#2 FELIZ SINK-O DE MAYO!

An explainer to last week’s market stumble, as the Fed attempts to thread the needle

“I think we are not paying sufficient attention to the law of unintended consequences. We take decisions with an objective in mind and rarely think through what may happen that is not our objective. And then we wrestle with the impact of it…

We act sometimes like eight years old playing soccer. Here is the ball, we are all at the ball. And we don't cover the rest of the field.”

I wish the above comment was made by ManCity’s Pep Guardiola, explaining his team’s astonishing, last-minute defeat against Real Madrid last Wednesday. Instead and more worryingly, it can be traced back to the Director of the IMF, Kristalina Georgieva.

“Don’t tinker with complex adaptive systems”, as Taleb would put it.

Adding to the compendium of grim quotables, Fed Chairman Powell described the impact of their actions on the US economy in last week’s FOMC presser as having “a good chance to have a soft or soft-ish landing”.

Very reassuring indeed, Mr. Powell…

The comment followed a fairly consensus FOMC statement, where the Fed unveiled a 50bps hike and a balance sheet reduction path starting at $47.5bn / month and escalating to $95bn / month over the next three months. The presser tilted dovish / pro-risk as Powell effectively ruled out 75bps fed fund rate increments in coming meetings, removing the most hawkish tails.

If the different “bps and billions” are difficult for you to interpret, simply know this:

The Fed is attempting to thread the needle. Single hikes (25 bps) seem off the table for now as they need to show their intent on reining in inflation.

On the other hand, the Fed knows its monetary policy generally works with a (12-18 month) lag and smaller increments allow them to lengthen the tightening cycle by buying them additional time in case Month-on-Month (MoM) prints remains higher for longer.

