$1 ONE FOOT IN THE SHADED AREA

I can hear the sound of virtual typewriters spilling digital ink in the financial press about the oh-so-imminent recession

The macro feels heavy.

Inflation is proving persistent—one year from the onset of the “transitory” debate—and economic growth is swiftly decelerating. Renewed supply-side deterioration fostered by the Russian invasion of Ukraine (impacting food, energy and metal exports) and the latest COVID wave in China (creating factory shutdowns and shipping delays) is pushing current and future prints to the upside.

Yields are widening, driving escalating debt servicing costs at corporate and household levels. Mortgage rates rise for the sixth week to decade highs—5.4%, as per the Mortgage Bankers Association (MBA).

Different measures of consumer sentiment have been weakening—including this week’s Amazon Q1 figures / guidance—amid a slowdown in real wages and nose-bleed inflation prints (March US CPI +8.5%, PCE +6.6%). Latest studies show that only 44% of Americans have savings to cover a $1,000 surprise expense.

Rent is skyrocketing. I can already imagine Blackstone’s quarterly letter to LPs.

Steve Schwartzmann likes this 👍

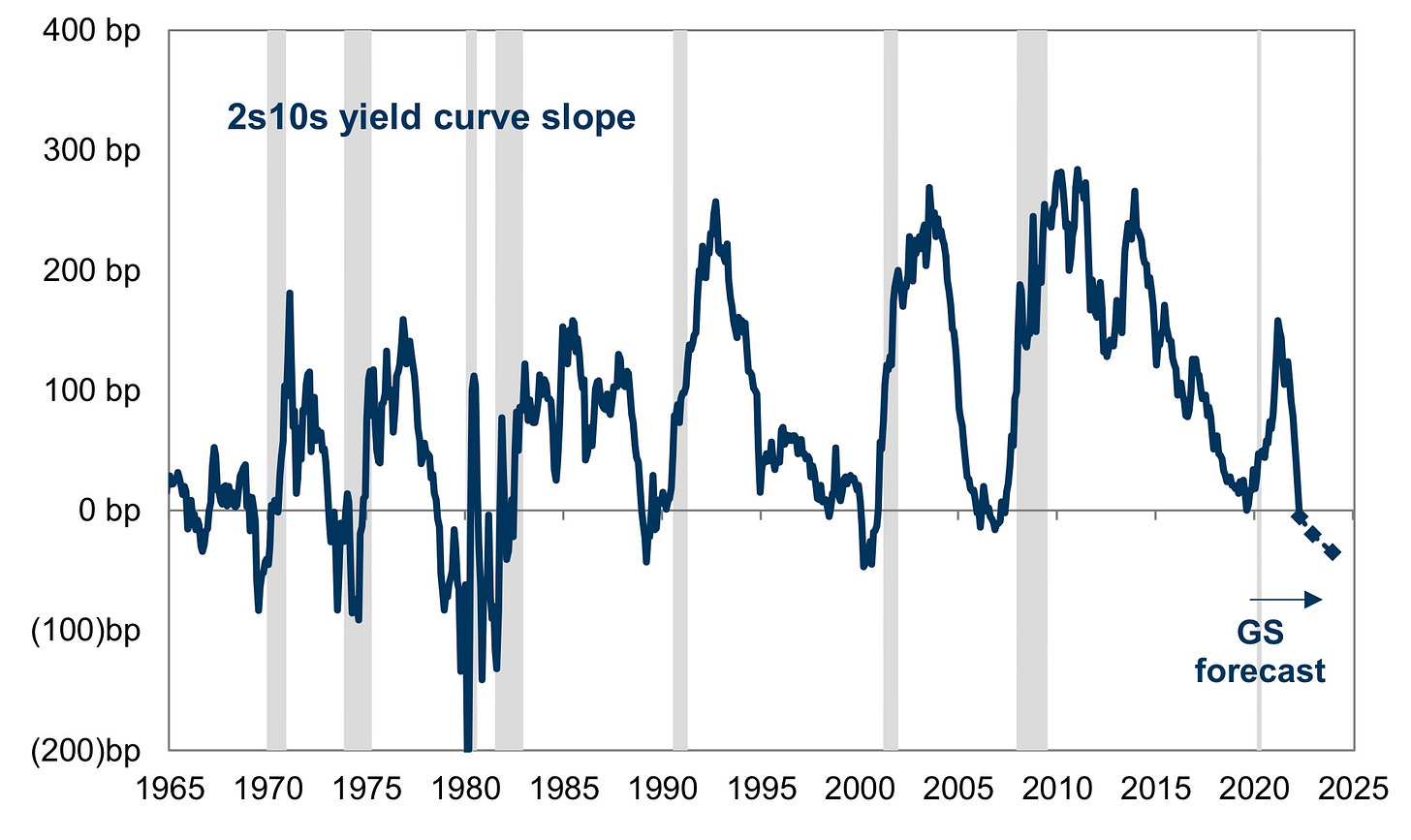

Recently, all these developments seem to have been captured by the most recent yield curve inversion. This economic phenomenon virtually preceded every modern recession (gray-shaded area), as reflected in the figure below depicting 2Y and 10Y treasury yield differentials.

