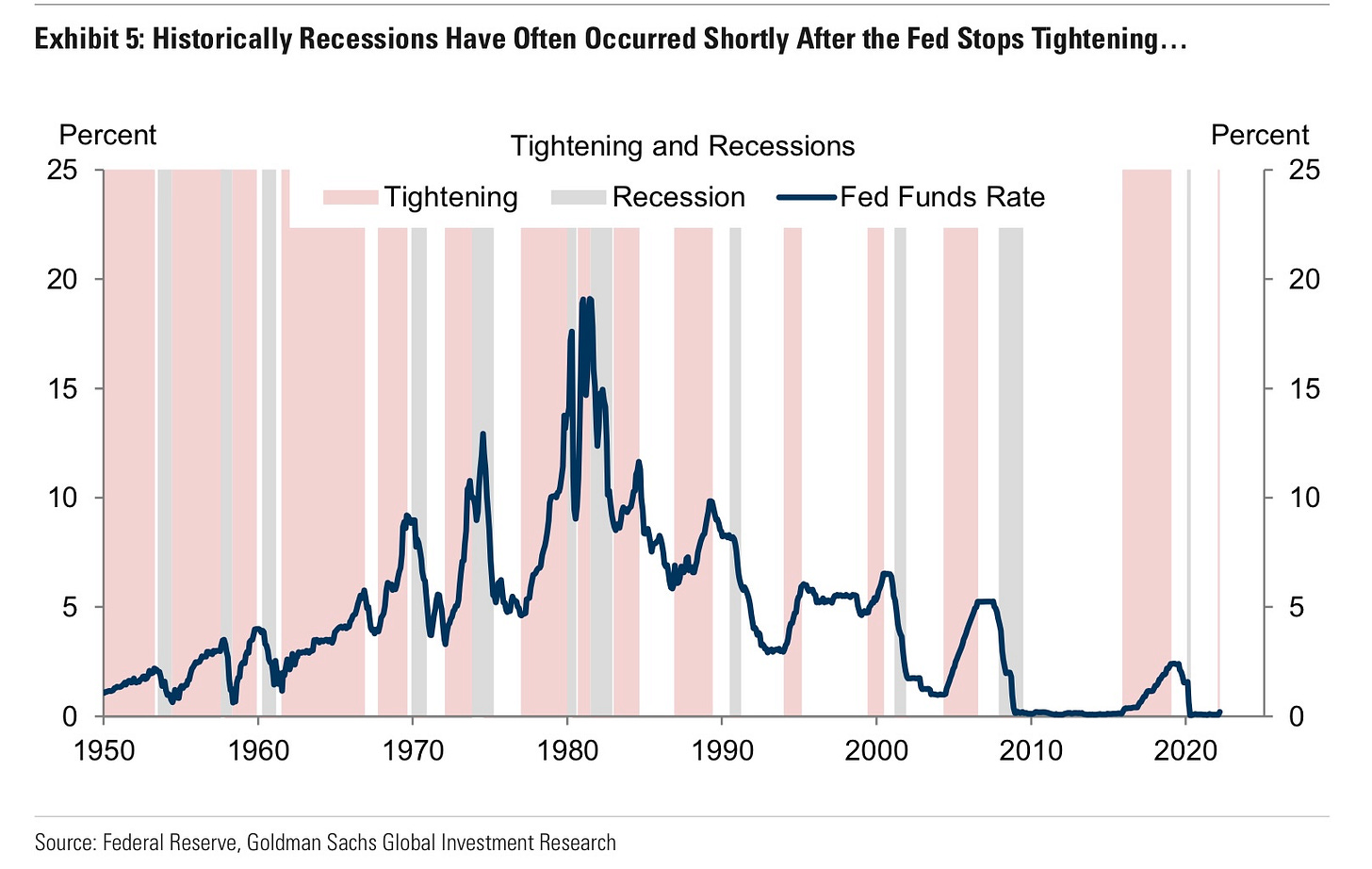

Under this scenario—the “pause narrative”—the Fed would then stop hiking to evaluate the necessity for incremental policy action to achieve / approach their inflation target of 2% per annum.

In summary, on top of my recession indicators (i.e., PMIs, housing, employment, retail / consumer, corporate credit / yields, volatility and flows) I’m closely tracking the evolution of the stories described above.

All roads lead to Rome

Overall, any progress in today’s acute supply-demand imbalance story will likely prove fleeting (note to self: avoid the term “transitory”!).

The Fed seems set on reversing the impact of its pandemic policies and drive down demand, as they know inflation will overshoot the target despite supply normalization. As I explained recently (#3 RRRRRRRRRRRRRRB) the Fed is therefore unlikely to change its stance.

We are only beginning to feel the impact of monetary policy and expectations on the most cyclical sectors of the economy (e.g., air coming out of housing) and markets are in disarray. And don’t forget monetary policy works with a 12-24 month lag.

Barring a major economic crash or drop in inflation, they will raise the fed funds rate to “neutral”—2.25-2.5% by most estimates—by year end, on top of balance sheet reduction (quantitative tapering, QT) to the tune of $95bn per month.

Beyond this point and should nothing break, Powell & Co would hike rates beyond “neutral” and accelerate QT beyond the current pace. Don’t forget the Fed holds almost $9tn in balance sheet assets—up from $4.2bn pre-pandemic (February 2020)—and projects a $2.5bn reduction by mid-2025!

The economic end game sees the story repeating itself: the Fed keeps their foot on the brake until something breaks, which is structurally bearish for markets.

Subscribers will know the above visual by heart now, so let’s take this piece as a weekly reminder that the Fed no longer has our backs.

$$$

Thanks for reading,

John Galt