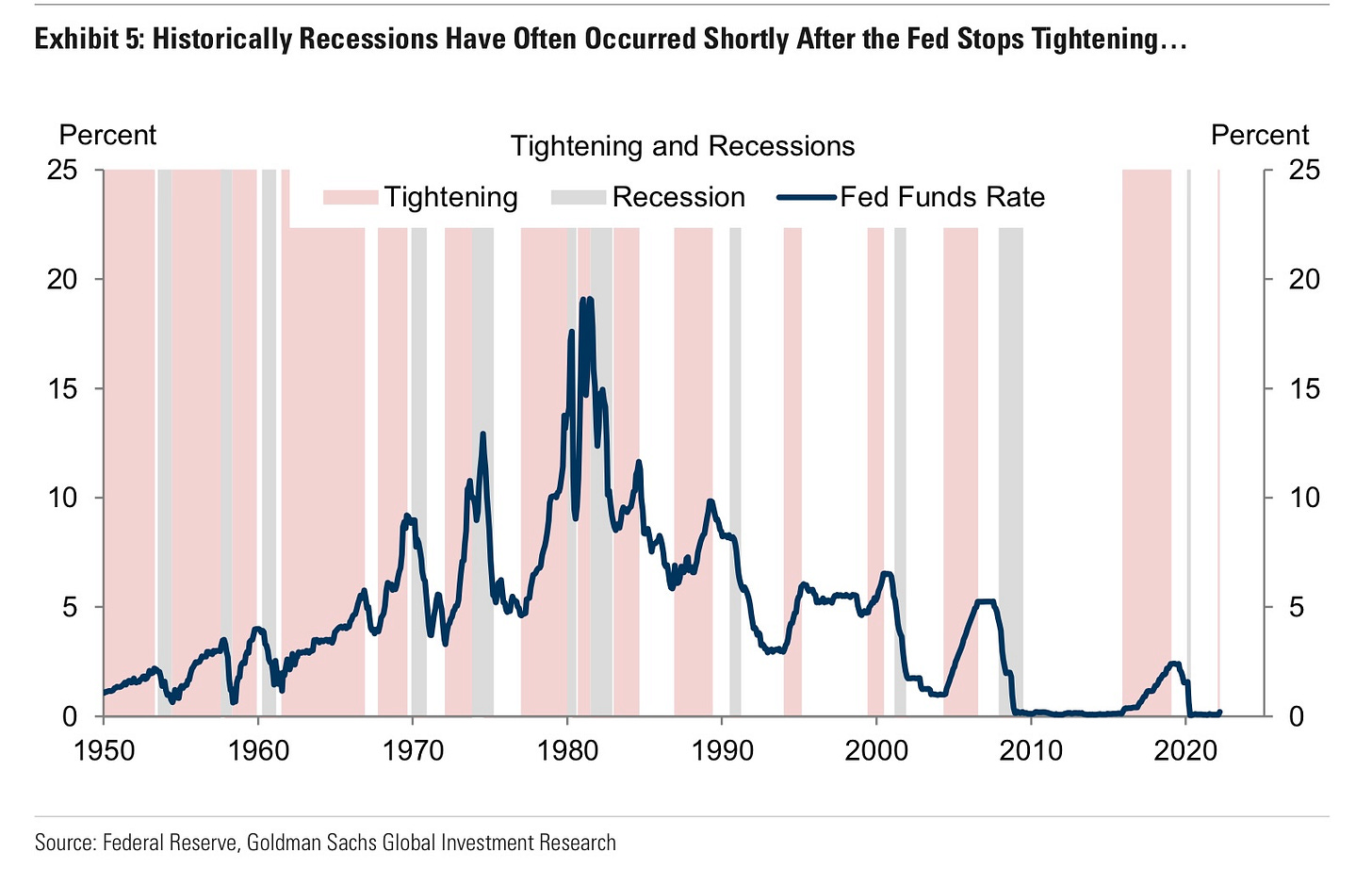

As I discussed in my previous post (#1 ONE FOOT IN THE SHADED AREA), something always breaks in tightening cycles. The question is when.

Yes, it’s a big “if” as most tightening cycles are followed by a recession (i.e. the Fed tightens until its too late).

In 2000 it was at levels of 6.5%, 5.25% for 2008 and 2.5% in 2018 before Powell’s post “we are a long way from neutral” dovish pivot. We now stand at 0.75% and the market is trembling—we may be close to “peak hawkishness”.