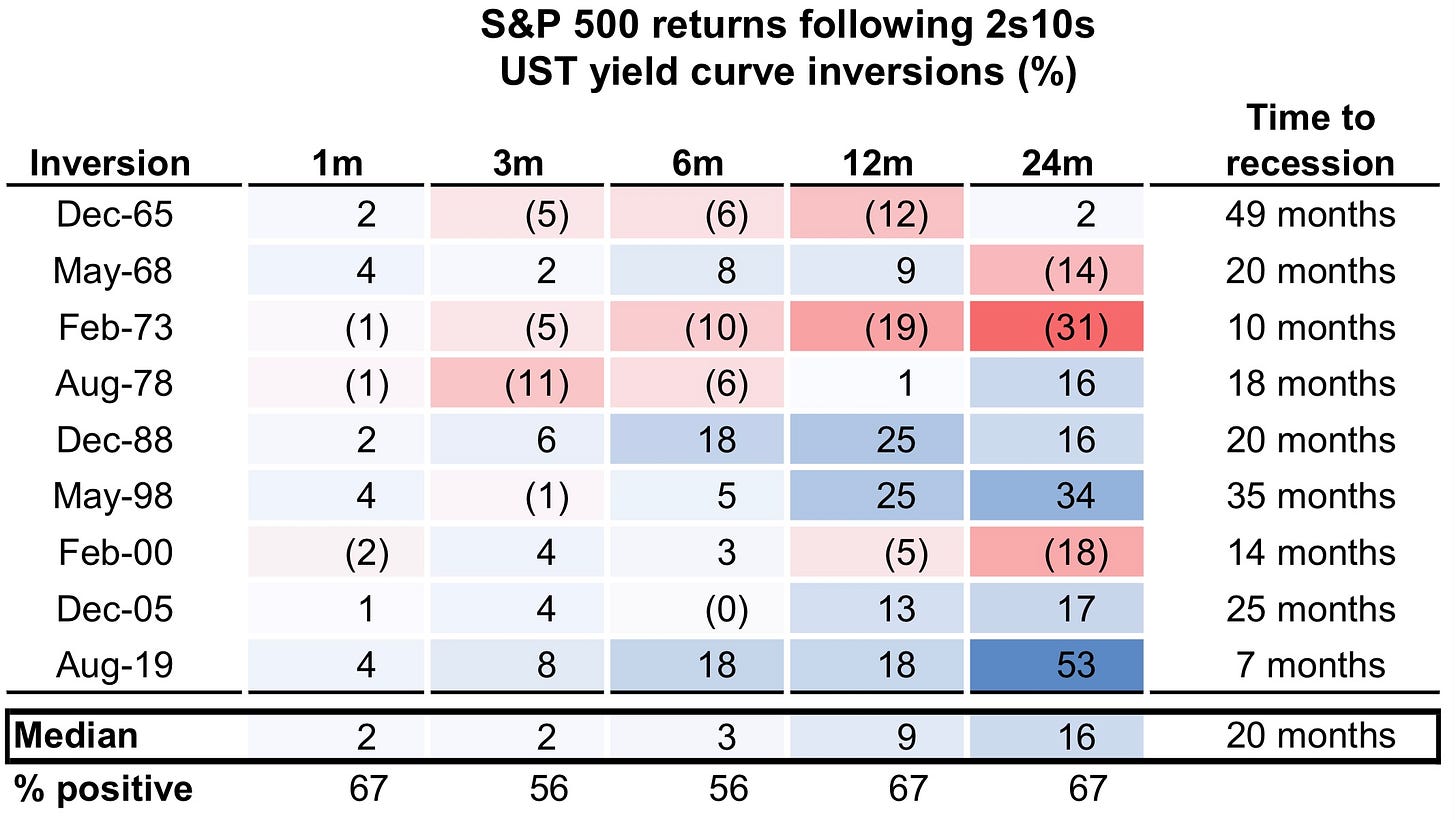

So… based on this is it clear a recession is imminent? Not so fast… there is often a substantial lag between inversion and recession (20 month median) and often these are catalyzed by unrelated factors. In fact, the last data point on GS’ table below shows an inversion 7 months before the last, pandemic-induced recession. I tend to fade “this time it’s different” narratives and this is an important indicator, but it’s more difficult than that.

But wait a second… is the table above implying that we were already on track for a recession prior to the pandemic? Very possibly.

Don’t fight the Fed

It’s against this macro backdrop that the Fed will hike rates next week—with all probability the first 50 bps rate increase in the Fed Funds Rate in 20 years—in an effort to rein in inflation. The market is pricing three consecutive hikes at / above 50bps, which would be the first time the Fed has done more than one move of this magnitude (50bps) at consecutive meetings since 1994.

The transmission mechanism of these hikes / hike expectations starts with a tightening of financial conditions, followed by demand destruction leading prices lower.