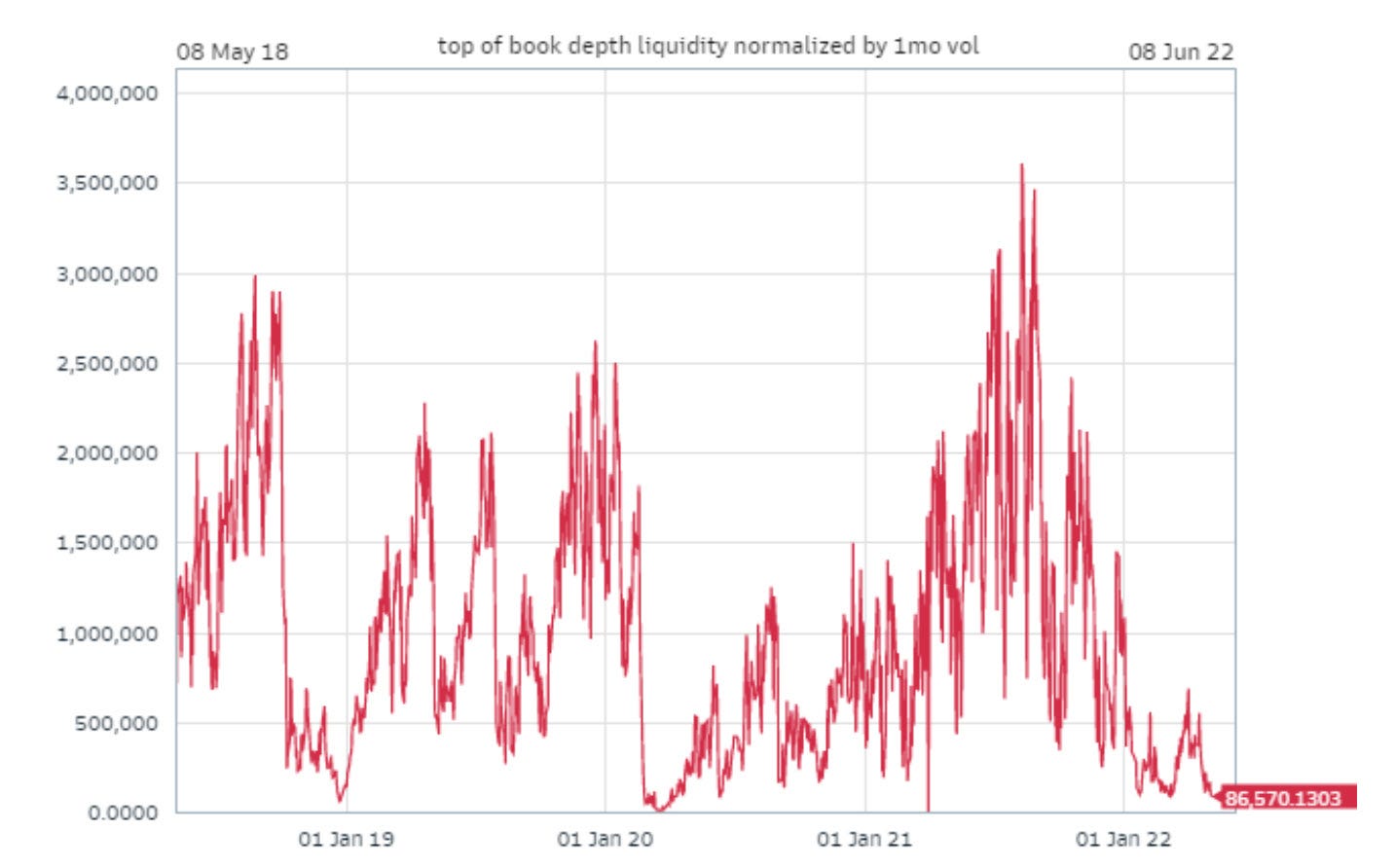

Lack of liquidity, the unwinding of elevated implied volatility in anticipation for a potential Fed surprise and extreme (option) positioning triggered a short squeeze during the event.

Many of us warned the move would prove fleeting (tactical), as the market proceeded to stumble viciously into the end of the week driven by a steep escalation in bond yields. Feliz Sink-o De Mayo!

I would argue last week’s correction is a “desirable” outcome for the Fed, as they seek to tighten financial conditions (i.e. increase real yields, lower stocks, widen credit spreads and a strengthen the mighty dollar) to anchor price expectations in short order.

More importantly, it reverses a year of gains for the S&P since it sat at 4,200 last May vs. the current 4,000… And that’s without adjusting for a year of scorching-hot headline CPI prints. The adjusted figure is a double digit real loss, even considering dividends.

In case you’re asking, figures are worse for the beleaguered Nasdaq coming off its worst monthly performance since Lehman.

Last week many of you reached out to request a more constructive approach which paints both sides of the picture. So enough of the bearporn for now—‘till next week!

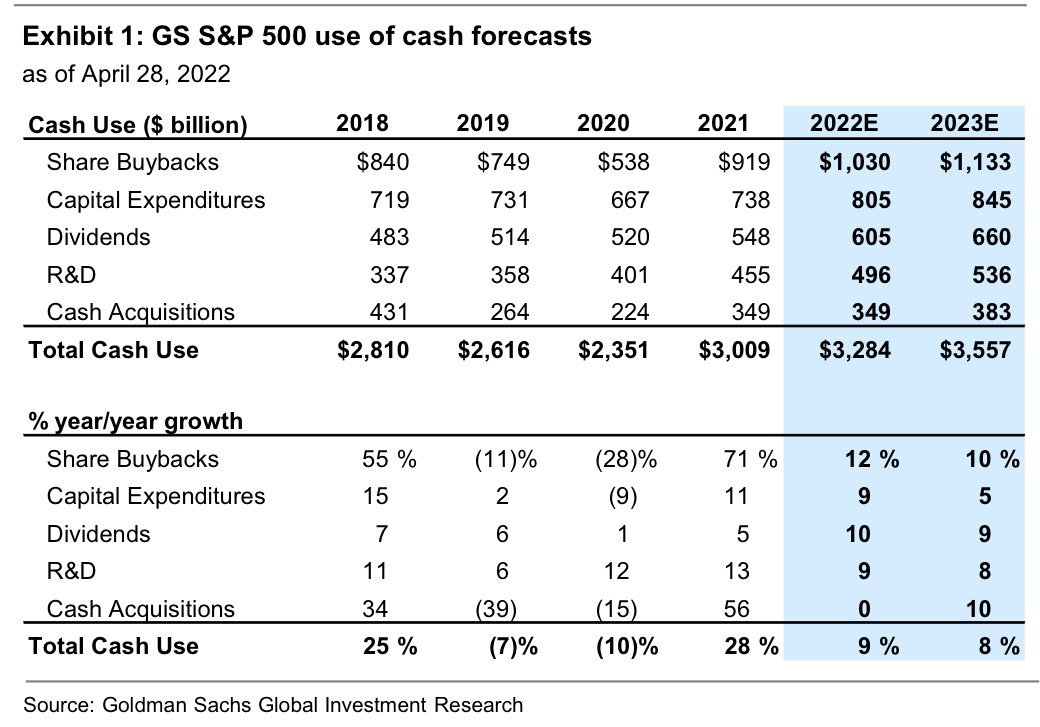

First, recent market instability has coincided with the buyback blackout window. I’m inclined to always remind people that buybacks are the largest source of demand for US equities and the largest use of cash for companies.

Buyback authorizations reached $1.2 trillion last year (2021) and currently sit at $400 billion YTD—$919bn for the S&P. According to Goldman Sachs, that is “22% above the record pace at this time last year.”

Overall, earnings remain spectacular with Q1 EPS growth at 9% Year-on-Year (YoY), as >50% of the S&P has announced results. Dividends are expected to grow by roughly 10% YoY.

On a different note, there is growing evidence that some elements in the supply chain might be normalizing, despite China’s unswerving efforts to stick to its “Dynamic Zero-COVID” policy. This would substantially reduce the odds of global stagflation, as it would allow the Fed to adopt an increasingly balanced cadence.

Noise vs. signal… it’s complicated however to gauge if the underlying forces behind this “evidence” are actually positive or negative.

As you can see below, rates can be normalizing… but for the wrong reasons!

If you don’t follow Saxobank’s @Ole_S_Hansen you are missing out, by the way.

This goes hand in hand with the notion that broad inflation might be peaking—we could be experiencing peak Fed hawkishness. If that is the case, markets should stabilize going forward.

The key here is to compare the coming inflation prints versus expectations—this will be one of the primary drivers of stocks and bonds in coming months.

Different measures show that the market is oversold and blistering bull rallies in bear markets are frequent. “Extremely light positioning has historically been indicative of a near-term rally”, as Goldman Sachs’ David Kostin put it a few days ago. Most analysis points toward 1-month forward returns of >5%.

In fact, BMO’s Brian Belski ran the data for the past 50 years, showing that “non-bear-market corrections” tend to be followed by steep rebounds in US equities. On average and when we sit at current levels, the S&P averages +14% over the subsequent three months and 27% over the next year. Of course, these only refer to “non-bear-market corrections” and that’s a big caveat.

BMO are not alone, by any means. Here’s Compound’s CharlieBilello offering a similar view. Yes, yes, we all realize January 1 is an arbitrary starting date, so the table only really tells us that its been a tremendously challenging year by any standard.

All in all, considering the oversold state of the market today, volatility levels and positioning / flows, I expect markets to rebound first from these sub-4,000 levels in the S&P.

Please do not mistake this as a change in my medium-long term view. I do think we are in a bear market and the macroeconomic elements are difficult to overcome. All this means is that, with today’s information, I expect the market to rebound lightly and continue to whipsaw lower in coming weeks, once it digests the last stumble.

I’m tactically lightening on my shorts here ($HYG, $SPX, $QQQ) and expect to rebuild that position if the market rebounds a few percentage points. The risk is that the market continues lower and I miss my entry point.

Liquidity is incredibly impaired, so invest accordingly.

In the coming days I intend to focus on how market architecture is shaping the current market, explaining the interaction of volatility, positioning and (option) flows.

I will also talk investment horizons in the context of some of my longer term investments, which include uranium ($SPUT, $URNM, $URA, $CCJ) and China tech ($KWEB, alongside a few different large cap tech names).

$$$

Thanks for reading,

John Galt