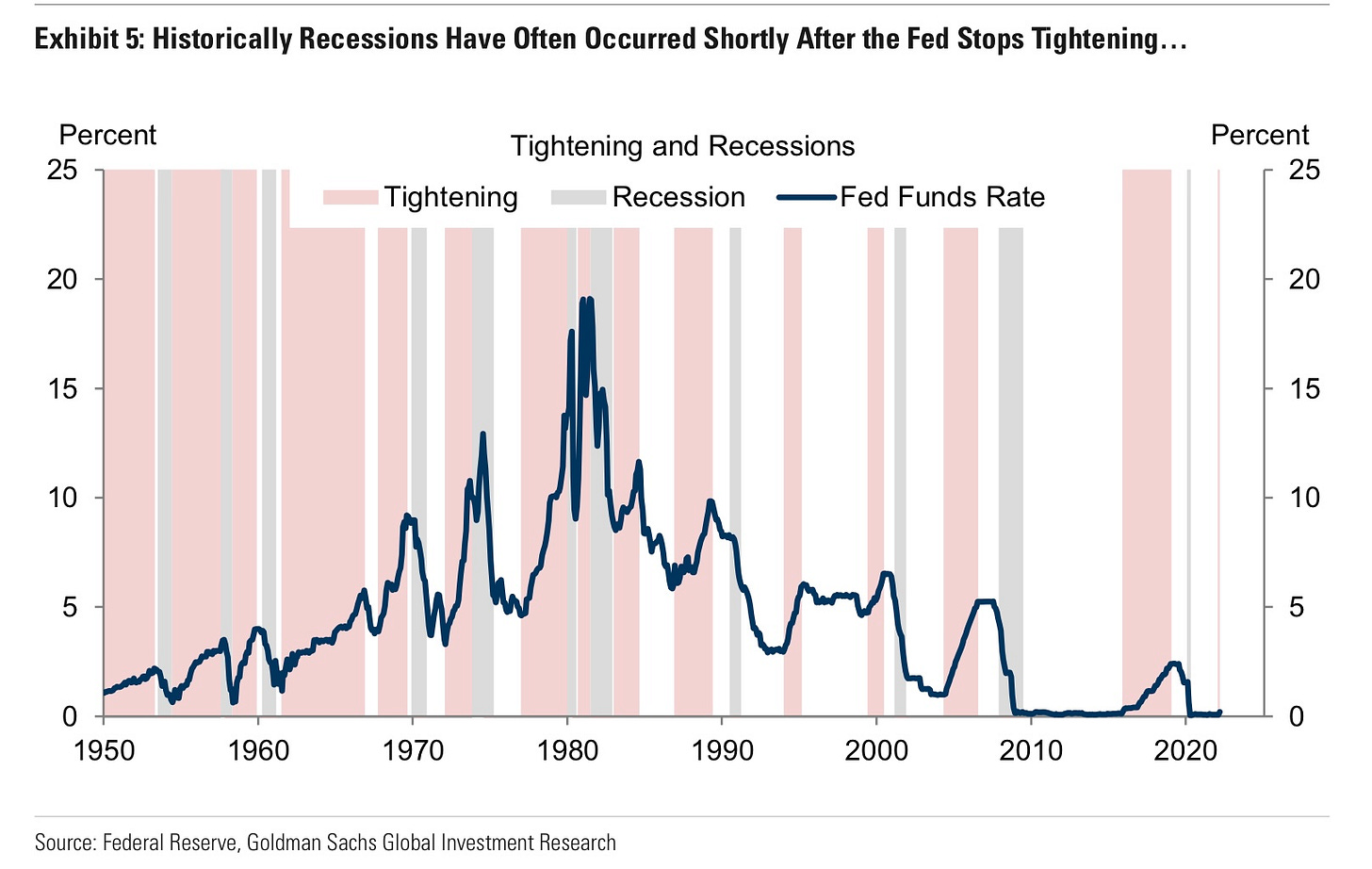

If they are able to reduce price pressures without killing the economy / crashing the market, that’s what Fed Chair Powell has been lately calling a “soft landing” and that’s likely the point when the Fed will take their foot off the brake.

Yes, it’s a big “if” as most tightening cycles are followed by a recession (i.e. the Fed tightens until its too late).

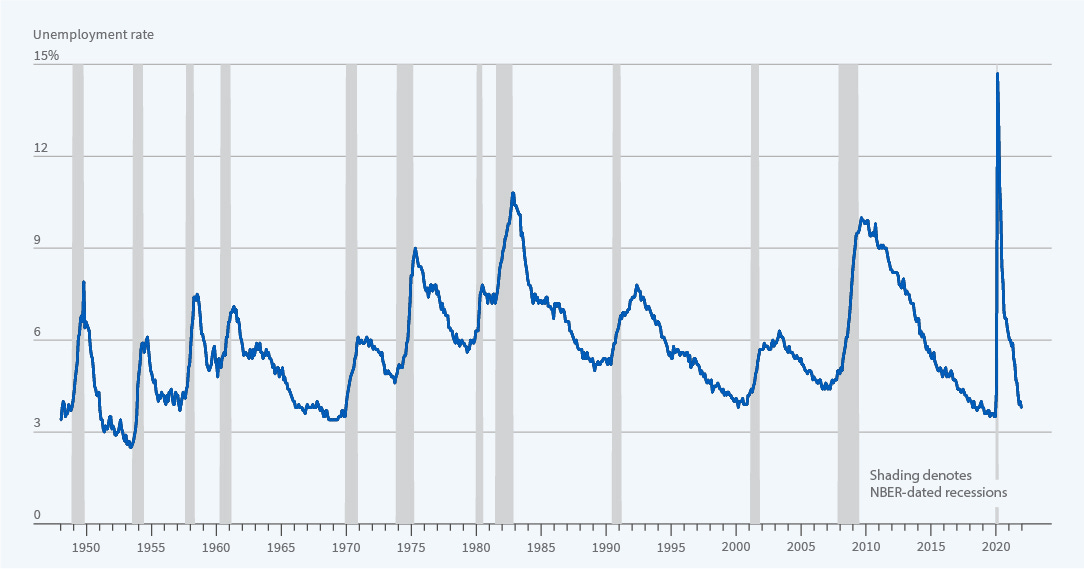

As you can see, the Fed’s dual mandate—maximum employment and stable prices—seems to have temporarily morphed into a single mandate and some tradeoffs will likely be obvious in coming months.

No question the Fed is behind the curve, yet this time they truly seem set on delivering on the hawkish rhetoric we’ve seen accelerating since late Q4 / early Q1. Call it the “path of least regret”, as the Reserve Bank of New Zealand (RBNZ) put it earlier this month.

No wonder the S&P 500 has ended April with its worst start to a year since the outbreak of World War 2... and no wonder other investors are turning bearish.

It’s currently not particularly challenging to spin a dour narrative

On Thursday, the US seemingly set one foot in the shaded area of economic recession. The standard definition for a recession implies two consecutive negative GDP prints and this week’s -1.4% initial read took all but a handful of analysts by surprise (est. +1.0%) and a step closer in that direction.

The latest GDP print is mainly relevant to the extent it serves as yet another robust building block for developing, late-cycle narratives.

Public perception seems to be moving from a Quad 3 economic regime (decelerating growth / accelerating inflation) toward Quad 4 (decelerating growth / decelerating inflation).

The Quad macro framework is a simplified, yet relatively useful construction using GDP and CPI changes to contextualize economic regimes and their direction. The figure below shows a (slightly dated) example of that framework borrowed from Hedgeye, a popular US investment research firm.

More importantly, note how Quad 4 tends to align with a dovish monetary policy bias (i.e. loosening financial conditions)—the opposite of the Fed’s current direction.

What is clear is that inflation might have pushed the Fed into a difficult predicament, forcing it to tighten into a declining economy and potentially into a policy error.

In either case—even barring an imminent market crash where correlations tend to 1—Quad 4 often delivers atrocious returns for risk assets. For months I’ve been paring down my net exposure and nibbling on the short side, I intend to accelerate this process (subject to changing conditions) in coming weeks.

Despite the amount of bearporn in this post, please don’t mistake my market stance as completely one-directional. There are evolving cross-currents / opposing vectors that will trigger strong rebounds, but—as generally in bear markets—we will likely see lower highs and lower lows until the macro improves.

In future posts I plan to lay out potential investment pockets in which to hide (e.g. certain commodities, themes and geographies) and explain what leading indicators / “canaries in the coal mine” I’m paying attention to. Hint: PMIs (Purchasing Managers Index), (residential) real estate data, investment flows (incl. option flows), credit and volatility.

I also intend on writing about investment horizons and how I’m making strategic (longer term) and tactical (short term) investment choices.

The highest ROI is often outside the investment world

On a different note, many friends who have built a small portfolio over the years as a side hustle ask me about their positioning and new potential opportunities to invest in. Sometimes these are the same people who book holidays only a few weeks in advance, buy cars that sit idle in the garage they rent or take on credit card / consumer debt.

It all tends to come down to mental accounting. But it’s important to think in these cases as a capital allocator would.

You’re guaranteed to pay more for bookings if you wait and you’re guaranteed to feel stupid if you buy stuff you don’t need.

Beyond that, these decision are often a tax on your time, as Farnam Street puts it (great free subscription, by the way):

Good decisions create time, bad ones consume it. Good initial decisions pay dividends for years, allowing abundant free time and low stress. Poor decisions, on the other hand, consume time, increase anxiety, and drain us of energy.

$$$

Thanks for reading,

John Galt

PS: Note that most investors—and count me in that camp—do not subscribe to the simplified “two negative quarters make a recession” definition, opting instead for frameworks more aligned with NBER’s Cycle Dating to call out recessions.